(Bloomberg) -- China’s property debt crisis is deepening challenges for creditors. The latest is a record drop in bonds from a Hong Kong-based lender with a comparatively high rate of soured loans to the sector.

Almost 9% of Bank of East Asia Ltd.’s (OTC:BKEAY) loans to Chinese property developers were likely impaired as of the end of June 30, Bloomberg Intelligence estimated based on the bank’s real estate exposure and impaired loan data. That outstrips 3-6% for major Chinese peers.

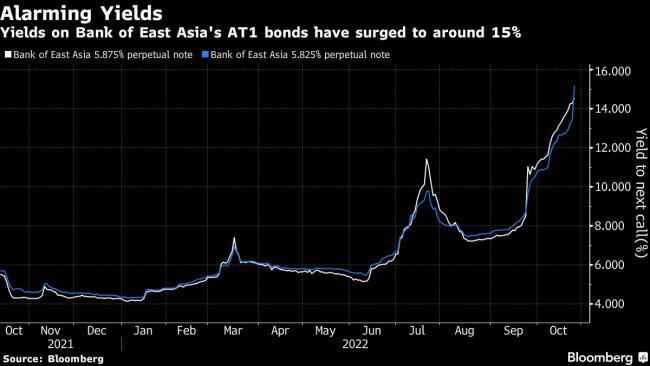

As distress in Chinese property debt mounts, the yield to next call on BEA’s 5.875% Additional Tier 1 note has jumped a record 572 basis points this month to 16.9%. The yield to next call on BEA’s other AT1 has spiked 451 basis points to 15.3%. The lender doesn’t comment on the price performance of its listed securities, but said it has been proactively managing its Chinese commercial real estate portfolio.

Those increases make BEA stand out, even as they raise concerns about broader risks to other lenders with exposure to the country’s troubled property sector. Such bonds are the riskiest type of bank debt that could either be converted to equity or written down to absorb losses in times of stress. The yield to next call shows the return an investor demands to hold such notes until the call date, when borrowers are generally expected to redeem them.

The moves exceed an average jump of about 167 basis points in October for AT1s from other Hong Kong or Chinese lenders. And they leave the rates at the highest for such securities in that group after a note by Zhongyuan Bank Co., which is based in Henan province, an epicenter of China’s property crisis, and a note by Hong Kong’s Chiyu Banking Corp. that is facing a call option next month, according to Bloomberg-compiled data.

“We consider BEA’s concentration in the property sector, especially in mainland China, as a significant and relative weakness compared to its peers,” said Shinoy Varghese, an analyst at S&P Global Ratings. BEA’s above-average exposure to property loans relative to foreign peers operating in China has led to higher credit loss rates, he said, adding that the rating firm expects additional provisions for the rest of this year.

But the bank has adequate capital to absorb potential losses, and it had also reduced its mainland commercial real estate loans by about 8% year-to-date as of June, Varghese said.

BEA’s shares in Hong Kong have lost 29% this year, compared with a 26% slump in the broader Hang Seng Finance Index. The lender’s stock is hovering near the lowest since 1998 and is worth just about 0.2 time its book value, while the average ratio for listed banks included in the index is three times as much, according to Bloomberg-compiled data.

“With headwinds affecting the sector, BEA has been proactively managing our Chinese commercial real estate portfolio, including reducing exposure and other risk mitigation measures where appropriate,” the bank said in response to questions from Bloomberg News.

China’s real estate market has been rocked by a liquidity crunch fueled in part by a clampdown started in 2020 on excessive borrowing by property firms and speculation by home buyers. That’s snowballed into record defaults, as Covid restrictions also take a toll on home sales.

As of June 30, BEA had HK$60.2 billion ($7.7 billion) existing loans to China’s privately-owned developers, according to an August research note by China International Capital Corp. following the lender’s semi-annual financial result release. Among those, the CICC report said HK$14 billion were “high-risk” lending including non-performing and special-mention loans. BEA has not responded to a Bloomberg inquiry on those figures.

BEA’s AT1 yields are high, particularly when compared with stable US banks like Bank of America Corp (NYSE:BAC). and JPMorgan Chase & Co. (NYSE:JPM), and are in line with UK and European peers which had other economic headwinds and bank-specific negative headlines, said Pri de Silva, a Bloomberg Intelligence analyst.