By Jonnelle Marte

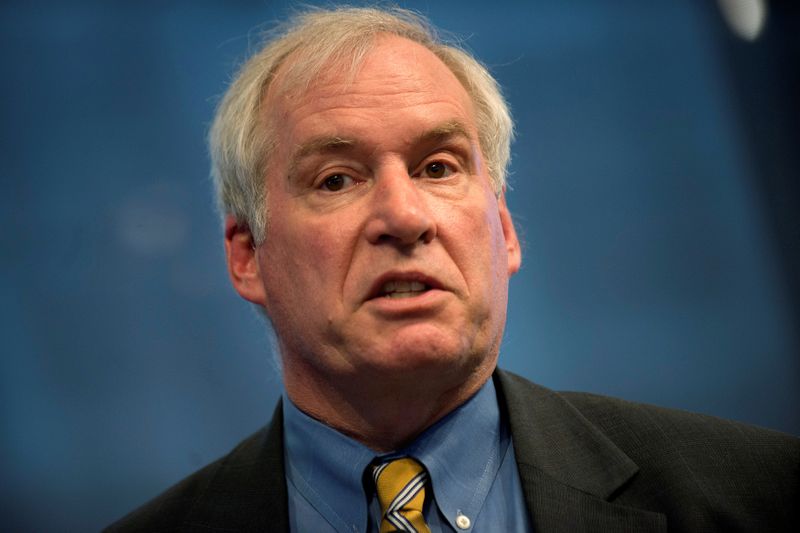

(Reuters) -Inflation will be temporarily distorted this spring as the U.S. economy works through imbalances caused by the pandemic but the pressures should be short-lived and should not lead to a pullback in monetary policy, Boston Federal Reserve Bank President Eric Rosengren said on Wednesday.

"Despite the ebbs and flows of the data, inflation is expected to remain close to 2 percent over the forecast horizon," Rosengren said during a virtual event organized by Boston College. "This does seem to me to be the most likely outcome, which should allow monetary policymakers to be patient in removing accommodation."

Fed policymakers agreed last week to leave interest rates near zero and to continue purchasing $120 billion a month in bonds until there is "substantial further progress" toward the Fed's goals for inflation and maximum employment.

The outlook for the U.S. economy is strong thanks to health improvements and robust fiscal support, but under the Fed's new framework, officials are going to wait until that stronger growth materializes before they make changes to monetary policy, Rosengren said. The policymaker said he will keep a close eye on data, including wage growth, to monitor inflation trends.

For now, Rosengren said "significant slack remains in the economy" and made it clear it is too soon to start talking about reducing the Fed's asset purchases.

"We need to have a substantial improvement for us to begin tapering. It is quite possible that we'll see those conditions as we get to the latter half of the year," Rosengren said. "But right now what we have is one really strong employment report, one quarterly strong GDP report. And so I think it's premature right now to focus on the tapering."

Fed officials will give market participants plenty of warning when the time comes, Rosengren said: "The Fed has no desire to surprise markets."