As Bitcoin (BTC) underwent a massive rally, bringing the price to an all-time high of $65,000, altcoin prices mimicked BTC’s price action until the reference coin started to swing between $50,000 and $60,000. Altcoins have gained momentum, breaking away from their BTC pairing, which has decayed for more than a month, slowly losing grip but not letting go of the market just yet.

Bitcoin is king but altcoins are top-tier contenders; as data from Blockchaincenter.net highlights, the market is nearing the peak of altcoin mania. An ‘altseason’ is an indicator whereby 75% of the top 50 coins by market cap have performed better than BTC in the last 90 days. The price rally of Ethereum, Cardano, and DogeCoin in the past month, all of which broke their previous ATH’s, is indicative of an altseason.

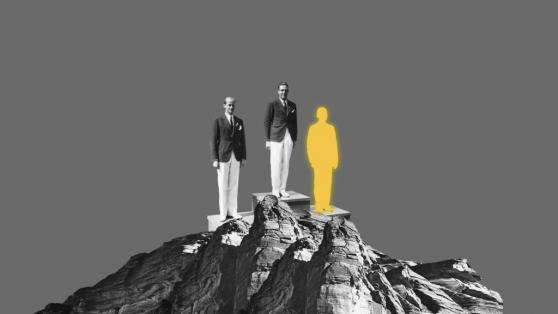

The Breakthrough Parade

Market monopoly from Bitcoin is slowly losing ground as more projects break through from price discovery. BTC’s market dominance has fallen to 43% while ETH holds 18.6% of the market dominance, while dino coins continue to dazzle the market.

Ethereum’s price has broken a psychological milestone, passing the $4,000 threshold on May 10th. JP Morgan attributed Ethereum’s growth to factors like the Canadian ETH exchange-traded fund as well as growing interest from at-home traders. In reality, Ethereum’s growth was not short-sided and was fueled by growing demand in DeFi and NFT’s. Additionally, the Berlin hard fork release, which enabled a decrease in transaction fees, spurred a new DeFi mania for Ethereum. As the ecosystem builds towards a new consensus mechanism on Ethereum 2.0, staking ETH will become symmetrical with mining, with over $9 worth of ETH currently being staked.

Cardano is a much-demanded blockchain project as it originates from an academic standpoint. However, their meticulous development makes releasing updates such as Goguen timely. What’s more, Cardano is backed by a strong community which helps reinforce the project’s credibility. As emphasized by Coin Bureau, ADA could reach a high of $3 by the summer if their smart contract update is flawless. Still, as data suggest, Ethereum is the preferred platform for dApps and even DeFi, as more developers will want to link to Ethereum through layer 2. Still, Cardano’s popularity and dApps offering could shift things as we advance.

On the Flipside

- Future all-time highs would stagnate if Bitcoin continues to lose steam and might end the alt-season abruptly.

- Micro-cap coins with a high-value proposition will start seeing a high trading volume and stomp dino coins from advancing.

- An unfavorable decision in the XRP case could impact cryptocurrencies sentiment for corporate investors.

What’s Next on the Horizon

With the entry into altseason, previous top 10 coins such as Litecoin, Monero, or EOS regained momentum and broke away from the crypto fiasco; a fiasco expedited by Elon Musk and aided by the release of Binance Smart Chain, which makes DeFi “worthwhile”. Adam Morris highlighted that Dogecoin’s growth is due to a “gambling mentality” and, coupled with a lack of cryptocurrency knowledge, could be detrimental for future investors. Additionally, projects like SafeMoon or GMR Finance are rewarding meme coin investing without contributing to the vertical growth of the blockchain space.

The release of the ChainLink 2.0 whitepaper inspired further optimism for Decentralized Oracle (NYSE:ORCL) Networks. According to analysts, with more than 500 integrations, ChainLink can exponentially increase due to a network effect that could see the price double in the next two months. Furthermore, enthusiasm about ChainLink is reaching its previous 2017 height as data from Google (NASDAQ:GOOGL) Trends emphasizes a growing interest in the token.

Exchange token Binance (BNB) has increased by over 1,400% since January 2021, fueled by growing interest in cryptocurrencies. Binance Smart Chain launched as an alternative to DeFi, previously controlled by Ethereum. Whilst Binance’s alternative seems workable on paper, BSC experienced “instances of hacks” which, according to Binance, doesn’t fully reflect the network security. However, Binance’s market growth as the go-to exchange can incur a new rally as BSC gains more momentum.

Ripple is another top 20 coin that could break through and even challenge its previous all-time high. With a price at crossroads given the ongoing lawsuit between Ripple Labs and the SEC, XRP has gained momentum regardless of the circumstance. XRP’s usability is indisputable as it targets corporate entities. A favorable result in the ongoing lawsuit will incite further assurance for the Ripple network and its holders, as the XRP token will no longer be placed under scrutiny.

EMAIL NEWSLETTER

Join to get the flipside of crypto

Upgrade your inbox and get our DailyCoin editors’ picks 1x a week delivered straight to your inbox.

[contact-form-7] You can always unsubscribe with just 1 click.