Bitcoin experienced its steepest ever decline in monetary value on April 16, when the price decreased by at least $8,000. This comes as a result of several negative news stories regarding the cryptocurrency that began after a Twitter account misled followers about the U.S. Treasury’s investigation into digital currencies. Coupled with a blackout in China which decreased its hash rate by nearly 25%, sentiment toward the cryptocurrency quickly shifted.

Bitcoin is the staple of the cryptocurrency market and influences price movements through the entire network of digital currencies. Recent activity in the market, however, has not been exclusively dependent on Bitcoin, as altcoins such as Ethereum, VeChain, and TRON have gained outside momentum. However, the cumulative effect of negative news items has generated a ripple effect through the whole network, offsetting previous market gains. As a result, the total cryptocurrency market cap lost roughly $300 billion.

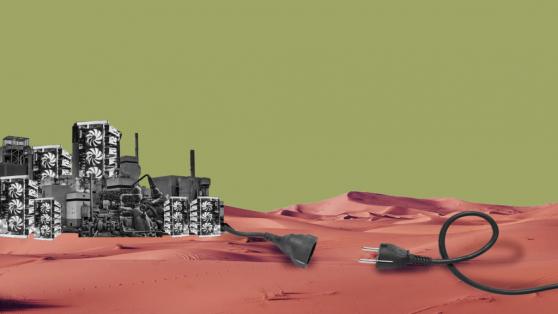

Bitcoin Hash Rate In China Causes Concern

According to reports, between April 15-16, the network hash rate of Bitcoin dropped by an estimated 20-25%. The Chinese region of Xinjiang experienced a major electrical blackout due to a coal mine explosion, destabilizing the entire Bitcoin network.

Bixin Group relocated part of their mining operation to Xinjiang due to China’s dry season. The mining entity manages over 300 MW/hour and holds 2.5% of the global Bitcoin hashing power. Following government intervention, which aimed to minimize losses and preserve workers’ safety, over 80% of the mining rigs have been offlined.

Two provinces in China, namely Xinjiang and Sichuan, handle 50% of Bitcoin’s global hashing power. Despite the premise of decentralization, the event that affected the hashrate is somewhat worrying as a significant power outage in both areas can shake the entire Bitcoin network to its core.

Bitcoin Is Weather Dependent

As the spotlight shines brighter and brighter on the top cryptocurrency, regulatory bodies are investigating it in more detail. The main concern regarding Bitcoin is its environmental impact, given the intensive workload required to operate a mine. However, as data indicates, Xinjiang province had 35% renewable energy in 2019, which has risen to 43.5% this year.

Miners’ main incentive for running mines is the profit share. While energy can be easily accessible anywhere, finding more efficient and cost-effective energy sources will increase the profit margins for miners. Furthermore, in China, multiple other regions facilitate access to renewable energy such as solar or hydro.

However, Bitcoin farm operators need to relocate their operations during various seasons. Thus Bitcoin farms in China can obtain 100% renewable energy in the summer and 40% renewable energy during the winter. Additionally, looking at Bitcoin farms placement, there is a correlation between the availability of renewable energy and mining operations, as farms outside China are located in places such as Iceland, Siberia, or Sweden.

On the Flipside

- Commentators have argued that the 40% decrease in hash rate did not cause the sudden price fall in Bitcoin.

- Bitcoin’s price was due for a correction to facilitate a healthy upward trend in the coming months and shake off weak hands.

- A decrease in hash rate on the global level will increase the chances of a 51% attack on the network.

Can Bitcoin Decentralize Itself?

Bitcoin’s centralization in China has been a cause for concern for many years. Rumors floated concerning a ban on Chinese mining will be detrimental to Bitcoin’s long-term value. However, mining in China only accounts for roughly 32% of the global hash rate. Additionally, redistribution of network hash rate globally will not be detrimental for Bitcoin; in fact, it will cause blocks to mine slower only temporarily before regaining momentum.

The event in Xinjiang highlights the need for Bitcoin mining to dissipate through the globe, as a single outage can affect miners’ profits. Moreover, renewable energy is accessible around the world; however, the cost of relocating and investing in renewable energy could be an impediment for miners.

The concentration of mining resources in certain regions can affect the network hash rate but won’t necessarily affect network stability. Looking into the future, widespread Bitcoin mining farms will be beneficial to the cryptocurrency as they reduce the possibility of bad actors influencing Bitcoin’s network in any shape or form.