By Andrea Shalal

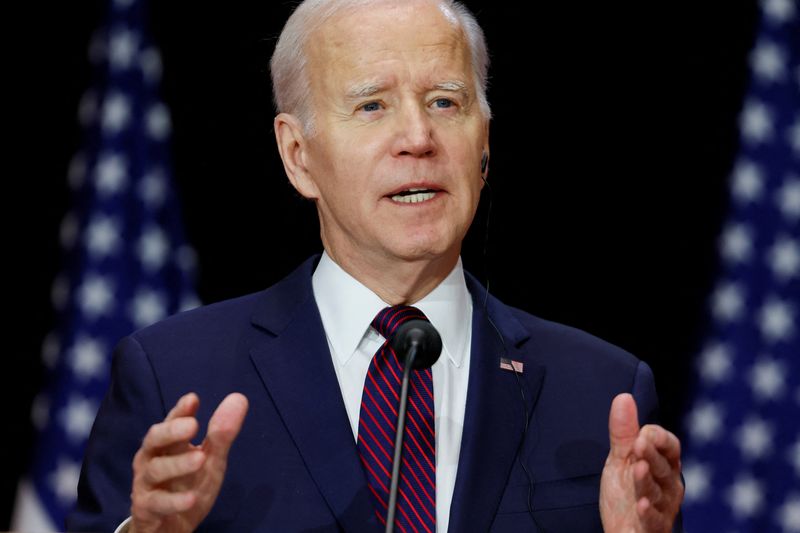

OTTAWA (Reuters) -President Joe Biden said on Friday that federal deposit insurance could be tapped for deposits above $250,000 if other U.S. banks fail, expressing confidence that mid-sized U.S. banks would survive strains in the sector.

Biden said U.S. banks are in "pretty" good shape, people's savings were secure and he did not see an industry ready to explode.

"If we find that there's more instability than appears, we'd be in a position to have the FDIC use the power it has to guarantee those (deposits) above $250,000 like they did already," he told reporters at a news conference in the Canadian capital of Ottawa.

Regional lenders in the United States are facing a crisis of confidence after the collapse of Silicon Valley Bank and Signature Bank (NASDAQ:SBNY) this month. The turmoil has prompted unprecedented moves by regulators to guarantee the deposits of SVB and Signature.

In recent days, Biden, U.S. Treasury Secretary Janet Yellen and other banking regulators have issued statements to reassure the public that the U.S. banking system is safe.

Still, investors have dumped banking stocks globally over the past two weeks, with rapid interest rate increases to rein in inflation blamed by some as the root cause of the debacle.

After a volatile, week, the S&P Bank index ended modestly lower, while the KBW Regional Bank index rose 2.9%.

Swiss-government brokered rescue deal for Credit Suisse has further spooked investors.

Biden said it would take some time for the situation to calm down but he said what happened with Credit Suisse in Europe was of no consequence for U.S. banks.

"I don't see anything that's on the horizon that's about to explode. But I do understand there's an unease about this," he said.