Read in the Digest:

- Bitcoin reclaims $20,000 as Fear and Greed Index jumps, signifying bullishness.

- Ethereum and The Sandbox lead Altcoin rally – Bitcoin miner revenue surpasses ETH miners.

- Charles Hoskinson hints that Cardano’s next wave is coming this month.

- Crypto lender Celsius Network repays $142.8M to MakerDAO.

- Three Arrows Capital makes massive transfers after filing for liquidation and bankruptcy.

Bitcoin Reclaims $20,000 as Fear and Greed Index Jumps, Signifying Bullishness

Although Bitcoin (BTC) closed last week below $19k, extending its losing streak, the world’s largest cryptocurrency has quickly regained lost ground, benefiting from a slight rebound in investor sentiment.

The Bitcoin Fear and Greed Index—the most popular metric used to gauge Bitcoin price sentiment—jumped over the weekend, moving from 11/100 to 19/100 on Tuesday, July 5th.

The price of Bitcoin jumped in tandem with the metric, seeing it recover from a low of $19,037 on Saturday, July 2nd, to trade as high as $20,405 on Tuesday, July 5th.

The 3 day price chart for Bitcoin (BTC). Source: CoinMarketCap

After the significant recovery, the price of Bitcoin has once again retraced below $20k. The leading crypto is trading at $19,500 at the time of writing, while the Fear and Greed Index is currently gauged at 14/100.

The 24 hour price chart for Bitcoin (BTC). Source: CoinMarketCap

Flipsider:

- On a larger scale, the Fear and Greed Index has remained static in extreme fear territory, with investors unconvinced that macroeconomic and idiosyncratic jitters will wane anytime soon.

Ethereum and The Sandbox Lead Altcoin Rally – Bitcoin Miner Revenue Surpasses ETH Miners

Recovering from a week of choppy trading, Altcoins are beginning to show signs of bullishness. Although most Altcoins have made significant recovery in their own right, Ethereum (ETH) and The Sandbox (SAND) are leading the charge.

Ethereum’s (ETH) price shot up by as much as 7.5% to trade as high as $1,165. ETH now trades at $1,130 at the time of writing. The Sandbox (SAND) posted even larger gains, rallying 19% to set a new weekly high of $1.23.

The 48 hour price chart for Ethereum (ETH). Source: CoinMarketCap

The 48 hour price chart for The Sandbox (SAND). Source: CoinMarketCap

Flipsider:

- Despite the recovery of ETH outperforming that of BTC, data shows that the revenue of bitcoin miners has surpassed that of Ethereum miners.

- In May, Ethereum miners generated $100 million more than Bitcoin miners. However, in June, the total amount generated by bitcoin miners hit $656.47 million, while Ethereum miners generated $549.58 million.

Why You Should Care

The engagement of an Altcoin rally without the need of market-moving headlines could be an indication that the bulls are finally taking over.

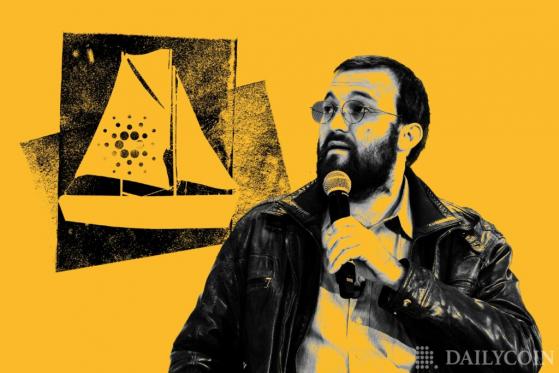

Charles Hoskinson Hints That Cardano’s Next Wave Is Coming This Month

Just days after announcing the launch of the Vasil Hard Fork on the Cardano testnet, Charles Hoskinson, founder and CEO of Cardano, has teased that Cardano’s “next wave” will be coming this month.

Hoskinson’s comment came in response to a comment made by Sebastien Guillemot, CTO and co-founder of dcSpark. Guillemot tweeted that the launch of Vasil would allow the transfer of Ethereum tokens (stablecoins, non-custodial tokens, and stateful tokens) to the Cardano blockchain.

Hoskinson replied to the tweet, saying: “Coming this month, Cardano’s next wave!” The Vasil Hard Fork was carried out on the testnet on July 3rd, with developers promising the implementation of the upgrade on the mainnet four weeks after testing—signifying the last week of July.

The Vasil upgrade is a highly anticipated event, promising to bring full dApp functionality and improvements to the network’s usability and efficiency. Additionally, Vasil is expected to improve Cardano’s overall speed and throughput.

Flipsider:

- At Vasil’s testnet launch, Input-Output Global (IOG) noted that there would be no proposal to launch Vasil on the mainnet until the ecosystem’s partners indicated their readiness.

Why You Should Care

Charles Hoskinson’s comment serves as confirmation that the Vasil Hard Fork will be implemented on the Cardano mainnet in July.

Crypto Lender Celsius Network Repays $142.8M to MakerDAO

Three weeks after liquidity concerns forced Celsius Network to halt withdrawals, the retail crypto lending platform kicked off July by repaying a substantial amount of its outstanding debt to MakerDAO.

According to reports from DeFi Explorer, the crypto lender has repaid $142.8 million of its MakerDAO loans across four different transactions since July 1st. By paying down its Maker debt, Celsius has also succeeses in de-risking its loan position from potential liquidation.

The loan repayment has helped the Celsius Network to reduce the liquidation price on its WBTC collateral from over $10,800, to $4,967.09.

Not only did Celsius open July by repaying its MakerDAO debts, but crypto researcher Plan C reports that the crypto lender also paid off further debts to Aave and Compound on July 2nd, amounting to $67 million.

Flipsider:

- Although Celsius has made progress repaying its loans, the lender is still responsible for $82 million in outstanding debt to the Maker Protocol. The firm is currently staring down the barrel of a loss of $667.2 million on its $1.8 billion in lifetime investments.

Why You Should Care

The Celsius Community has celebrated the loan repayment, especially in light of the drastic reduction brought to its liquidation price.

Three Arrows Capital Makes Massive Transfers After for Filing Liquidation and Bankruptcy

Three Arrows Capital (3AC), may not be as insolvent as it previously claimed. Amidst the extreme downturn in the crypto market, 3AC was forced to file for Chapter 15 bankruptcy protection.

Blockchain security company PeckShield has reported that Three Arrows Capital transferred Tether (USDT) and USD Coin (USDC) stablecoins worth tens of millions of dollars to cryptocurrency exchange KuCoin.

The recent transfers come a few days after 3AC filed for Chapter 15 bankruptcy protection in the US Bankruptcy Court in the Southern District of New York to stop creditors from seizing its assets in the country.

At the end of June, the British Virgin Islands ordered the hedge fund to liquidate. Soon after, as a result of discrepancies in the reported operations of 3AC, the Monetary Authority of Singapore (MAS) called out the hedge fund for providing false information in regards to the company’s assets.

Flipsider:

- The ongoing winter has driven 3AC, which held as much as $10 billion in assets under management at its peak, into liquidation.

Why You Should Care

3AC is among the high-profile hedge funds whose investments were swallowed whole by the implosion of the Terra ecosystem and the ensuing market collapse.