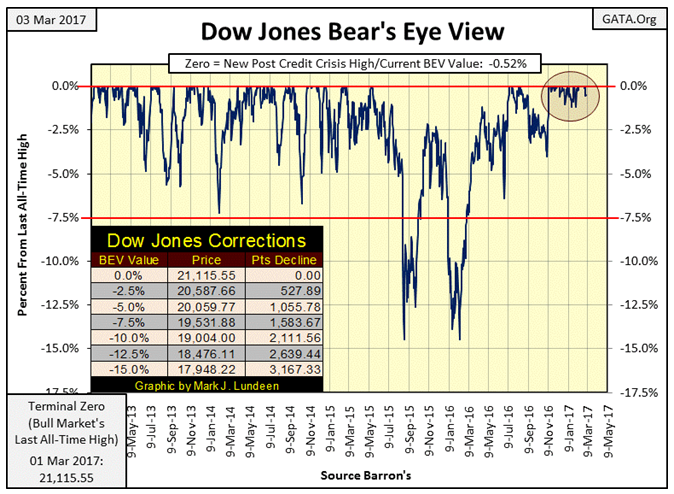

The Dow Jones Bear’s Eye View (BEV) chart below is so weird. Immediately after the November 8th Presidential elections, the Dow Jones leaped up to a new all-time high (0.00% / BEV Zero line) and has stayed within 1.21% of being a new all-time high for the past four months (Red Oval). Making 32 new all-time highs in the past 77 NYSE trading sessions, or seeing a new all-time high in 41% of the daily closings since the November election is simply historic market action.

How much longer can this go on? I don’t know about you, but after four months of this I’m getting bored with it. Reason tells me we’re closer to the end of this amazing string of new all-time highs than to its beginning. That plus the FOMC, after eight years of zero interest rates, is finally seeing the necessity of increasing their Fed Funds Rate. Now that Donald Trump is president, it seems the dudes making “monetary policy” now feel an obligation of popping the bubble they’ve inflated in the stock and bond markets.

Those policy dudes always make it sound as if they’re above politics. That “monetary policy” is always driven by economic data. But that’s ridiculous. Obama is a commie-community organizer from the South Side of Chicago, the part of town that’s now seeing a blood bath of gang violence. That’s something the guys at the top of the economic food chain could respect. Trump on the other hand wants the prosperity of the 1950s to be restored to America’s middle class, and that’s something they cannot allow.

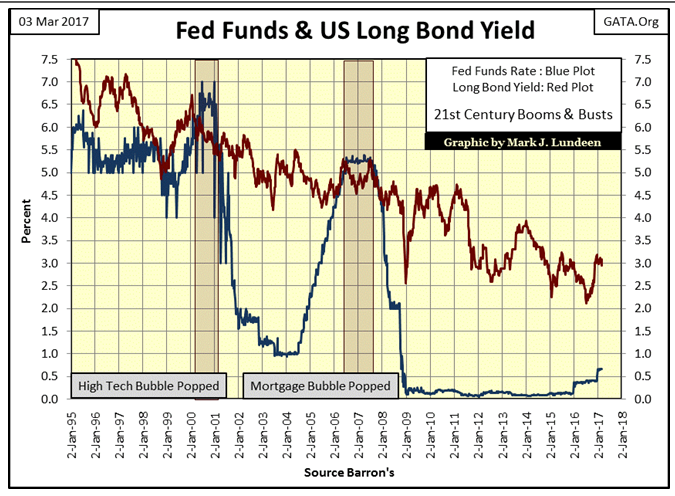

Here’s a chart plotting the Fed Funds Rate and the US Long Bond Yield going back to 1995. The FOMC sets the Fed Funds Rate as they “execute monetary policy.” And each time the Fed Funds Rate (Blue Plot) was increased above the Long Bond Yield (Red Plot), a bubble in the financial markets began deflating. First the NASDAQ High-Tech bubble in 2000, then the Sub-Prime Mortgage bubble in 2007.

The “policy makers” kept their Fed Funds at near zero for the entirety of the Obama Administration – eight years. We can be sure that isn’t going to happen during the Trump Administration. They won’t come out and publicly admit it, but the FOMC has finally found the motivation to once again invert the yield curve by increasing their Fed Funds Rate above the yield of the US Long Bond, knowing full well the bearish consequences of doing so. I know it has to be done sometime. But the FOMC’s timing of popping this bubble is off by about six years.

My readers will not want to own stocks or bonds when that happens! And we may see the financial markets begin deflating before the yield curve actually inverts.

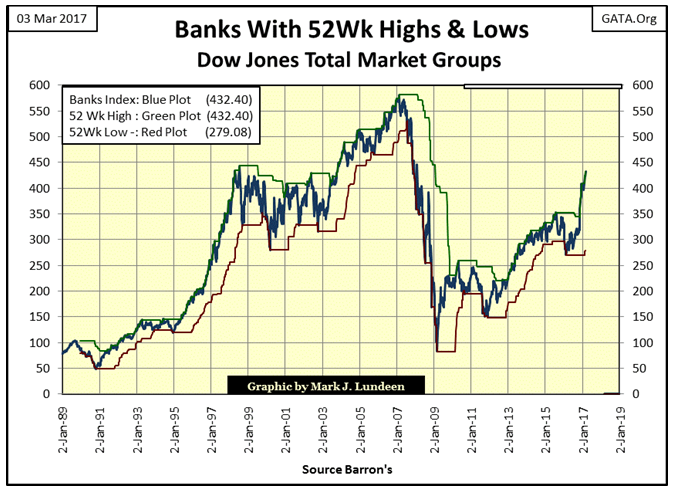

So, how are the banks doing? Like the Dow Jones, apparently since the November election, they can only do one thing – go up in valuation. Well, it’s about time. After having trillions of dollars “injected” into their balance sheets, the Federal Government altered accounting standards to maintain a fiction of solvency, and have every stock tout on Wall Street extol their virtues; should we be surprised these banks are finally going up?

But things are not right with the big banks. Former Fed Governor, Kevin M. Warsh retired from the Federal Reserve in March 2011. After five years at the Fed, he obviously felt the need to come clean, which he did in the May 2011 issue of Central Banking.

"Market participants, for example, need a clearer, better understanding of large financial institutions to be good policemen themselves. But the financial statements, the annual reports, the 10Ks, the 10Qs of the largest banks around the world tell us so little about their true risks. If you spend a few hours reading the financial statements of Wal-Mart (NYSE:WMT) or Proctor & Gamble, then you would understand their business and financial statements reasonably well. It is virtually impossible to do so for the largest global banks."

- Kevin M. Warsh, member of the Federal Reserve Board of Governors February, 2006 – March, 2011. Quote from May 2011 issue of Central Banking (pages 32-40)

This quote is six years old. However if anything, things for the big banks have become worse with the passage of time. The people managing these financial institutions are predators who have good reason to believe they’re above the law, and they act accordingly.

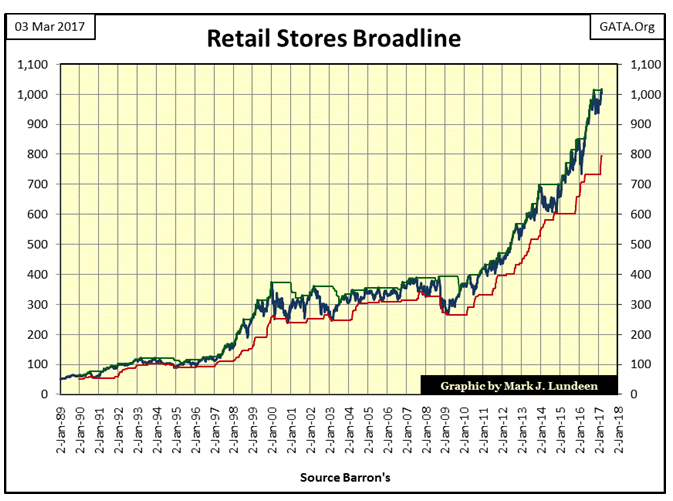

Here’s the chart for the Retailers. They’ve been one of the best performing groups since 1989. But this amazing growth has gone hand in hand with the expansion of consumer debt. If the number of ads I see on the television for attorneys specializing in personal bankruptcy is any indication, as a class, consumers in 2017 are in trouble. The retailers won’t be far behind.

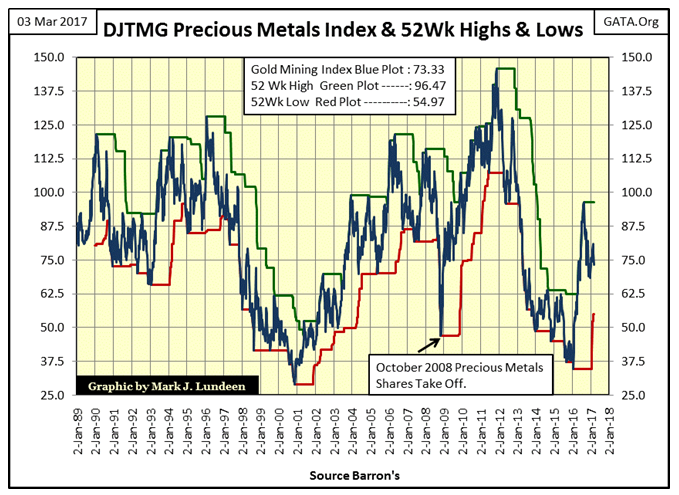

Now let’s look at the gold miners. Compared to the Dow Jones, the banks and retailers above, and just about anything else, the gold mining stocks have done little since 1989. During the past three decades, the plot below has been contained between 25 and 145. Compare that performance with the banks and retailers above.

That’s not to say the precious metals miners haven’t had their days since January 2001. They’ve seen excellent advances that placed them near or at the top in the Dow Jones Total Market Groups, as we saw last year. But there has always been something preventing them from seeing the superb – long term advances most other groups in the DJTMG have enjoyed since 1989.

So, what’s the problem with the gold and silver miners? That’s simple; gold, silver and their mining shares don’t directly benefit from the inflation flowing from the Federal Reserve. By design; stocks, bonds and real estate do. What drives precious metal assets valuations up is DEFLATION (big bear markets) in stocks, bonds and real estate.

Take a look at how the gold miners performed in the aftermath of the NASDAQ High-Tech (2001-06) and sub-prime mortgage (2008-2011) bubbles. It was during these times the gold miners became a top performing stock group. Had Greenspan in 2000, and again with Doctor Bernanke in 2008 not practiced bear-market interrupt us with their massive “injections of liquidity” and interest rate manipulations, the gold mining chart above would have a completely difference appearance today in March 2017!

Fear not, the day is coming when rising bond yields and interest rates will once again do what they have always done; motivate capital to flee from deflating financial assets into gold, silver and their mining shares. The bear market in stocks and bonds coming our way is going to be historic, and for that reason I expect so too will be the bull market in gold, silver and their miners.

I don’t read as much as I used to. In fact, after I began writing weekly articles in 2008, I hardly read books anymore. But when I did read I really enjoyed Niall Ferguson’s views of the world and his interpretation of history. Mr. Ferguson is a professor of history at Harvard University. What makes his historic insights unique are his favorable views of Western Civilization’s Judeo-Christian values. This is especially true when it comes to making and keeping contracts.

The link below goes to Mr. Ferguson’s video series (part #1) on how the Christian West came to dominate the world. The West’s secret was having a society where the rule of law applied to both rulers and the ruled, individual property rights were acknowledged and protected by law, and the enforcement of contracts by the legal system.

It’s not hard making the case that as the Christian West became more secular (socialist), the West’s rulers soon rose above the law, individual property rights were eroded, and contracts are not enforced as they once were. A case in point is the Federal Government’s Social Security System.

At the time, the mid-1930s, one objection to Social Security was the fact that it intended to assign anunique number to each American citizen; an action that was repulsive to many people at the time, and rightly so. The Federal Government’s response to that objection was that this number – the SSN – was to be used only in conjunction with the Social Security System. And for decades it was. On my first Social Security card it was clearly labeled that it was “NOT FOR INDENTIFICATION PURPOSES.”

But in the 1960s, the military began using servicemen’s SSN as their serial numbers. The banking system was not far behind in collecting people’s SSNs. My cable provider; Comcast (NASDAQ:CMCSA), uses my SSN too as does just about everyone else in corporate America. In fact, there’s a local pizza-take out that once demand, and may still do so today, that its customers tell the minimum wage employee taking the call their SSN before they accept an order over the phone! No doubt they’re checking whether or not the prospective pizza consumer has a history of not paying their bills.

So much for the Federal Government restricting its SSN to matters pertaining to the Social Security System, and a major reason identity theft is such a wide spread crime today – the Federal Governmentreneged on a clause from their 1930s’ Social Security System’s contract with the American people to prevent its SSN from becoming an identification number outside the Social Security System.

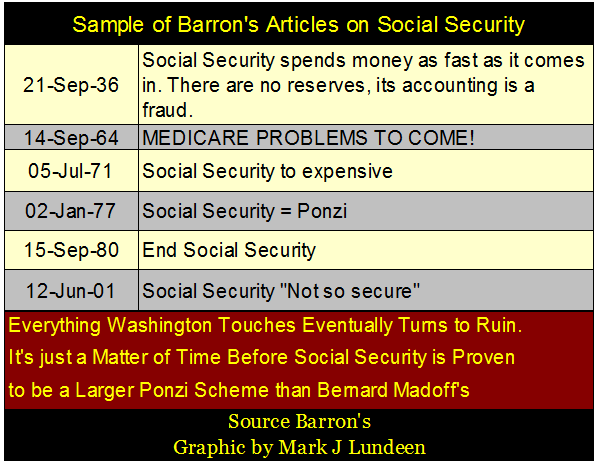

But then Roosevelt’s, and the Democratic party’s Social Security program was a fraud from its inception. Below is a table listing Barron’s articles on Social Security and their issue dates. This list is not inclusive; there are many more spanning the decades I did not note.

The September 1936 article above is as true for Social Security today as it was eight decades ago. And seeing the Federal Government operate in a manner that would be considered criminal if conducted in the private sector is as common today as then – if not more so.

Since the 1960s, government has enlarged its scope of operation into the health care system, as seen in Barron’s September 1964 article above. Originally,Medicare was targeted at the aging poor. But as with Social Security, Medicare’s mandate has been widely expanded since its inception. And with the introduction of Obama Care, the Federal Government’s involvement into the healthcare system has become totalitarian.

The Affordable Healthcare Act (Obama Care) was designed to run America’s healthcare system into bankruptcy, as a means to enlarge the scope of the Federal Government into the lives of the American people via the health care system. But it wasn’t supposed to go bankrupt until after 2017 when Obama departed from office; however it did.

To keep this criminal conspiracy’s finances above water, Obama ripped off billions from investors in Fannie Mae and Freddie Mac in defiance of court orders.

This is a VERY BIG STORY. However you’ll only see it on INFOWARS, as the main-stream FAKE news outlets, including Fox News protect the rogues and scoundrels who did this to us.

Since the 1913 passage of the Federal Reserve Act, money too has become political. Once the dollar was a metallic standard; a statutory defined weight of gold or silver. Paper money was a debt payable in gold or silver. But after the inflation of the 1920s went bust in the 1930s, all that was to change.

Instead of removing the Federal Reserve Notes circulating in the economy, and directing the Justice Department to prosecute members of the FOMC and their accomplices in the New York banking establishment, FDR, exactly like Obama seventy-six years later, bailed the bankers out at the expense of everyone else. Whereas Obama allowed the Federal Reserve to implement their quantitative easing programs, FDR in 1934 devalued the dollar from $20.67 to $35.00 an ounce of gold; an overnight 70% devaluation of the US dollar.

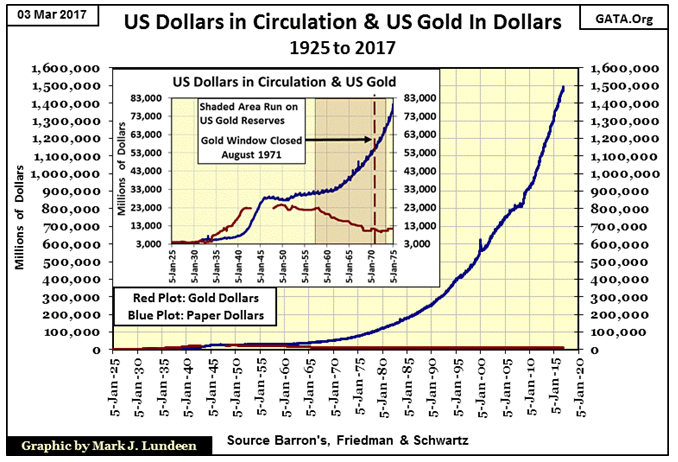

The sorry history of the US dollar from 1925 to today is on view in the following chart. The US Treasury gold reserves, in dollars (Red Plot) and paper dollars issued into circulation (CinC / Blue Plot) are plotted below.

Economists always claim that rising valuations in the financial markets are “economic growth.” No it’s not. Bull markets on Wall Street are just as much inflationary events as is rising consumer price inflation. Whether the economy sees “growth” in asset valuations, or “inflation” in consumer prices depends on where the inflation seen below flows to – Wall Street or rent and food prices.

One thing is for sure; since 1925, monetary inflation flowing from the Federal Reserve System has been unrelenting.

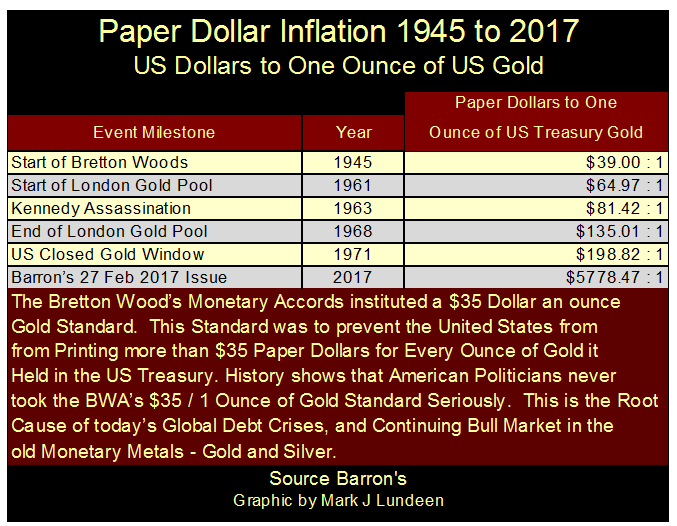

From 1945 to 1971, the US dollar was officially valued at 35 paper dollars / one ounce of gold held in the US Treasury’s gold reserves. In other words; by law the US Treasury wasn’t to issue more than 35 paper dollars for each ounce of gold held in its reserves. But like contracts the Federal Government makes with the public, it finds keeping its own laws impossible. By the time President Nixon suspended the Bretton Woods’ $35 gold peg in 1971, the US Treasury had issued 198.82 paper dollars for each ounce of gold held in its gold reserve. See table below.

Currently, there are 5,778.47 paper dollars in circulation for each ounce of US Treasury gold.

Only a few old geezers from the Baby-Boom Generation still squawk about this today. In the days to come I’d be surprised if the Millennials (thoseborn from 1977 to 1995) don’t receive a personal, one on one lesson on inflationary“monetary policy” by Mr Bear in the coming years.

Here is what Robert M. Bleiberg; managing editor of Barron’s thought about gold and paper money in 1979.

“Extravagances and absurdities like floating exchange rates and Special Drawing Rights (IMF’s SDR) come and go. Gold endures.

And what a lot it has had to put up with. After insisting for decades - over optimistically, in the event – that the dollar was as good as gold, the U.S. monetary authorities, by fiat, so to speak, desperately sought to prove that in global financial affairs it was better. First they closed the gold window thereby reneging on a generation of solemn pledges to the contrary. They threw their weight behind the Special Drawing Right, a bastard form of what John Exter has aptly termed the “I-Owe-You-Nothing.” Several years ago as hundreds cheered, gold was officially drummed out of the international monetary system and the IMF launched on a series of sales aimed at disposing of the barbarous relic forever. In turn, the Treasury beset by a plunging dollar has stepped up its own liquidation from 300,000 ounces per month to the current rate of 1.5 million.”

- Robert M Bleiberg: Barron’s Managing Editor, 29 January 1979

Our lives are affected by more than just the tides of “liquidity” flowing first into this market, only to later drain into some other, so I watch more than just the markets. One of my favoritesources of non-financial news is INFOWARS; a next generation news service that’s not afraid to report on the globalist elite, whose banking system is whatBill Murphy and Chris Powell at GATA.Org call the gold cartel.

Below are three links to stories that are important. The first has to do with the hypocrisy of the Hollywood elite. Leonardo DiCaprio is the case in point; an environmentalist champion defending the Earth from “global warming.” But as you’ll see,Leonardo has the carbon footprint of a stampeding herd of elephants.

The Democratic Party’s current obsession is the fictional connection between the Trump administration and the government of Vladimir Putin. But Putin released Russian banking documents proving the Russian government actually did give money, lots of money to Hillary and John Podesta. The FAKE news outlets could care less as they now demand a special prosecutor to investigate Jeff Sessions (Trump’s AG) for alleged improper connections to Russian intelligence.

All this brouhaha about Trump and Russian intelligence is only a diversion from what could be the biggest political scandal of 2017, if not the entire 21st Century: exactly what is on Anthony Weiner’s lap top seized by the NYPD during a routine police investigation of Mr. Weiner’s improper contact with an underaged girl.

Unlike the whimsical Russian connection with the Trump administration CNN and its colleagues in the media continues wasting our time on, the NYPD and FBI are holding megabytes(gigabytes?) of potentially sensational data that could drive the news cycle for months, and maybe years to come when released.

Strangely however, there is absolutely no pressure from the main-stream FAKE news media to make public the contents of this laptop to either clear the air surrounding the Weiner’s, or for the authorities to move to indict Washington’s privileged and powerful for crimes apparently spanning from pedophilia to treason.

If things really are changing in Washington,the data stored on Anthony and Huma’s laptop will not long remain in the background.