By Geoffrey Smith

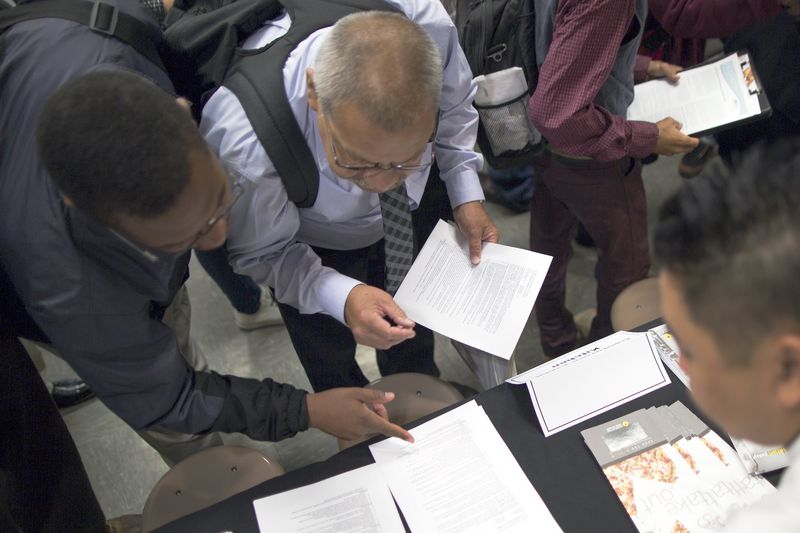

Investing.com -- The U.S. labor market's revival at the start of 2021 continued last week, with initial claims for unemployment benefits falling to their lowest in over a month.

The Labor Department said initial jobless claims fell to 779,000 last week, and also revised the previous week's figure down to 812,000 from an initial estimate of 847,000.

The news follows an expectedly strong report on private-sector hiring on Wednesday by ADP. The payrolls processor said that the private sector hired a net 174,000 people in the month through mid-January.

The numbers are the latest to suggest the U.S. economy has started the year more solidly than expected by many, and come as President Joe Biden makes his first steps to pushing through a $1.9 trillion relief and recovery package of fiscal measures. The Congressional Budget Office earlier this week raised its forecast for economic growth this year, reflecting in part the expected impact of the measures. The CBO now expects U.S. gross domestic product to return to its pre-pandemic level by the middle of the year.

The Labor Department said the number of continuing claims, which are reported with a one-week lag to initial claims, fell to 4.592 million, a drop that was over 100,000 more than expected.

The news sent the yield on the 30-year Treasury bond to its highest in over 10 months, as the market priced in a fuller and faster recovery from the pandemic.