By Christian Kraemer and Leika Kihara

NIIGATA, Japan (Reuters) -Finance leaders of the Group of Seven (G7) nations warned on Saturday of mounting economic uncertainty, in a subdued end to a three-day meeting overshadowed by concerns about the U.S. debt stalemate and fallout from Russia's invasion of Ukraine.

The gathering in the Japanese city of Niigata came as global policymakers - already preoccupied by U.S. bank failures and efforts to reduce reliance on China - are now forced to grapple with a potential default by the world's largest economy.

While the communique made no mention of the U.S. debt ceiling stalemate, it figured constantly in discussions.

The standoff has hit markets as borrowing costs have risen on aggressive monetary tightening by U.S. and European central banks.

"The global economy has shown resilience against multiple shocks, including the COVID-19 pandemic, Russia's war of aggression against Ukraine, and associated inflationary pressures," the finance ministers and central bankers said.

"We need to remain vigilant and stay agile and flexible in our macroeconomic policy amid heightened uncertainty about the global economic outlook," they added in the communique after the meeting.

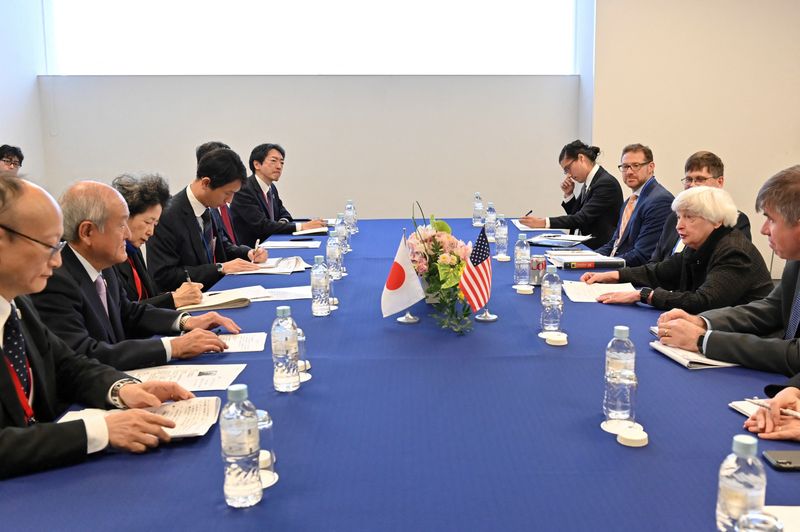

U.S. Treasury Secretary Janet Yellen, who has said a first-ever U.S. default could occur within weeks if the impasse is not resolved, told Reuters on Saturday the standoff was "more difficult" than in the past but remained hopeful of a solution.

Britain's finance minister, Jeremy Hunt, gave a sobering assessment, saying it would be "absolutely devastating" if the United States failed to reach agreement to raise the federal borrowing limit and had its economic growth "knocked off track".

G7 central bank chiefs vowed to combat "elevated" inflation and ensure expectations on future price moves remained well-anchored, a sign many of them will not let their guard down against stubbornly high inflation.

The debt ceiling showdown was discussed at a dinner on Thursday night, Japanese Finance Minister Shunichi Suzuki told a press conference after the meeting. He declined to elaborate.

CHINA AND SUPPLY CHAINS

Seeking to reassure investors after recent U.S. bank failures, the G7 finance chiefs retained an April assessment that the global financial system was "resilient".

But they pledged in the communique to tackle "data, supervisory, and regulatory gaps in the banking system".

China, although not a member of the G7, was a focus. Japan has spearheaded efforts to diversify supply chains and reduce the G7's heavy reliance on the world's second-biggest economy.

In the communique, the finance leaders set a year-end deadline for launching a new scheme to diversify global supply chains.

That envisages the G7 offering aid to low- and middle-income countries to secure them a bigger role in supply chains for energy-related products.

"Diversification of supply chains can contribute to safeguarding energy security and help us to maintain macroeconomic stability," the communique added.

It did not mention an idea, flagged by the United States, to consider targeted restrictions on investments to China to combat Beijing's use of "economic coercion" against other countries.

But it said G7 countries would work to ensure foreign investment in critical infrastructure did not "undermine the economic sovereignty of host countries".

INFLECTION POINT

Many central banks face an inflection point, with aggressive interest rate hikes beginning to cool growth and unsettling the banking system.

Bank of Japan Governor Kazuo Ueda, who chaired the meeting's discussion on monetary policy, said most central banks appeared to feel the impact of past interest rate hikes had yet to show fully as they look to guide future monetary policy.

"Many said they wanted to guide monetary policy taking that point in mind," he said at the press conference with Suzuki.

The group reiterated its condemnation of Russia's invasion of Ukraine and pledge to strengthen monitoring of cross-border transactions between Russia and other countries.

The discussions will lay the groundwork for the G7 summit starting on Friday in Hiroshima, where concern about China's use of "economic coercion" in its dealings abroad will figure.

U.S. President Joe Biden had planned to attend the Hiroshima summit, Yellen said, but added he has said he could cancel the trip if progress on the debt impasse was insufficient.