Investing.com - Here are the top five things you need to know in financial markets on Thursday, December 14:

1. Dollar Stabilizes After Post-Fed Slide

The dollar stabilized against a basket of the other major currencies, having slid after the Federal Reserve raised interest rates as expected, but left its rate-hike projection for 2018 unchanged due to concerns over the sluggish inflation outlook.

The U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, was little changed at 93.42, after falling 0.7% from a one-month high on Wednesday.

The Fed raised interest rates for a third time this year and indicated that it would stay on a similar path next year, disappointing some dollar bulls who had speculated the U.S. central bank could raise its interest rate projection for next year to four rate hikes.

The central bank also said it expected inflation to remain below its target for another year, tempering expectations for an accelerated pace of rate hikes.

Looking ahead, the Commerce Department will publish data on retail sales for November at 8:30AM ET (1330GMT). The consensus forecast is that the report will show retail sales increased 0.3% last month. Core sales are forecast to gain 0.7%.

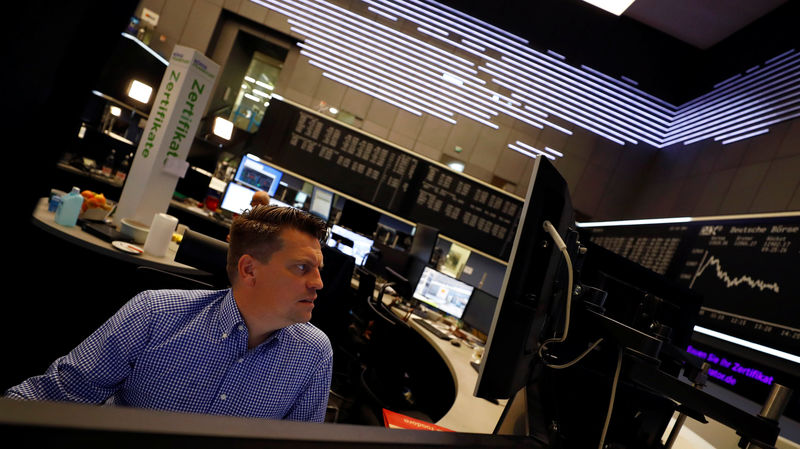

2. Global Stocks Mixed as Markets Brace For 'Central Bank-A-Palooza'

Global stock markets were mixed, as investors reacted to the Federal Reserve's decision to raise interest rates, while awaiting policy decisions from the European Central Bank and Bank of England.

Most Asian-Pacific markets closed slightly lower, as a decline in the region's financial stocks weighed.

In Europe, the majority of the continent's bourses were in negative territory in mid-morning trade, as financial sectors caught the cold from U.S. and Asian trading.

On Wall Street, U.S. stock futures pointed to a slightly higher open. The Dow and the Nasdaq ended higher on Wednesday, but the S&P could not sustain gains in choppy trading following the release of the Fed's statement.

3. European Central Bank Policy Meeting

The European Central Bank's latest interest rate decision is due at 1245GMT (7:45AM ET), with no major policy changes expected.

Most of the focus will be on President Mario Draghi's press conference 45 minutes after the announcement, where he is most likely to reiterate his pledge to support the economy and maintain super-low borrowing costs in the months ahead.

The ECB will also unveil initial 2020 inflation projections, which will likely show price growth at or just below target, rising only gradually over the coming three years, lending support to the bank's decision to withdraw monetary stimulus only slowly.

The euro was little changed against the dollar, with EUR/USD at 1.1830, having advanced 0.7% the previous day.

4. Bank of England Policy Announcement

The Bank of England will announce its rate decision at 1200GMT (7:00AM ET), with analysts expecting no major change in policy, as policymakers grapple with uncertainty over Brexit, low wage growth and weak productivity, which are all weighing on the economy.

Last month, the BoE added back the 25 basis points it took off borrowing costs in the aftermath of the Brexit vote, taking interest rates back to 0.50%, but said it sees only gradual rises ahead as Britain prepares to leave the European Union.

In addition to the BoE, politics is likely to be at the back of investors' minds, as they keep an ear out for any news regarding the Brexit negotiations. British Prime Minister Theresa May will urge European Union leaders to approve an agreement to move Brexit talks on to a second phase in an EU leaders' summit in Brussels on Thursday.

Sterling edged higher, with GBP/USD rising 0.2% to 1.3445.

5. IEA Warns on Surging U.S. Shale Production

The International Energy Agency warned that there were signs that the ongoing rise in U.S. crude oil production was likely to continue into 2018 and upset rivals who are cutting back.

"We see that 2018 might not be quite so happy for OPEC producers, " the Paris-based organization said in its latest monthly report Thursday.

The IEA forecast that non-OPEC supply, which includes the U.S., was set to rise by 600,000 barrels per day (bpd) in 2017, and 1.6 million bpd in 2018. It also noted that global oil supply rose 200,000 bpd in November to 97.8 million bpd, adding that this was "the highest in a year, on the back of rising U.S. production."

U.S. crude oil production rose by 73,000 bpd last week to 9.78 million bpd, according to government data, bringing output close to levels of top producers Russia and Saudi Arabia.

U.S. West Texas Intermediate crude futures traded at $56.59 per barrel, little changed on the day. Meanwhile, Brent inched up 0.2% to $62.60.