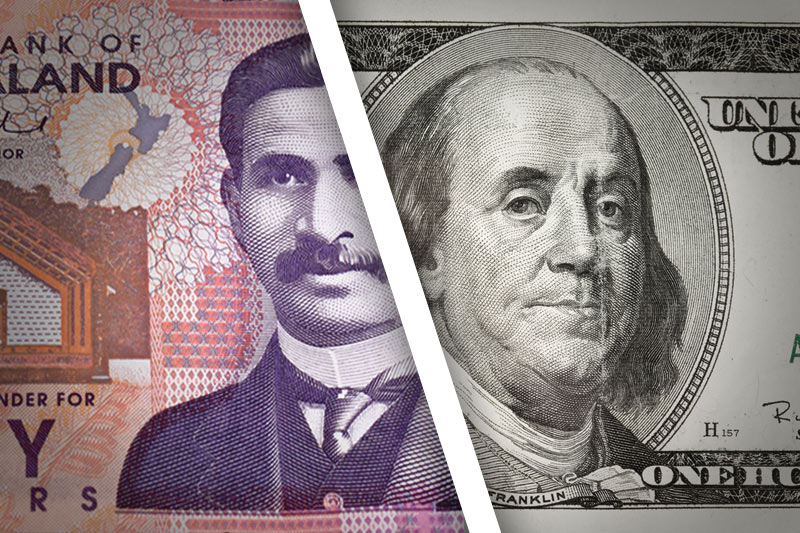

Investing.com - The New Zealand dollar gained on Wednesday in Asia following a central bank report on stability, while investors looked ahead to consumer sentiment in Australia and speeches by Bank of Japan board members.

NZD/USD traded at 0.7808, up 0.04%, after the release. USD/JPY traded at 115.98, up 0.18%, and AUD/USD changed hands at 0.8690, up 0.04%.

The Reserve Bank of New Zealand on Wednesday said the loan-to-value (LVR) restrictions on housing mortgages will remain because of concern of a resurgence in house prices due to strong immigration flows.

Later at the press conference following the release of its annual financial stability report, RBNZ Governor Grahme Wheeler said the LVR limits aren't meant to be permanent but the RBNZ's preference would be to "probably ease

rather than remove them outright."

On the exchange rate, Wheeler said he wouldn't "comment on intervention" but said he still believes that the "exchange rate is unjustified and unsustainable."

Ahead in Australia, the November Westpac-MI Consumer Sentiment Index is due at 1030 Sydney time (2330 GMT). Expectation is for a rise from 94.8 in October.

At 1130 (0030 GMT), Q3 wage price index is then due, with a forecast of a gain of 0.6% quarter-on-quarter.

Bank of Japan board member Ryuzo Miyao speaks to business leaders in Nagasaki at 1000 local time, (0100 GMT). Also on Wednesday, BoJ board member Takehiro Sato will speak on macroprudential policy and the BoJ's initiatives at Japan Society in London from 1330 GMT until 1420 GMT.

Overnight, the dollar traded largely lower against most major currencies on Tuesday in a quiet session that saw investors sell the U.S. currency for profits.

On Monday, the dollar resumed its rally on sentiments that the jobs report was strong enough to keep the Fed on track to hike interest rates some time in 2015 considering that the economy continues to add over 200,000 jobs a month, though profit taking wiped out gains on Tuesday and sent investors snapping up oversold euro positions.

The yen fell as speculation that Japan’s government may postpone a planned sales tax increase boosted risk appetite and fueled strong gains in Asian equities overnight, curbing safe haven demand for the Japanese currency.

Added talk that Shinzo Abe may call a snap election in December to shore up support and push through his reforms added to the yen's decline.

Elsewhere, data on Tuesday revealed that Japan posted an unexpectedly large current account surplus of ¥963 billion in September, boosted by a weaker yen.

The US dollar index, which tracks the performance of the greenback versus a basket of six other major currencies, rose 0.03% at 87.64.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Forex - Kiwi edges higher after RBNZ review, BoJ board members eyed

Published 11/11/2014, 05:33 PM

Updated 11/11/2014, 05:35 PM

Forex - Kiwi edges higher after RBNZ review, BoJ board members eyed

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.