Weekly Trading Levels

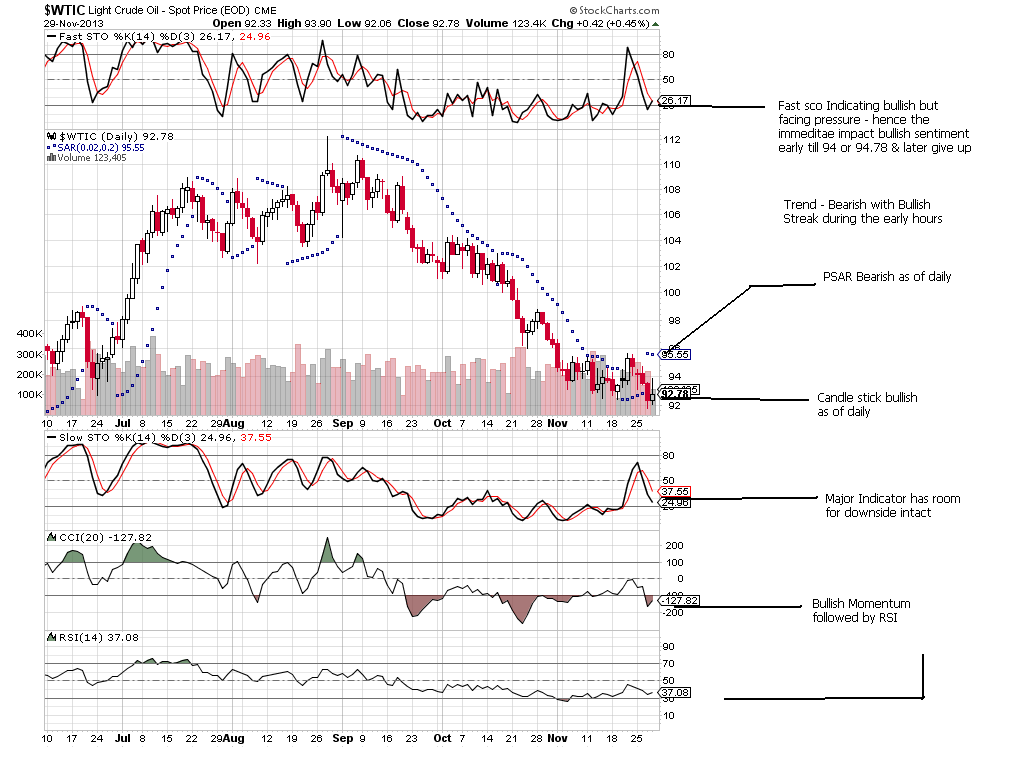

Best buy and Support for the week @ 94 (current resistance) Actual resistance and Best short Level for the week holds @ 94.78 . A break above 95.56 upside target @ 98.48 - 99.65 However a Crack Below 92.22 Downside target intact @ 89.95 - 88.80

As explained in the daily charts, we had positive readings or a positive sentiment earlier in the day, which may push prices up till 94. I don't see 94.78 because the monthly charts play a major role compared to all different time frames

Weekly Trend: All indicators in Bearish zone but a reversal in place and my view on it is Neutral or call it a dud Indicator in current scenario

Monthly Trend: as explained in the charts out of 6 indicators 3 Major indicators have a reversal tendency however Initial 3 Indicators are suggesting firm bearish trend, hence we remained bearish initially then turned bullish substantially

Strategy sell crude oil for the week between 94 - 94.78 for the week keeping a strict stop loss above 95.60 for target 90.82 and 89.96 respectively.

"88.80" is the key for bulls as per current strategy and its objectives.