WTI Crude Oil Non-Commercial Speculator Positions:

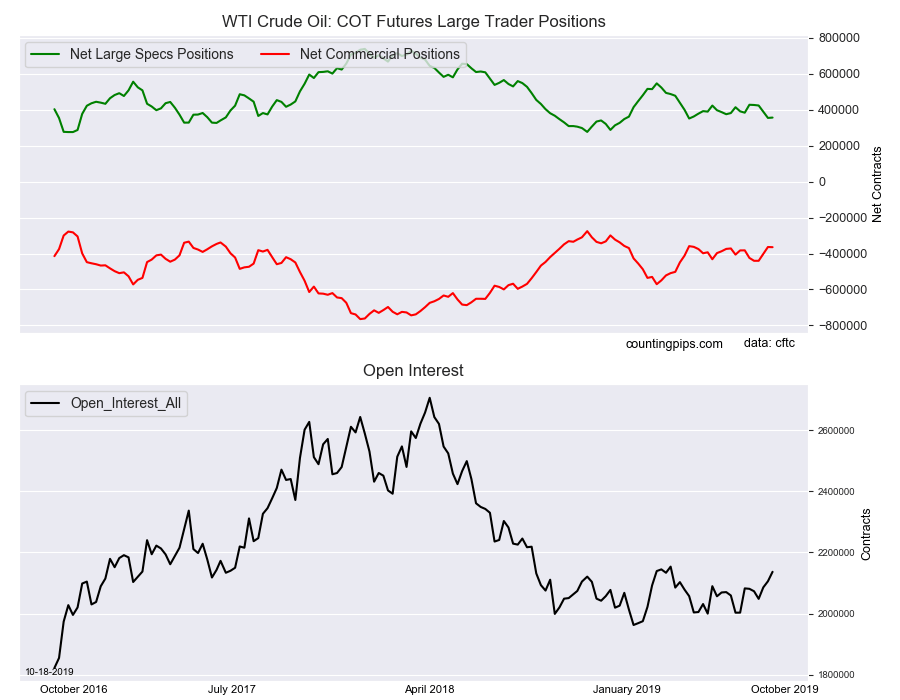

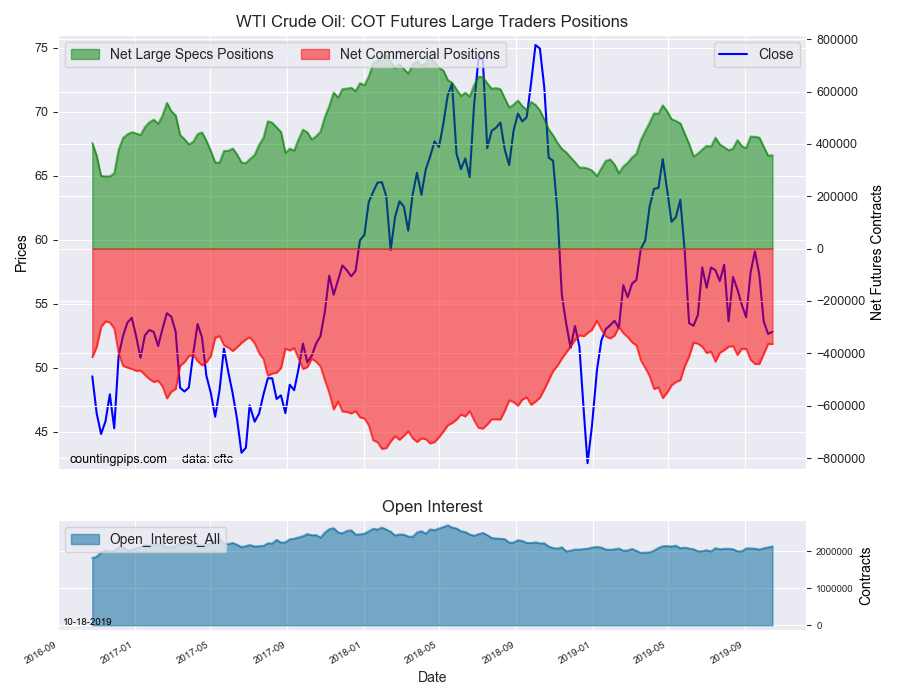

Large energy speculators slightly bumped up their bullish net positions in the WTI Crude Oil futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of WTI Crude Oil futures, traded by large speculators and hedge funds, totaled a net position of 356,884 contracts in the data reported through Tuesday October 15th. This was a weekly change of 1,799 net contracts from the previous week which had a total of 355,085 net contracts.

The week’s net position was the result of the gross bullish position (longs) going up by 16,123 contracts (to a weekly total of 536,406 contracts) while the gross bearish position (shorts) that also rose but by a lesser amount of 14,324 contracts for the week (to a total of 179,522 contracts).

Crude oil speculators edged their bullish bets slightly higher this week following four weeks of declining positions. The bullish position had decreased by a total of -73,120 contracts in the previous four weeks and fell to the lowest level since June 11th when net bullish bets totaled +351,655 contracts. The current bullish level has now been under the +400,000 net contract level for three straight weeks.

WTI Crude Oil Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -364,457 contracts on the week. This was a weekly decrease of -948 contracts from the total net of -363,509 contracts reported the previous week.

WTI Crude Oil Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the WTI Crude Oil Futures (Front Month) closed at approximately $52.81 which was an uptick of $0.18 from the previous close of $52.63, according to unofficial market data.