(Bloomberg Opinion) -- Turbulent times should mean good business for insurers as people try to protect themselves against the hazards of an uncertain world. Hong Kong’s summer of unrest has proved anything but happy for shares of AIA Group Ltd., the city’s biggest seller of policies. The company may prove more resilient than investors are giving it credit for.

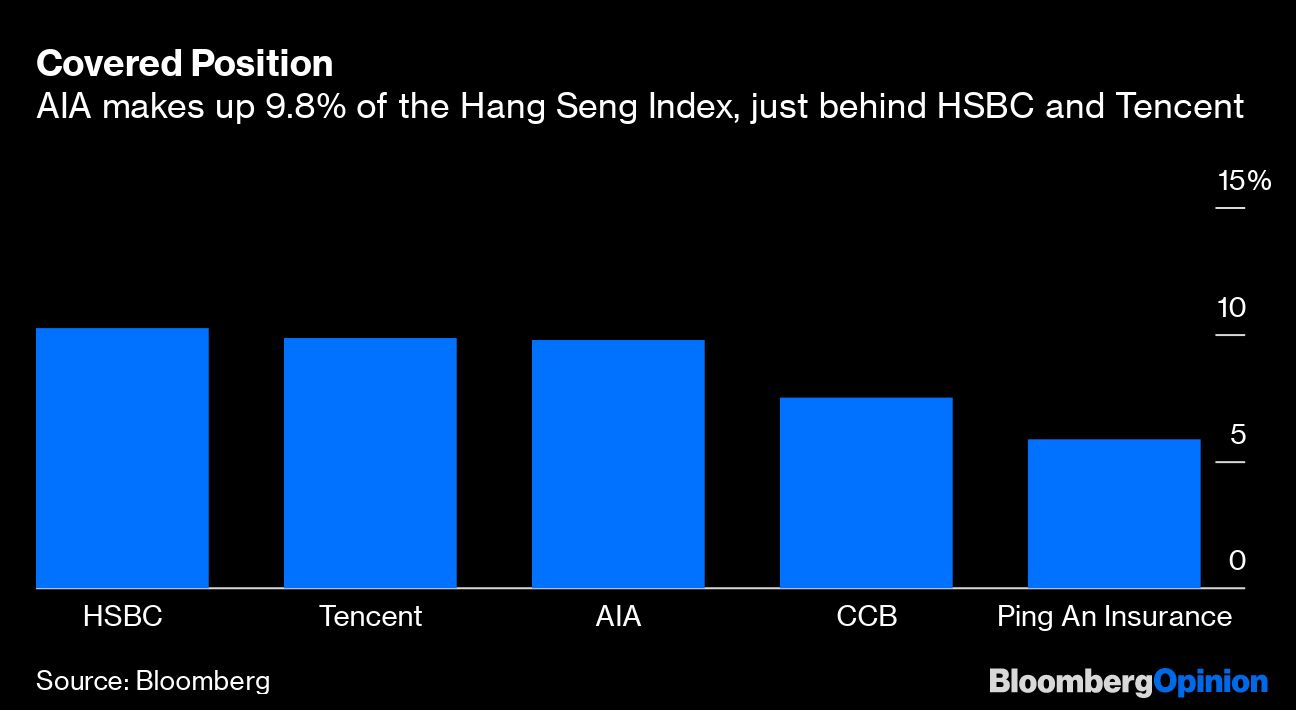

AIA has slumped more than 16% from its July 19 peak, among the worst performers on Hong Kong’s Hang Seng Index in that period. The insurer has the third-highest weighting in the benchmark after HSBC Holdings Plc (LON:HSBA) and Tencent Holdings Ltd., which have both lost less than 9% over the same time frame. AIA’s steepening decline is unusual for a stock that has mostly seen steady gains since it was spun out of American International Group Inc (NYSE:AIG). after the financial crisis in 2010.

Blame the Hong Kong protests. Anti-government demonstrations have led to a precipitous fall in mainland Chinese visitors to the semi-autonomous city. These tourists are an important source of business for Hong Kong insurers, whose dollar-based products offer a hedge against the falling yuan and a route outside China’s restrictive capital controls. Chinese tour groups to Hong Kong for the Golden Week holiday starting Oct. 1 are set to plunge 86% from a year earlier, Jinshan Hong and Qian Ye of Bloomberg News reported last week, citing the city’s Travel Industry Council.

Policies sold to mainland visitors accounted for 26% of total new premiums received from individuals in the first six months of 2019, according to Hong Kong’s Insurance Authority. While AIA sells insurance across Asia, Hong Kong contributed 40% of its new business value in the first half, Michael Chang of CGS-CIMB Securities Ltd. reckons. Of this, mainland Chinese visitors accounted for 20%, Chang estimates.

The physical presence of customers in Hong Kong is important because, unlike most financial assets, the city’s regulators require insurance to be sold face-to-face, at least to new clients. AIA, Prudential (LON:PRU) Plc and China Taiping Insurance Holdings Co., a state-controlled company based in Shanghai, are among the most reliant on mainland visitors, according to Bloomberg Intelligence analyst Steven Lam.

There’s more to AIA’s China exposure than sales made in Hong Kong, though. The company’s new business value in China surged 26% in the first half to account for 29% of AIA’s total. Demand for insurance is surging in the mainland as incomes rise while health and retirement systems remain under-developed.

Until recently, AIA had failed to make much headway in a market that’s dominated by state behemoths such as China Life Insurance Co., despite being the only foreign insurer allowed to operate without a partner (thanks to roots that stretch back to 1919, when AIG was founded in Shanghai). That may be starting to change as the government, under pressure from slowing economic growth, opens its financial markets further to overseas companies.

This year, the government loosened regulations that restricted AIA to five geographical regions: Beijing, Shanghai, Shenzhen and the provinces of Jiangsu and Guangdong. The insurer has now moved into new provinces and started selling policies in Tianjin municipality and in the city of Shijiazhuang in Hebei province. (German insurer Allianz SE has been given the green light to set up the first wholly foreign-owned insurance holding company in the country.)

In any event, the collapse in Chinese visitors to Hong Kong is likely to ease even if the protests continue. Investment-linked insurance products denominated in the Hong Kong dollar – which is pegged to the greenback – offer a perennial hard-currency allure for mainland individuals with few opportunities to diversify at home. Insurers in the city also sell policies denominated in the U.S. dollar itself. AIA’s new business value in Hong Kong jumped 19% in the first half.

The slide in AIA stock has taken its price to embedded value to 1.9 times, from a peak of 2.4 times at the end of June. That’s still a premium to rivals such as Ping An Insurance (Group) Co., at 1.3 times, and China Life at 0.5 times, according to data compiled by Bloomberg. Prudential, weighed down by its exposure to the slower-growing U.K. market, trades at 0.7 times embedded value. Still, 19 of 22 analysts tracked by Bloomberg rate AIA stock a buy, with only one sell recommendation.

This slump looks to have limits.