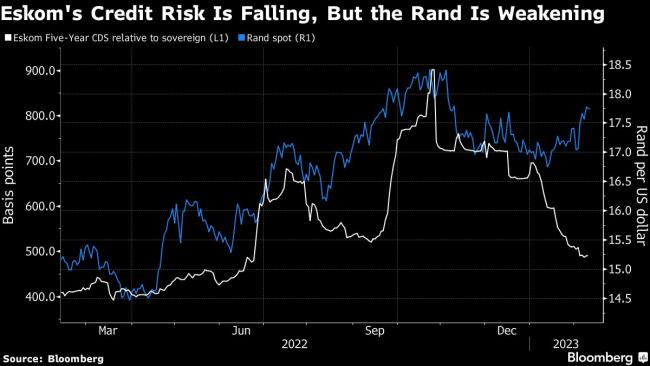

(Bloomberg) -- The Eskom risk premium is in full force for South Africa’s rand.

The currency of Africa’s most industrialized economy is headed for a fourth weekly loss versus the dollar, the longest streak since an emerging-market-wide selloff in October. This time, the under-performance is specific to South Africa. The rand is already down 4.1% this year, while most of its peers are firmer, with Chile’s peso racking gains of over 6%.

“Since the start of the year, the rand has been one of the worst performers in EM,” said Daria Parkhomenko, an FX strategist at RBC Capital Markets in a note to clients. “We think that a key driver of this has been the rand carrying a risk premium for the worsening power situation.”

Parkhomenko said market confidence was low as President Cyril Ramaphosa’s response to the ongoing crisis has been slow, while some pledges to address the situation have not been met sufficiently. Turning the tide with investors would boost the currency, she said.

“By our estimates, the pair would have space to sell off by almost 5%, with all else equal,” she said. “That would equate to ~16.90/95 from current spot levels of ~17.80.”

Credit default swaps for Eskom Holdings SOC Ltd. are trading at the cheapest in about eight months. That’s in anticipation of South Africa taking over as much as two-thirds of Eskom’s debt later this year, a deal that may be announced in the annual budget on Feb. 22.

The state electricity company has imposed power cuts for 13 consecutive months, based on Bloomberg calculations. Ramaphosa declared a state of disaster to enable the government to accelerate its response to an ongoing energy crisis, and said he’ll appoint a minister in his office who will focus on boosting the power supply.

“This can be a positive step,” said Parkhomenko. “But now the question is who will it be? Then, what will happen with the Department of Minerals Resources and Energy, and will Ramaphosa remove Gwede Mantashe from overseeing this department?”

“If the crisis worsens - a scenario that cannot be ruled out - the market will have to carry an even larger risk premium,” she said. “A more severe deterioration would likely see USD/ZAR test the triple top at ~18.50, with all else equal.”