By Seher Dareen

(Reuters) - Gold advanced more than 1% on Tuesday as Treasury yields eased after U.S. inflation data largely met expectations, reducing the likelihood of long-term aggressive policy tightening by the Federal Reserve.

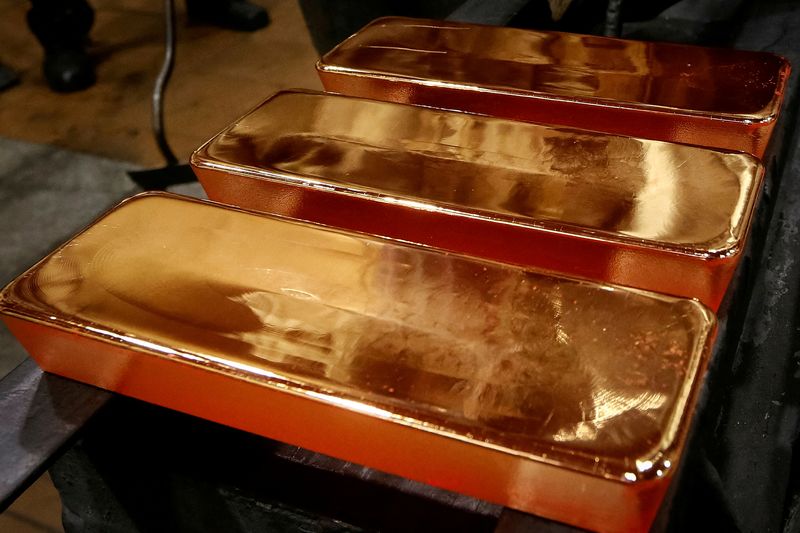

Spot gold XAU= was up 0.7% at $1,967.61 per ounce by 2:39 p.m. ET (1839 GMT), having hit its highest in nearly a month earlier in the session. U.S. gold futures GCv1 settled up 1.4% at $1,976.10.

The benchmark 10-year U.S. Treasury yield slipped after data showed inflation accelerated in March, but less than many market participants had expected. USD/ US/ (Full Story) MKTS/GLOB

While gold is considered an inflation hedge, rising prices can lead central banks to hike interest rates, pushing up bond yields and increasing the opportunity cost of holding zero-yield bullion. "If we're going to continue to see core inflation not surging to the same extent (as headline inflation), the Fed ... may not be as aggressive as when core was moving higher," said Bart Melek, head of commodity strategies at TD Securities. Federal Reserve Governor Lael Brainard said the combined effort of trimming its balance sheet and a series of rate hikes would help bring down inflation, adding a moderation in "core goods" inflation, excluding energy and food prices, is a "welcome" signal. "This doesn't change anything over the short term," with the Fed still expected to raise rates by 50 basis points next month to tame inflation, said Edward Moya, senior market analyst with OANDA. Gold continued to find support as a safe haven from developments surrounding Ukraine, with Russian troops massing for a new offensive. (Full Story) (Full Story) Palladium XPD= fell 3.5% to $2,346.66 per ounce on profit-taking, after hitting its highest since March 24 at $2,550.58 on Monday following the suspension of trading of the metal sourced from key producer Russia in London. Platinum XPT= was down 1.2% at $964.79. (Full Story) The suspension could exacerbate near-term palladium supply tightness, Standard Chartered (OTC:SCBFF) analysts said in a note. Spot silver XAG= rose 1.1% to $25.35 per ounce.