By Silke Koltrowitz

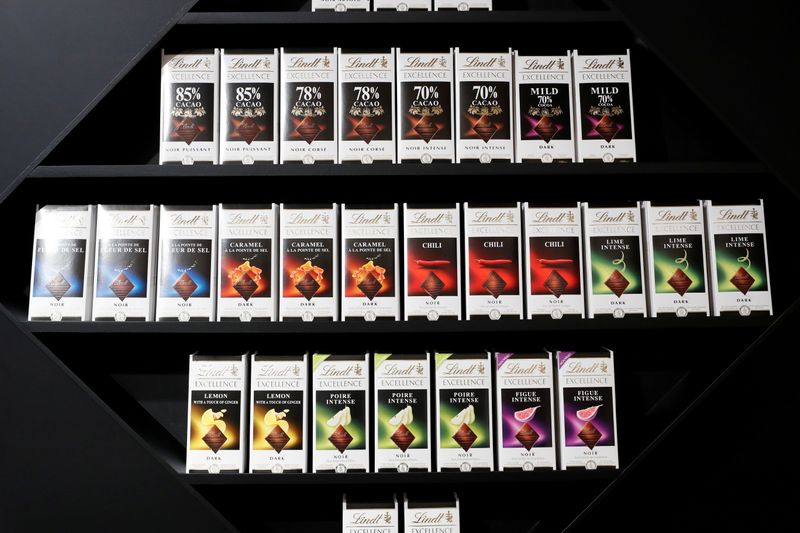

ZURICH (Reuters) - Strong demand for Lindor and Excellence chocolates boosted sales and profit at Switzerland's Lindt & Spruengli in the first half, allowing it to raise its full-year guidance as the impact of the COVID-19 pandemic waned.

The global chocolate confectionery market is still sluggish, but Lindt, whose organic sales dropped 6% last year, is now seeing demand for its upmarket chocolates recover due to continued investment in marketing and new products.

"Group sales have almost returned to their pre-COVID-19 trajectory," Chief Financial Officer Martin Hug told investors on a call on Tuesday.

He said the group had seen "exceptional growth" of 17.4% in the first half and gained market share in all its regions, with just its own stores and travel retail still below pre-pandemic levels.

Hug said growth would slow in the second half due to tougher comparisons, but was expected to be in the "lower double-digit range" for the full year, above previous guidance for 6-8% growth.

"We have benefited a lot from in-home consumption, now people will go out more," Hug said.

The group's participation certificates were up 3% at 0912 GMT, making it the best performer in a 0.6% weaker European food sector index.

Analysts at Vontobel and Kepler Cheuvreux called the results "mind-blowing" and "out of this world strong".

Net profit hit a record for Lindt's traditionally weaker first half at 101.6 million Swiss francs ($110.9 million), fivefold the amount recorded in the year-ago period and almost twice as much as expected in a Refinitiv poll.

The Zurich-based company expects an operating margin "at the upper end of 13%-14%" this year in spite of higher packaging and staffing costs, Hug said.

Lindt confirmed its medium-term target of 5%-7% organic growth and an operating margin of 15% from 2022 onwards. It said its share buyback programme of up to 750 million francs was on track and set a goal to make all its packaging recyclable by 2025.