Quotes

All Instrument Types

- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

⚠ Earnings Alert! Which stocks are poised to surge?

See the stocks on our ProPicks radar. These strategies gained 19.7% year-to-date.

Unlock full list

See the stocks on our ProPicks radar. These strategies gained 19.7% year-to-date.

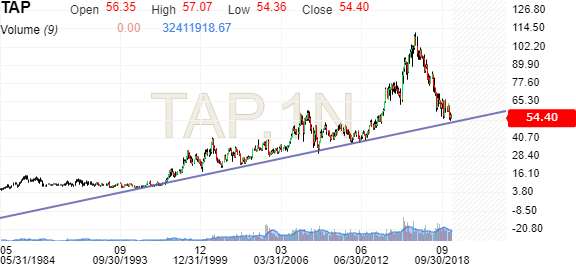

Molson Coors Brewing Co Class B (TAP)

NYSE

| Symbol | Exchange | Currency | ||

|---|---|---|---|---|

| TAP | NYSE | USD | Real-time | |

| TAPa | NYSE | USD | Real-time | |

| NY7 | Frankfurt | EUR | Delayed |

Add to/Remove from Watchlist

Add to Watchlist

63.54

+0.28

+0.44%

Pre Market

63.18

-0.36

-0.56%

8:35:49 - Real-time Data

Type:

Equity

Market:

United States

- Volume: 1,777,817

- Bid/Ask: 63.25 / 64.80

- Day's Range: 63.37 - 64.35

Molson Coors Brewing B

63.54

+0.28

+0.44%

- General

- Chart

- News & Analysis

- Financials

- Technical

- Forum

TAP Ratios

Assess the performance of Molson Coors Brewing B (TAP). This table contains core financial ratios such as Price-to-Earnings (P/E ratio), Return-On-Investment (ROI), Earnings per share (EPS), Dividend yield and others based on Molson Coors Brewing Co Class B's latest financial reports. Compare the performance metrics of Molson Coors Brewing B (TAP) against the industry averages.

| Name | Company | Industry | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

| Efficiency | |||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

TTM = Trailing Twelve Months 5YA = 5-Year Average MRQ = Most Recent Quarter

Unlock access to over 1000 metrics with InvestingPro

View advanced valuation and financial ratios for in-depth analysis of company financial performance.

Add Chart to Comment

Confirm Block

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

Report this comment

I feel that this comment is:

Comment flagged

Thank You!

Your report has been sent to our moderators for review