By MacDonald Dzirutwe and Libby George

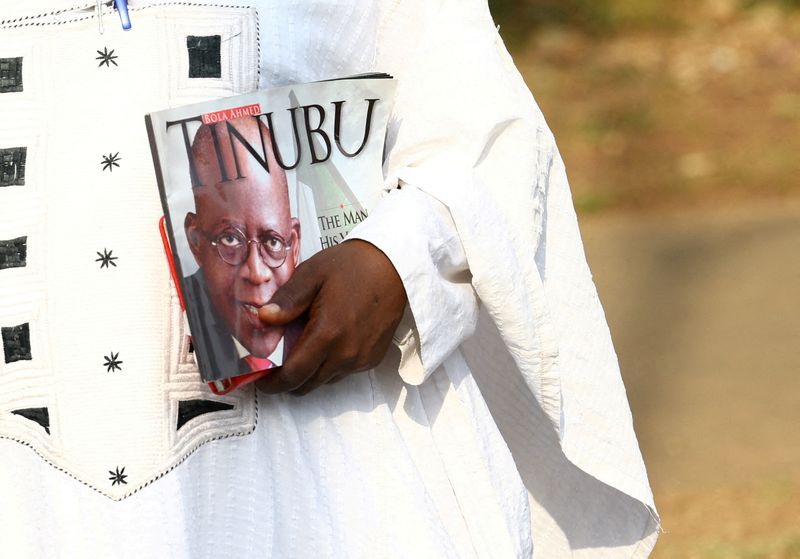

LAGOS (Reuters) - Nigeria's incoming President Bola Tinubu will inherit anaemic economic growth, record debt and shrinking oil output, but before he can start fixing these pressing problems he will need to secure public support for painful decisions.

Life is tough for citizens of Africa's biggest economy, and a tangle of protectionist economic policies and foreign currency interventions have spooked investors.

An attempt by Nigeria to reduce hugely expensive fuel subsidies a decade ago met with mass public protests and had to be dropped.

Tinubu, a member of President Muhammadu Buhari's All Progressives Congress, helped propel the outgoing president to power in 2015.

Now, businesses, international investors and citizens are hoping he can use his experience as governor of Lagos state to recharge Nigeria's struggling economy and finally confront its most difficult challenges.

IN DEBT, IN TROUBLE

Nigeria's debt has ballooned by nearly 60% since 2015, hitting $103 billion last year, according to the Debt Management Office. Its growth is outstripping GDP expansion, and the government has warned that once off-book loans from the central bank are added to the tally, it could hit 77 trillion naira ($167 billion).

While Nigeria's debt-to-GDP ratio is a modest 23.2%, compared with 60% in fellow oil producer Angola, experts say the portion of revenue needed to service the debt is alarming.

In January, ratings agency Moody's (NYSE:MCO) downgraded Nigeria, citing those figures. According to some calculations, debt servicing costs surpassed revenue last year.

Gregory Smith, emerging markets fund manager with M&G Investments said Nigeria's "shockingly low levels of government revenue" also raised questions around its ability to spend to boost growth.

"The debt pressures are symptomatic of that lack of government revenue," Smith said.

Increasing tax collection, Smith said, would be key for Tinubu.

OIL THEFT, SUBSIDIES

Some of the revenue troubles stem from rampant, industrial-scale theft that last year pressed oil output to its lowest in more than 30 years. Oil and gas typically fund half of Nigeria's budget and 90% of its foreign exchange. Continued theft, underinvestment and industrial disputes, hinder output.

On top of this, crippling fuel subsidies drain what is left from oil sales. Fitch Ratings estimates that the implicit petrol subsidy has cost the government approximately 2.4% of GDP in foregone revenue. Experts say taming the subsidy, and boosting oil output, are key.

"The market appears quite myopic in focusing on those two things in particular: the FX policy and the removal of fuel subsidies in addition to broader change at the CBN," said Yvette Babb of fund manager William Blair.

Buhari's government created a complicated web of official and parallel exchange rates in an effort to support the embattled naira. It also created a long list of items banned from using central bank foreign exchange.

Businesses say resulting widespread dollar shortages are crushing, while investors say the difficulty in getting money out of the country has strangled investment.

Smith and Babb said naira bonds, and investing locally, are virtually impossible as a result.

"The main thing is problems with being able to exit the market even if you felt like you could make a return," Smith said.

Government data showed that foreign direct investment dropped from $2.2 billion in 2014, the year before Buhari took office, to $468 million last year.

CHANGES ARE HARD SELL

Getting Nigerians to stomach painful reforms hinges on convincing them that they will make life better - and that will be a tough sell.

Inflation is at a nearly two-decade high, eating into savings and salaries. Unemployment is at a record 33%, prompting a punishing brain drain. Additionally, Tinubu's 8.79 million votes are the fewest won by a Nigerian president since the country returned to democracy in 1999, limiting his goodwill.

"He may need to demonstrate what he can deliver for the Nigerian people before he can take something away that is obviously reducing the cost of living for a large share of the population," Babb said of fuel subsidies. Allowing the naira to weaken, she added, also "comes at a cost."

($1 = 460.0000 naira)