Gold prices continue to fall in view of reduced interest of investors in risk-free assets. The demand for XAU/USD fell rapidly after Emmanuel Macron was elected the President of France. The victory of the pro-European candidate led to the reduction of political instability in Europe caused by Brexit and the election of Trump as the US President. Along with this, US dollar is currently a reliable and attractive asset in the middle term, and yesterday's statements by FOMC representatives confirm its strength. Thus, the head of FRB Cleveland Loretta Mester confirmed an excellent employment rate and stated that the inflation was approaching the planned level of 2%. FOMC representative James Bullard was more cautious saying that weaker economic indicators in the beginning of the year may slow down the plans of the Federal Reserve to toughen the monetary policy.

Today attention should be paid at the statement by the head of FRB Boston Eric Rosengren and FOMC representative Stephen Kaplan. Both officers are expected to make comments supporting the increase of the interest rate at the next meeting of the Committee in June which will strengthen USD and weaken the trading instrument.

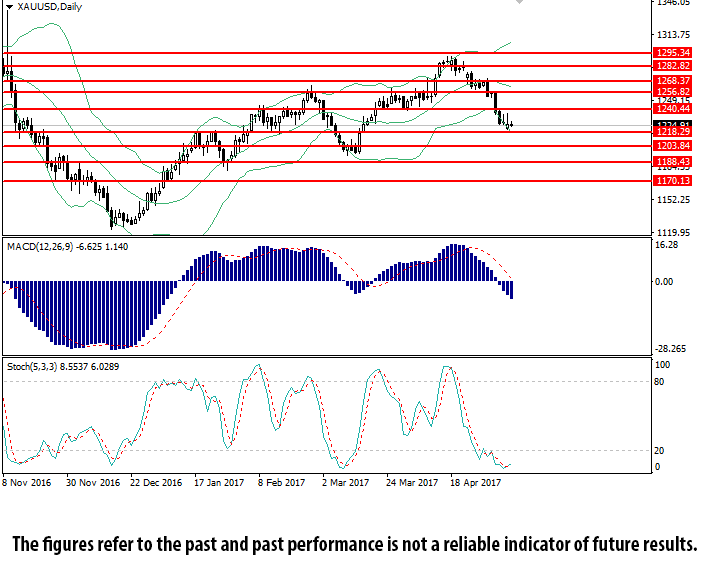

On D1 chart the instruments demonstrates decrease along the lower line of Bollinger Bands®. The indicator is reversing downwards while the price range has widened confirming the continuation of the downward trend. MACD histogram is in the negative zone with its volumes reducing and keeping the sell signal. Stochastic is in the oversold zone.

Indicators hint on the opening of sell positions.

Support levels: 1218.29, 1203.84, 1188.43, 1170.13.

Resistance levels: 1240.44, 1256.82, 1268.37, 1282.82, 1295.34.