By Jonathan Cable

LONDON (Reuters) - Euro zone business activity remained lacklustre at the start of the year, a survey showed a day after the European Central Bank said the manufacturing sector remained a drag on the economy, but there were some glimmers of hope for policymakers.

ECB rate-setters did not make any policy change on Thursday, standing by their pledge to keep buying bonds and, if needed, cut interest rates until price growth in the euro zone heads back to their goal.

Still, the slowdown in euro zone economic activity has probably bottomed out, according to a Reuters poll last week, which showed while the outlook for growth and inflation remained lukewarm the chances of a recession have faded. [ECILT/EU]

That outlook was somewhat supported by IHS Markit's Euro Zone Composite Flash Purchasing Managers' Index (PMI), seen as a good gauge of economic health, which held at 50.9 in January but missed the median prediction in a Reuters poll for 51.2.

Anything above 50 indicates growth.

"The unchanged reading for the euro zone's Composite PMI in January leaves it still consistent with fairly slow GDP growth," said Jack Allen-Reynolds at Capital Economics.

Following Friday's PMI, the euro continued to languish near a seven-week low after the ECB's more dovish tone at Thursday's meeting than some had expected.

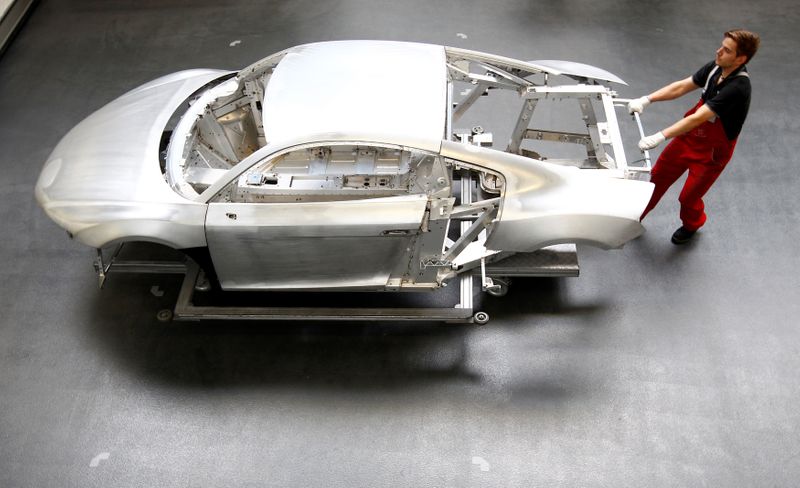

An earlier PMI from Germany, Europe's largest economy, showed the private sector gained momentum as growth in services activity picked up and the pullback in manufacturing eased.

French activity expanded at a weaker pace as nationwide strikes weighed and IHS Markit cautioned growth outside of Germany and France slowed to a six-and-a-half year low.

Britain's performance bettered the euro zone's for the first time since December 2018, a separate PMI showed, the strongest evidence yet of a post-election boost to the economy that could deter the Bank of England from cutting interest rates next week. [GB/PMIS]

The euro zone's headline index was bogged down by a still struggling factory industry. The manufacturing PMI marked the 12th month below the break-even mark, registering 47.8 - albeit an improvement on December's 46.3 and well above the Reuters poll's 46.8.

An index measuring output, which feeds into the composite PMI, rose to 47.5 from 46.1, its highest since August.

While most forward-looking indicators in the manufacturing PMI remained in negative territory, they were moving in the right direction. The new orders, employment, backlogs of work and quantity of purchases indexes were all still sub-50 but did rise.

"With manufacturing showing early signs of recovery and the service sector continuing to grow, chances of a recession are receding further," said Bert Colijn at ING.

However, the PMI for the bloc's dominant services industry weakened to 52.2 from 52.8, confounding expectations for no change.

And possibly of concern to policymakers, demand weakened suggesting there won't be a significant turnaround anytime soon. The services new business index fell to 51.5 from 52.1.

But optimism about the year ahead bounced. The composite future output index climbed to 61.2 from 59.4, its highest reading since September 2018.

Consumer confidence remained unchanged in January from December, official flash figures released on Thursday showed.