- Speculation for Fed rate cuts intensifies, keeping dollar in slow gear

- Yen advances as yields edge lower, stock markets resume selloff

- European PMIs exceed forecasts, but euro gets smoked by bank risks

Markets to Fed: We don’t believe you

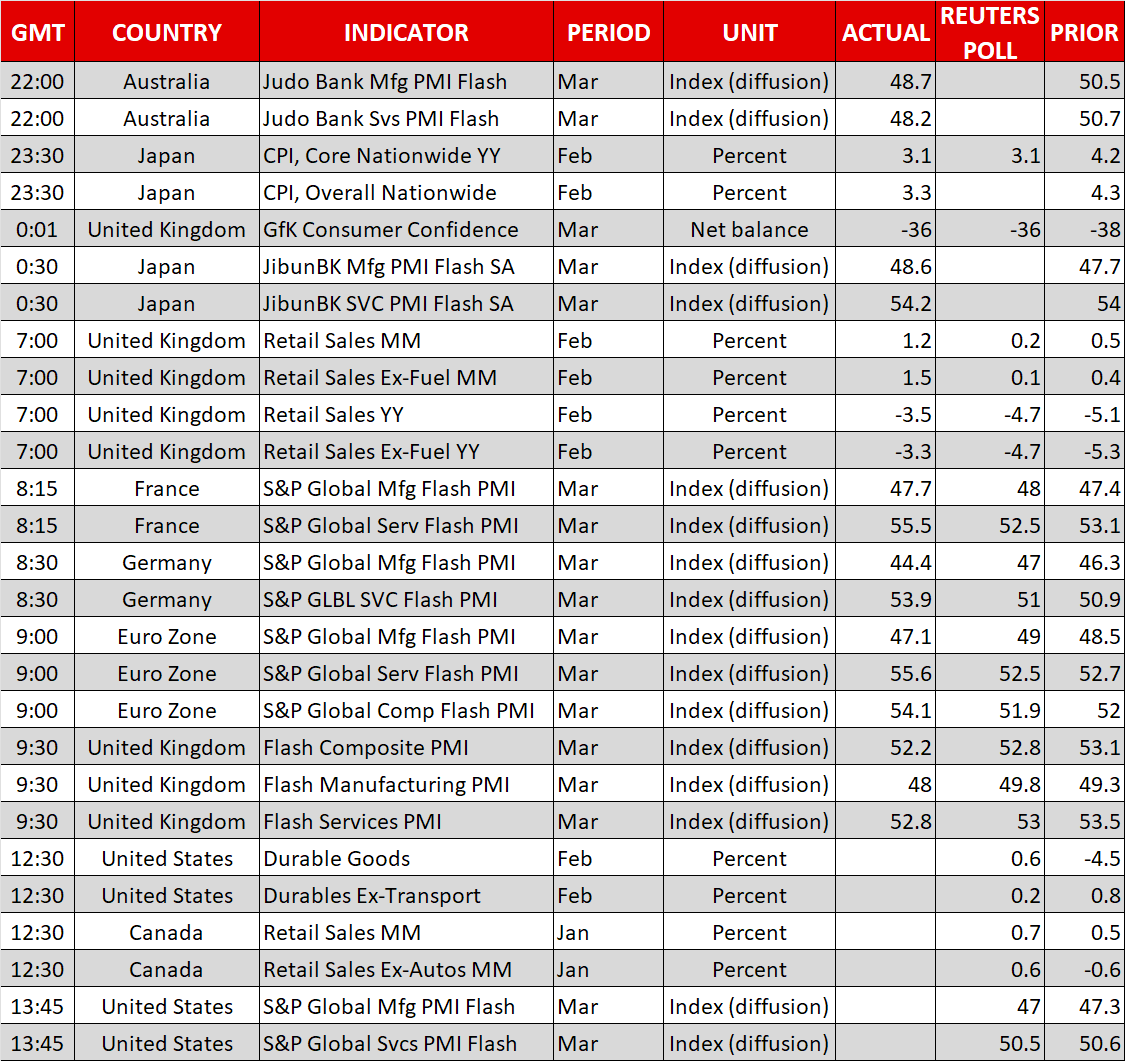

It has been a hectic week for global markets, with the underlying theme being a disbelief that the Federal Reserve will execute on its interest rate plans. Even though Fed Chairman Powell did his best to dispel speculation that rate cuts are around the corner, traders are not buying it.

Market pricing currently implies interest rates will end the year near 3.7%, dramatically below FOMC projections that anticipated rates to close the year above 5%. Investors seem concerned that a recession is quietly brewing and that the banking episode was only the first symptom in this process, which will ultimately force the Fed to slash rates.

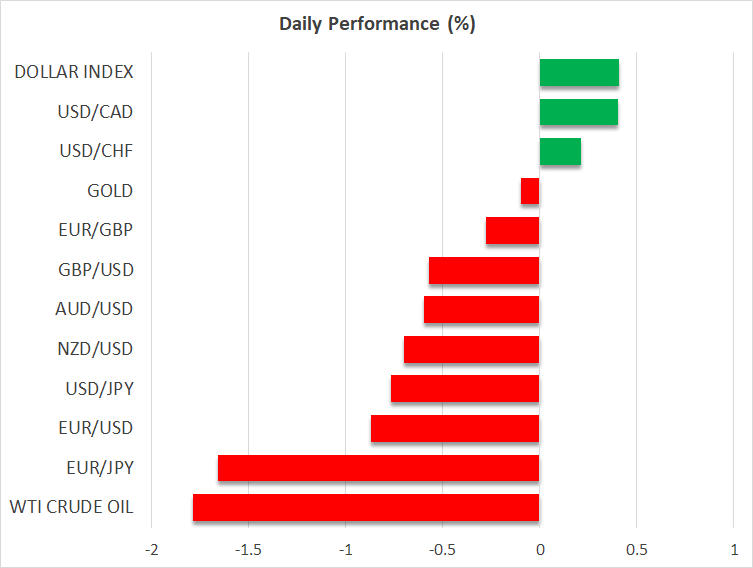

With bets for rate cuts intensifying, US yields have been smashed lower, wounding the dollar but breathing life back into rate-sensitive plays such as tech stocks, cryptocurrencies, and gold. When yields fall, most assets mechanically appreciate in value as it becomes less attractive for investors to buy bonds, pushing them towards riskier investments instead.

Yen capitalizes, dollar sags

In the FX domain, the Japanese yen has been the primary beneficiary of bets that the Fed will abandon ship soon. The data pulse in Japan seems to be improving too. Inflation has started to cool off as energy subsidies kicked in, but wage growth is likely to accelerate following the stellar results of the spring wage negotiations - both a blessing for Japanese consumers.

All told, the stars seem to be aligning in favor of the yen. Markets think the Fed’s tightening cycle has probably concluded already, whereas the Bank of Japan might still have a couple of moves to play judging by the signs of life in wages. With the global investment mood turning darker too, it’s a favorable environment for defensive currencies like the yen.

In contrast, the dollar has been hung out to dry. While the greenback managed to claw back some of its recent losses early on Friday, it is still set to close the week lower. Speculation for Fed rate cuts has essentially eroded the dollar’s classic rate advantage over other currencies. Still, it’s tough to be pessimistic about the reserve currency in a regime of heightened global stress and financial volatility.

Euro, sterling, and stocks

In the Eurozone, the latest business surveys painted a brighter picture. Business managers did not appear particularly concerned about the recent mayhem in the banking system, focusing instead on an encouraging increase in new orders, fading energy concerns, and abating inflationary pressures.

Despite these cheerful surveys, the euro is getting smoked on Friday. This might reflect concerns about the health of the banking sector, with shares of Deutsche Bank (ETR:DBKGn) sinking by 10% today and a spike in credit default swaps revealing rising demand for protection against European banks blowing up.

Over in the United Kingdom, the Bank of England raised interest rates yesterday as widely expected. Sterling moved higher initially but quickly lost its momentum, as BoE officials appeared hesitant to signal that further action will be required.

Stock markets edged higher yesterday with some help from tech shares, but have turned around on Friday. Overall, the risk/reward in US markets remains unattractive. An earnings recession is on the horizon, valuations are still expensive, and investors could soon realize that the breakdown in yields is not bullish for the economy.