By Geoffrey Smith

Investing.com -- Mining stocks rose sharply on Friday as base metals prices gained in response to a report that bolstered hopes for a quick relaxation to China's Zero-COVID policy.

Bloomberg reported earlier that China is working on plans to scrap a system that penalizes airlines for bringing virus cases into the country. The report revived this week's strong rally in Chinese stocks, which had begun when unverified claims on Chinese social media said the government may put together a new committee to coordinate an exit from a policy that has acted as a drag on the world's second-largest economy all year.

The National Health Committee had poured cold water on those suggestions on Thursday, but Friday's reaction suggested that a market that has underperformed badly amid the lingering disruption of the pandemic desperately wants to believe in a turn for the better.

Those hopes were reinforced later when newswires reported Zeng Guang, an epidemiologist who has previously advised the Chinese government, as telling an investment conference that he expects significant changes to the Zero-COVID policy within five to six months.

The Hong Kong Hang Seng index surged 5.4% on the news, completing its best week in 11 years. Mainland Chinese stock indices gained between 2.5% and 3.6%.

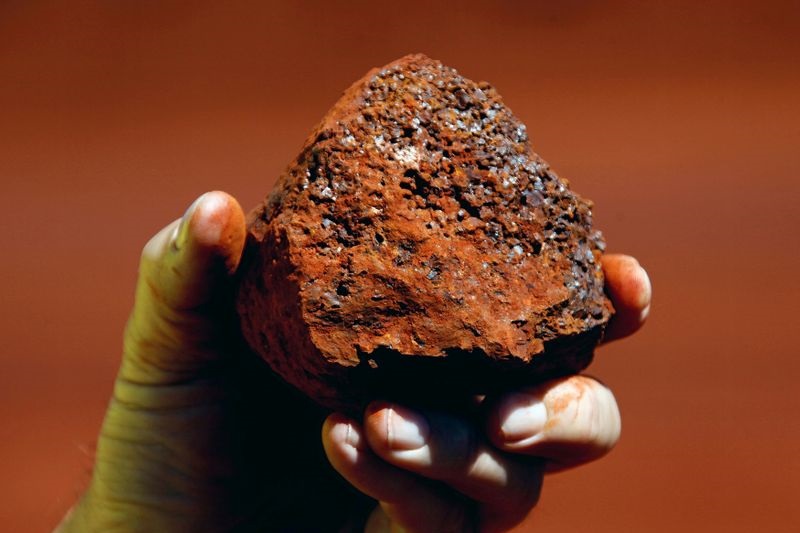

The optimism fed through immediately into iron ore prices, the traditional proxy for Chinese growth. They rose to $85 a ton in China, having hit a 2 1/2-year low of $80.03 earlier this week. Copper futures in London also rose 2.9% to $7,991 a ton, while aluminum and zinc futures rose 1.8% and 3.7%, respectively.

That translated into some big gains for London-listed mining companies in the first hours of trading in Europe on Friday. Anglo American (LON:AAL) stock rose 7.3%, while Rio Tinto (LON:RIO) stock rose 5.9%, and Glencore (LON:GLEN) stock rose 3.0%. Copper specialist Antofagasta (LON:ANTO) stock rose 5.5%, while coal mining group Thungela Resources (LON:TGAT) rose 2.2%.