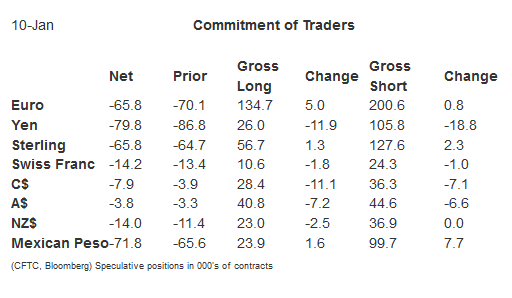

The dollar fell against the yen in four of five sessions of the CFTC reporting period that ended on January 10. Speculators in the futures market covered shorts and took profits, or at least liquidated long positions.

Nearly 12k long yen contracts were liquidated, leaving the bulls with 26k contracts. This is the smallest gross long position since February 2014. The bears covered almost 19k short yen contracts, leaving 105.8k.

There was one other significant (10k or more contracts) adjustment in gross speculative positioning in the futures market. It was the bulls liquidating 11.1k contracts to reduce the gross long position to 28.4k contracts. The Canadian dollar was in a strong appreciating trend. It has risen in 11 of the past 15 sessions, but only in three of the period's five sessions.

The bulls cut exposures in both the yen and Canadian dollar. It was part of a larger pattern. Of the eight currencies we track, there were three small exceptions. The gross long euro position rose by 5k contracts to 134.7. The gross long sterling position rose by 1.3k contracts to 56.7k. The bulls added 1.6k contracts to their long Mexican peso position, lifting it to 23.9k contracts.

Another pattern that continued is that the speculators are not as bearish the euro on balance as one might expect given that dollar appreciation has become consensus. The net short position in the euro has been trending lower, and it fell by a little more than 4k contracts in the latest reporting period to 65.8k contracts. This is the smallest net short position since last July.

The 10-year yield eased in three of the five sessions of the reporting period, but this did not deter the bears who continued to extend their record net and gross short position. They added 33.7k contracts to the gross short position, raising it to 849.8k contracts. The bulls pealed off another 6.1k contracts, leaving them with a still substantial 455.2k contracts. As a consequence of the gross position adjustments, the net short position rose to 394.7k contracts from 344.9k.

Speculators in the oil futures market trimmed the gross long position by 3.9k contracts to 604.3k. The bears added 2.7k to the gross short position, lifting it to 170.7k contracts. As a result the net long position eased to 433.6k contracts, a loss of 6.5k.