By Lucia Mutikani

WASHINGTON (Reuters) - A month-long strike at General Motors (N:GM) could cut U.S. job growth by as much as 75,000 in October, JPMorgan (NYSE:JPM) economist Daniel Silver said on Friday, an unwelcome development amid financial market fears of a recession.

Silver said in a research note that the estimated hit to nonfarm payrolls would be the result of both direct and indirect effects of the strike by about 48,000 workers at the automaker.

The estimate draws comparisons with the 1998 strike at GM, which JPMorgan estimated depressed payrolls in July of that year by about 150,000 jobs. That strike spilled over to other parts of the auto industry.

The Labor Department's Bureau of Labor Statistics (BLS), which compiles the closely watched employment report, treats striking workers, who did not receive a paycheck during the survey week, as unemployed. The October report is due Nov. 1.

Last week was the survey period for the nonfarm payrolls component of October's employment report. The BLS' strike report on Oct. 25 will offer details on the likely payrolls impact of the work stoppage that started in mid-September.

"The near-50,000 workers on strike at GM plants starting in mid-September should be removed from the October nonfarm employment count," said Silver. "We therefore look for the total drag on employment coming from the strike to be only somewhat larger than the direct effects, likely around 75,000."

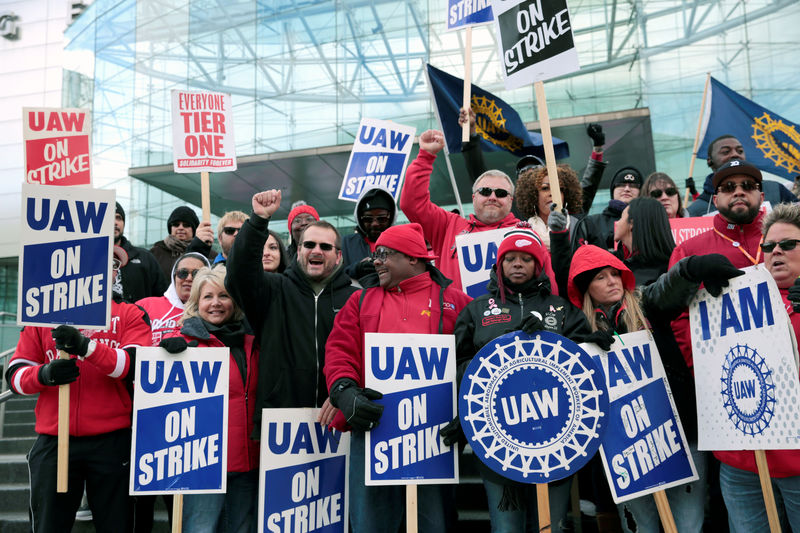

GM and the United Auto Workers union reached a tentative deal on Wednesday to end the strike. On Thursday, the union said workers would stay off the job while they vote on the proposed contract.

The strike depressed manufacturing output in September. The household survey from which the unemployment rate is derived would likely consider the striking workers as employed.

"We don't think that any upward pressure on the unemployment rate from the strike will be clearly visible," said Silver. "We would need to see unemployment increase by 164,000 for the unemployment rate to rise 0.10 percentage point with a steady labor force."

Though likely to be temporary, any drop in October payrolls could rattle financial markets already on edge following slower job growth in September. Payrolls increased by 136,000 jobs last month, below the monthly average of 161,000 this year. The three-month average gain in private employment fell to 119,000, the smallest since July 2012, from 135,000 in August.

A spate of weak data, including September retail sales and manufacturing production, have also cast a cloud on the longest economic expansion on record. The expansion, now in its 11th year, is being hamstrung by a 15-month trade war between the United States and China, which has eroded business confidence and weighed on business investment.