By Ambar Warrick

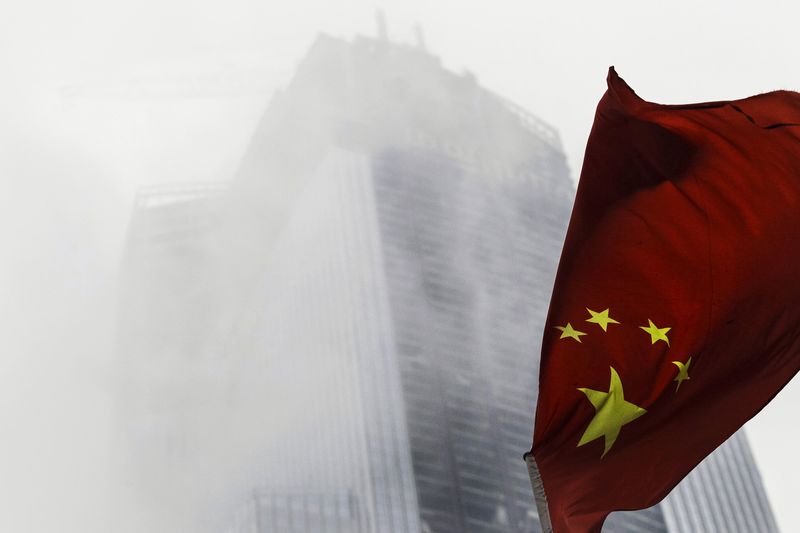

Investing.com-- Most Asian stocks bounced back from recent losses on Tuesday, with Chinese bourses leading gains after Beijing rolled out more stimulus measures, while social media rumors suggested that the Chinese government was considering the scaling back of its anti-COVID policies.

China’s blue-chip Shanghai Shenzhen CSI 300 index surged nearly 3%, recouping all of its recent losses, while the Shanghai Composite index added 2.2%. Hong Kong stocks also rallied, with the Hang Seng index jumping over 4%.

New social media rumors suggested that Beijing was considering acquiescing to recent civilian protests and scaling back its strict zero-COVID policy. The policy was the subject of countrywide protests over the weekend, amid growing public ire towards COVID-linked restrictions.

The rumors suggested that Beijing will announce an end to the zero-COVID policy by focusing on the low fatality rate of recent outbreaks.

But China is still grappling with record-high daily increases in infections, which saw the reintroduction of curbs over the past two months.

Chinese health officials are now set to hold a briefing later in the day to provide more guidance on the country's anti-COVID policies.

Chinese property stocks were the best performers for the day, after the government lifted a ban on equity financing in the sector. The move opens up a new line of funding for the beleaguered sector, which also counts for around a fourth of the Chinese economy.

Optimism over the real estate move and the prospect of a Chinese reopening helped markets look past concerns over anti-government protests in the country. But the protests also appeared to have simmered down after an escalation over the weekend.

China-focused bourses logged strong gains as they recovered from recent losses. South Korea’s KOSPI added 0.9%, while the Taiwan Weighted index rose 1%.

Australia’s ASX 200 index also added 0.3%, although gains were held back by losses in heavyweight bank stocks.

Indian stocks raced to record highs as sentiment improved and as investors focused on the country’s relatively stronger economic prospects for the year. The BSE Sensex 30 benchmark index rose 0.6% to a record high of 62,792.40 points, while the blue-chip Nifty 50 index rose 0.6% to a record peak of 18,662.35 points.

The Indian economy is forecast to expand by nearly 7% this year, vastly outperforming most global economies, according to the International Monetary Fund.

On the other hand, Japan's Nikkei 225 index sank 0.4% after disappointing retail sales data heralded more headwinds for the Japanese economy.