Website development platform Wix.com (NASDAQ:WIX) stock has seen a dramatic (-64%) sell-off in shares year-to-date losing more than twice the NASDAQ drop.

The world’s largest do-it-yourself (DIY) creation and development platform saw much volatility stemming from the falling GDP. However, the internet continues to grow despite inflationary pressures and falling production.

Commerce is still a key area that is continuing to migrate online. The Company continues to be the leader in website building and workflow content creation. Its SaaS worksite builder has doubled the net new subscriber count as the closest competitor.

E-commerce has slowed down the tepid pace that was spawned by pandemic lockdowns. This reversion is further advanced by headwinds including China lockdowns, inflation, rising energy prices and the Russian Ukraine conflict.

All things considered transitory, the Company is weathering these headwinds by focusing on driving operational efficiencies and implementing prudent cost management.

Prudent investor that have waited patiently for exposure into the largest DIY website platform can watch for opportunistic pullbacks in shares of Wix.com.

Q1 Fiscal 2022 Earnings Release

On May 16, 2022, Wix released its fiscal first-quarter 2022 results for the quarter ending March 2022. The Company reported an earnings-per-share (EPS) loss of (-$0.72) excluding non-recurring items versus consensus analyst estimates for a loss of (-$0.61), missing estimates by $0.11.

Revenues rose 12.3% year-over-year (YoY) to $341.6 million beating analyst estimates for $340.47 million. The board approved financial plan to reach 20% FCF margins by 2025. Wix CEO Avishai Abrahami commented,

"Wix has remained focused on executing on our long-term opportunities, our product and marketing roadmaps, and concentrating on what we can control despite the recent months of instability and volatility.

"Investments over the last several years have driven a significant expansion of our addressable market through the growth of our product platform, product innovation and development and go-to-market activities.

"We'll continue to push these efforts forward to build the best platform so any type of user and any business can build a powerful and successful digital presence."

Downside Guidance

Wix issued downside revenue guidance for fiscal Q2 2022 between $342 million to $346 million versus $356.2 million consensus analyst estimates. The Company issued fiscal full-year 2022 guidance for revenues to come in between $1.396 billion to $1.434 billion versus $1.45 billion consensus analyst estimates.

Conference Call Takeaways

CEO Abrahami addressed the growth opportunity thanks to the internet continuing to grow. In light of a negative GDP in Q1, Wix.com grew around 14%. That should accelerate as GDP returns back to GDP growth of 1% or higher.

He also cautioned that the pandemic triggered an anomaly growth rate of 2X or 3X the average pace of growth, so a reversion makes sense. He feels that of the growth drivers of the internet and SMBs, 50% of them are still not online. This will drive continuous migration.

The internet has enabled so many things like consulting, learning, and booking appointments, but still has so many more things that can be done online including the migration of commerce.

He doesn’t see any significant change in the market with no competitor taking any large market share away from their platform, which is the largest self-creator platform in the world.

He cautions that the pandemic accelerated e-commerce over the last two years and is now seeing a reversion back to the mean as evidenced by the slowdown in online shopping on Amazon (NASDAQ:AMZN), Shopify (NYSE:SHOP), and PayPal (NASDAQ:PYPL).

Consumers are heading back out to do their shopping which would normally be done online, just to get some fresh air. Slower payments are the result of lower GPV due to headwinds and changes in FX rates.

WIX Opportunistic Pullback Levels

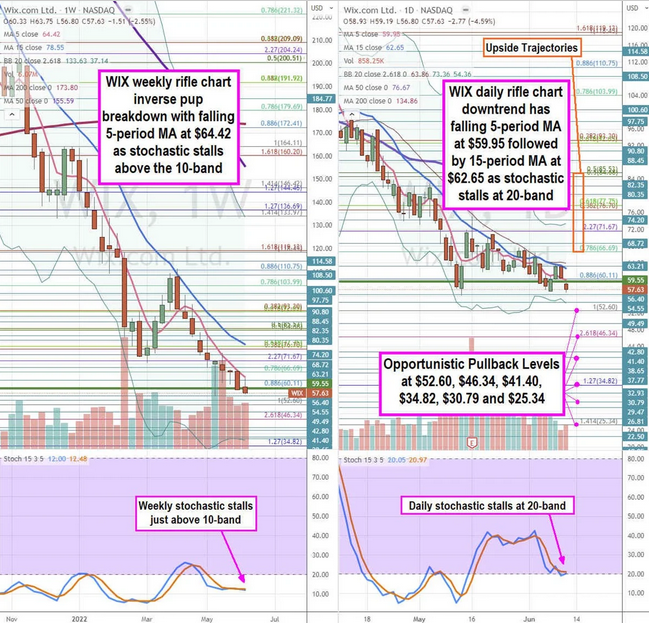

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for WIX stock. The weekly rifle chart triggered an inverse pup breakdown on the rejection and subsequent breakdown off the $100.75 Fibonacci (fib) level.

The weekly rifle chart downtrend has a falling 5-period moving average (MA) resistance at $64.42 followed by the 15-period MA at $78.55. The weekly lower Bollinger® Bands (BBs) sit at $37.17. The weekly stochastic is stalling near the 10-band before another mini inverse pup down or a cross up.

The weekly market structure low (MSL) buy triggers on a breakout through the $59.55 level. The daily rifle has a downtrend with a falling 5-period MA at $59.95 with lower BBs at $54.36. The daily stochastic stalled at the 20-band for a mini inverse pup lower or a coil. The daily upper BBs sits at $73.36.

Prudent investors can watch for opportunistic pullback levels at the $52.60 fib, $46.34 fib, $41.40 fib, $34.82 fib, $30.79, and the $25.34 fib level. Upside trajectories range from the $66.69 fib up to the $85.52 fib level.