(Bloomberg) -- China’s economy showed further signs of improvement in June with a strong pickup in services spending as Covid outbreaks and restrictions were gradually eased.

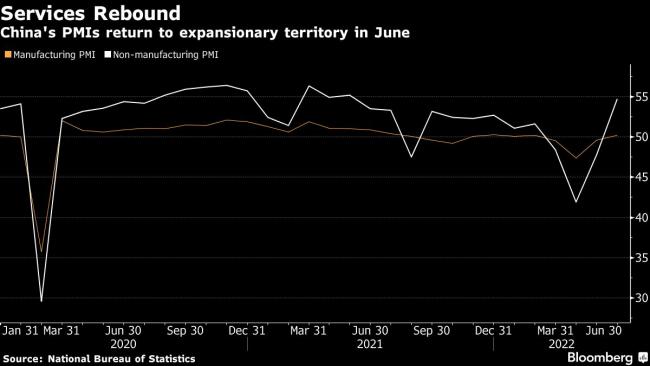

The official manufacturing purchasing managers index rose to 50.2 from 49.6 in May, the National Bureau of Statistics said Thursday, slightly below the median estimate of 50.5 in a Bloomberg survey of economists. It was the first time since February that the index was above 50, indicating expansion in output compared with May.

The non-manufacturing gauge, which measures activity in the construction and services sectors, climbed to 54.7, the highest in more than a year and well above the consensus forecast of 50.5.

China’s CSI 300 Index rose as much as 0.9% while major stock gauges in Asia broadly fell.

Government restrictions to contain Covid outbreaks have gradually eased over the last month. The financial hub Shanghai lifted its two-month lockdown at the start of June by allowing more shops to reopen, more factories to resume production, and for port operation to pick up.

The data suggests “the pace of recovery accelerated as the Covid situation stabilized,” said Peiqian Liu, chief China economist at NatWest Group Plc. There was a “broad based but still soft recovery in both production and new orders,” and the figures show the rebound is still milder compared with the recovery from the Wuhan lockdown in 2020, she said.

Some 19 of the 21 sectors in the service sectors tracked in the survey returned to expansion last month, up from just six in the previous month, according to the NBS. Gauges of sectors previously hit badly by the outbreaks all improved, such as railway transport, air transport, accommodation, catering and entertainment.

The recovery remains fragile though as the country sticks to its Covid Zero strategy, meaning restrictions could be tightened if outbreaks of the highly transmissible omicron variant flare up again. Chinese President Xi Jinping reaffirmed his Covid Zero policy this week, saying it was the most “economic and effective” for the country.

Economists, meanwhile, are holding firm on their gross domestic product growth forecasts for this year. The median projection in a Bloomberg survey for 2022 growth is 4.1%, well below Beijing’s annual target of around 5.5%. Bloomberg’s aggregate index of eight early indicators showed some improvement in June, though the recovery remains muted.

(Updates with additional details)

©2022 Bloomberg L.P.