By Jonathan Stempel

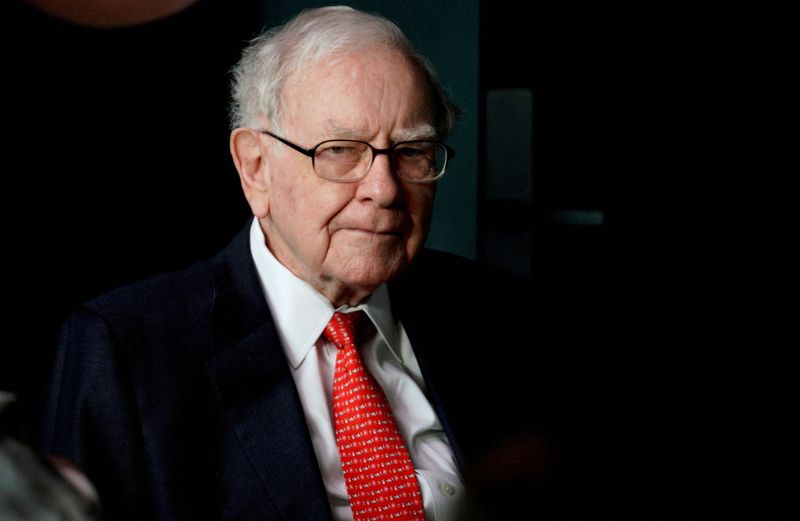

OMAHA, Neb. (Reuters) - Warren Buffett's Berkshire Hathaway (NYSE:BRKa) Inc dove into equity markets in the first quarter, spending more than $51 billion on stocks including a much larger stake in Chevron Corp. (NYSE:CVX)

Berkshire, which Buffett has run since 1965, also said on Saturday quarterly operating profit was little changed from a year earlier, with some businesses able to fend off supply chain disruptions. Geico, the car insurer, posted an underwriting loss.

The Omaha, Nebraska-based company also said it repurchased $3.2 billion of its own stock in the quarter, but none in the first three weeks of April.

Berkshire's disclosures suggest that Buffett has finally found large new uses to dispose of Berkshire's cash pile, which shrank more than $40 billion to about $106 billion.

The Chevron stake grew to $25.9 billion as of March 31 from just $4.5 billion three months earlier, as oil prices surged higher following Russia's invasion of Ukraine.

That came on the heels of Berkshire's purchase of well over $6 billion of stock in Occidental Petroleum Corp (NYSE:OXY), where it already had a $10 billion preferred stock stake.

Buffett has also committed $11.6 billion to buy insurance company Alleghany (NYSE:Y) Corp, and bought $4.2 billion of HP Inc (NYSE:HPQ) stock.

Berkshire ended March with $391 billion of stocks, more than half of the company's $712 billion overall market value.

Other businesses include the BNSF railroad, Berkshire Hathaway Energy, and a variety of manufacturing and retail operations including See's Candies and Dairy Queen ice cream.

NET RESULTS FALL

First-quarter operating profit edged up to $7.04 billion, or about $4,786 per Class A share, from $7.02 billion a year earlier.

Berkshire's net income fell 53% to $5.46 billion, or $3,702 per Class A share, to $11.71 billion, or $7,638 per Class A share, a year earlier.

Net results included $1.58 billion of gains and losses from stocks including Apple Inc (NASDAQ:AAPL), as well as Chevron.

An accounting rule requires Berkshire to report unrealized gains and losses with net results, and Buffett urges investors to ignore the resulting volatility.

Berkshire released results ahead of its first in-person annual shareholder meeting since 2019 in Omaha.

DISRUPTIONS

In its quarterly report, Berkshire alluded to the Ukraine invasion, without mentioning it specifically, and the spread of Omicron variants of COVID-19 in discussing the supply chain issues that many businesses now face.

"Significant disruptions of supply chains and higher costs have persisted in 2022," it said. "Further, the development of geopolitical conflicts in 2022 have contributed to disruptions of supply chains, resulting in cost increases for commodities, goods, and services in many parts of the world."

Berkshire businesses that took hits included Precision Castparts aircraft parts, Clayton Homes mobile homes and McLane food distribution.

Chip shortages were also a problem, dampening consumer shipping volume at BNSF and reducing sales volume at Berkshire Hathaway Automotive car dealerships.

Revenue nevertheless rose at both, with BNSF benefiting from higher fuel prices and surcharges, and car and truck sales revenue growing because vehicles are getting more expensive.

Rising used car prices and shortages of replacement parts also weighed on the Geico auto insurer, which posted an underwriting loss because loss claims are increasing.

Profit from Berkshire Hathaway Energy, one of Berkshire's largest businesses and a steady earnings generator, rose 7%, helped by higher electric utility margins and tax benefits at its MidAmerican Energy unit.

Berkshire's stock has withstood recent market volatility far better than many other large U.S. stocks. Its Class A shares are up more than 7% this year, while the Standard & Poor's 500 has fallen 13%.