(Bloomberg) -- The pound extended losses and short-dated UK government bonds edged higher after the Bank of England slowed the pace of tightening as the economy enters a recession.

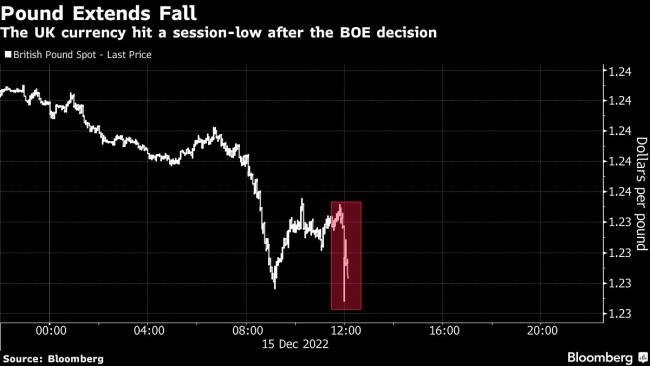

Cable fell as much as 1.1% to $1.2288 after the decision while the five year gilt yield slipped 9 basis points to 3.21%. The BOE raised rates by 50 basis points — as widely expected — following an unprecedented 75-basis point hike in November.

The nine-member Monetary Policy Committee split three ways on the decision as officials tried to balance the risk of inflation getting entrenched against squeezing too hard on growth.

“The voting split suggests that this is a dovish rate hike with two MPC members voting for unchanged,” said Valentin Marinov, FX strategist at Credit Agricole. “The GBP could extend its recent correction lower as investors adjust their BOE rate expectations for 2023.”

Money market traders pared rate hike wagers, pricing interest rates will rise to 4.54% by August compared to 4.61% before Thursday’s decision.

The BOE’s decision comes a day after the Federal Reserve raised rates by half point and signaled borrowing costs will probably head higher than investors expect next year. The European Central Bank is also expected to raise rates by 50 basis points later on Thursday.

The BOE will publish a market notice at 6 p.m. Friday outlining the progress of gilt sales under its quantitative tightening program and the operational arrangements for the first quarter of 2023.