- Business software giant Oracle's stock is down close to 8% since the beginning of this year

- Ever since it released its Q3 results, investors have hit the ‘buy' button

- Long-term investors could consider buying the dips, especially if shares drop below $80

Shareholders in the enterprise software heavyweight Oracle (NYSE:ORCL) have seen the value of their investment increase more than 21% over the past 52 weeks. But ORCL stock has lost 7.9% in 2022. By comparison, the Dow Jones US Software Index is up 13.5% in the past 12 months, but down 13.2% since the start of the year.

On Dec. 10, ORCL shares went over $106 to hit a record high. The stock’s 52-week range has been $66.33–$106.34, while the market capitalization stands at $214.6 billion.

In terms of database management, Oracle is the most important software maker. But its share of the enterprise applications market as well as the customer relationship management (CRM) market is less than 5%. In previous quarters, management has been working to increase the company's total cloud revenue.

Oracle released Q3 FY22 figures on Mar. 10. The software group reported $10.51 billion in revenue, up 4% year-over-year. Adjusted earnings came in at $1.13 per share. A year ago, it had been $1.16 per share.

The company reports revenue in four segments:

- Cloud services and license support (73% of total revenue)

- Cloud license and on‐premise license (12% of total revenue)

- Hardware (8% of total revenue)

- Services (7% of total revenue)

On the metrics, CEO Safra Catz said:

“Strong top line growth was coupled with a solid non-GAAP constant currency operating profit growth of 4%, but the big story is that our overall revenue growth is being driven by both our rapidly growing Cloud Infrastructure and Cloud Applications businesses.”

Prior to the release of the quarterly results, ORCL stock was around $75. As of Wednesday's close, shares are at $80.39, up about 7% in two weeks.

Next Move In ORCL Stock

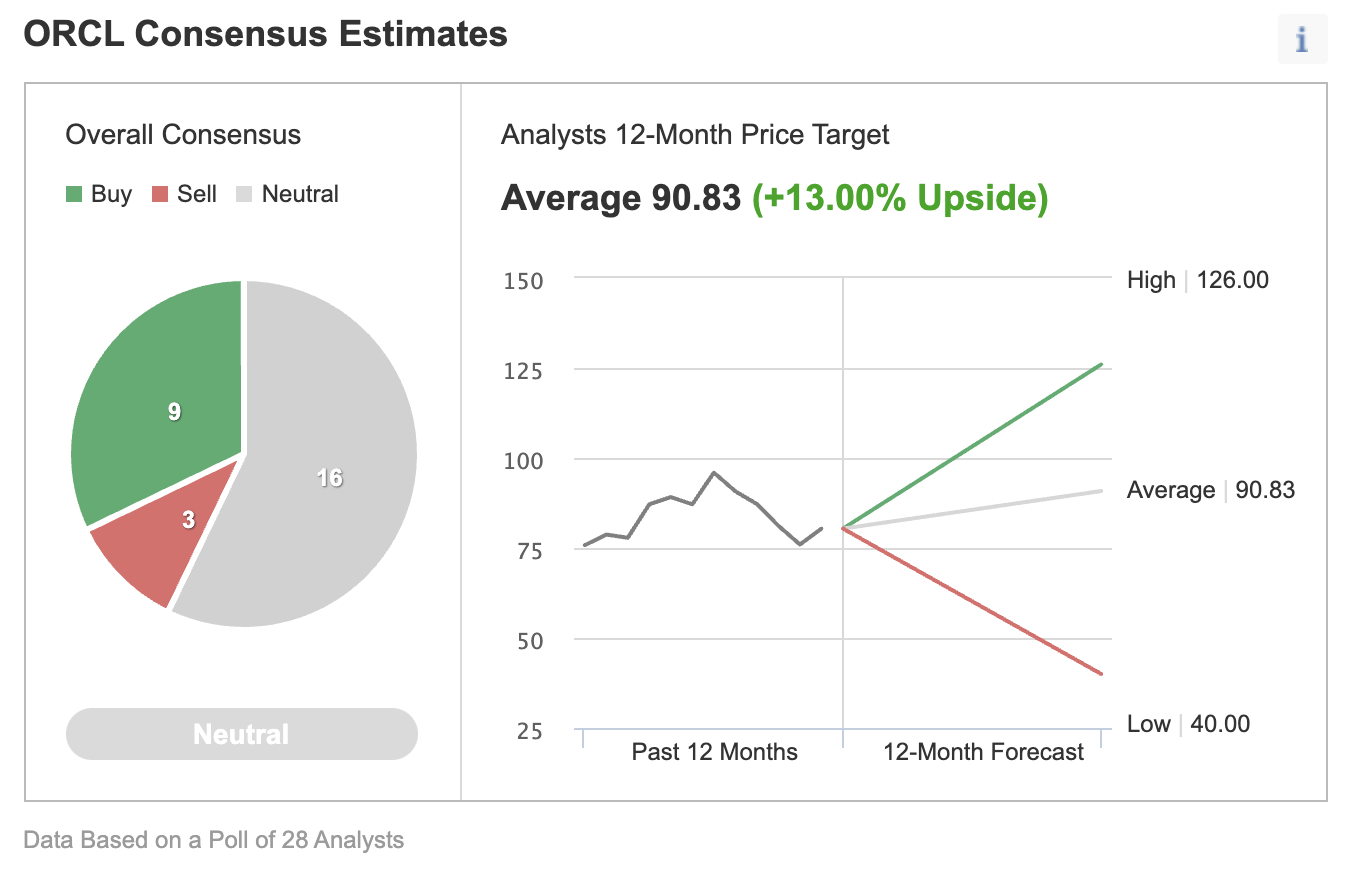

Among 28 analysts polled via Investing.com, Oracle shares have a “neutral” rating, with an average 12-month price target of $90.83.

Source: Investing.com

Such a move would imply an increase of well over 12.5% from the current level. The target range is between $40 and $126.

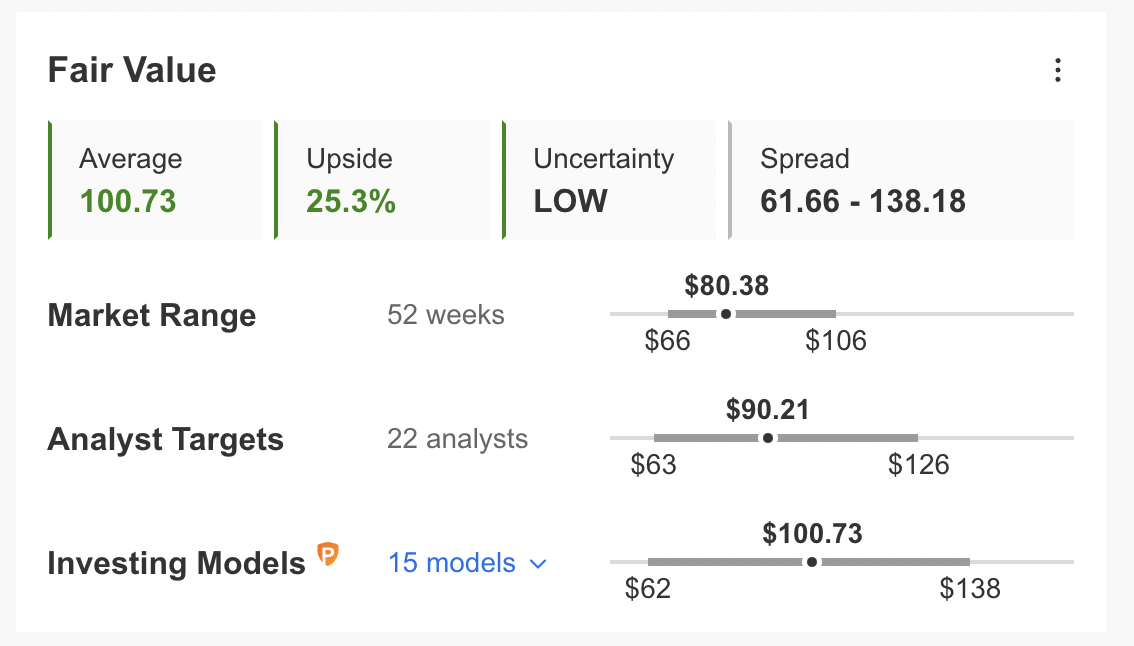

Similarly, according to a number of valuation models like those that might consider P/E or P/S multiples or terminal values, the average fair value for ORCL stock at InvestingPro stands at $100.73.

Source: InvestingPro

In other words, fundamental valuation suggests shares of the software company could increase close to 25%.

We can also look at Oracle’s financial health as determined by ranking more than 100 factors against peers in the information technology sector.

At present, ORCL’s P/E and P/S ratios are 28.4x and 5.1x, respectively. Comparable metrics for peers stand at 26.7x and 6.7x, respectively.

Our expectation is for ORCL to build a base between $77.50 and $82.50 in the coming weeks. Although it might even dip below $77.50, shares are likely to bounce back before too long. Afterward, Oracle stock should start a new leg up.

Adding Oracle To Portfolios

Oracle bulls who are not concerned about short-term volatility could consider investing now. Their target price would be $90.83, the analysts' forecast.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has ORCL stock as a holding. Examples include:

- iShares Expanded Tech-Software Sector ETF (NYSE:IGV)

- Invesco BuyBack Achievers ETF (NASDAQ:PKW)

- First Trust NASDAQ Technology Dividend Index Fund (NASDAQ:TDIV)

- iShares U.S. Tech Breakthrough Multisector ETF (NYSE:TECB)

- Global X Artificial Intelligence & Technology ETF (NASDAQ:AIQ)

Finally, investors who are experienced with options could also consider selling a cash-secured put option in ORCL stock—a strategy we regularly cover. As it involves options, this setup will not be appropriate for all investors.

Cash-Secured Puts on Oracle

Price Intraday: $80.40

Such a bullish trade could especially appeal to those who want to receive premiums (from put selling) or to possibly own Oracle shares for less than their current market price of $80.40.

A put option contract on ORCL stock is the option to sell 100 shares. Cash-secured means the investor has enough money in his or her brokerage account to purchase the security if the stock price falls and the option is assigned.

Let's assume an investor wants to buy Oracle stock, but does not want to pay the full price of $80.40 per share. Instead, the investor would prefer to buy the shares at a discount within the next several months.

So the trader would typically write an at-the-money (ATM) or an out-of-the-money (OTM) put option and simultaneously set aside enough cash to buy 100 shares of the stock.

Let's assume the trader is putting on this trade until the option expiry date of May 20, 2022. As the stock is $80.40 at time of writing, an OTM put option would have a strike of $77.50.

So the seller would have to buy 100 shares of Oracle at the strike of $77.50 if the option buyer were to exercise the option to assign it to the seller.

The ORCL May. 20, 2022, 77.50-strike put option is currently offered at a price (or premium) of $2.35.

An option buyer would have to pay $2.35 X 100, or $235, in premium to the option seller. This premium amount belongs to the option seller no matter what happens in the future. The put option will stop trading on Friday, May 20.

Assuming a trader would enter this cash-secured put option trade at $80.40 now, at expiration on May. 20, the maximum return for the seller would be $235, excluding trading commissions and costs.

The seller's maximum gain is this premium amount if ORCL stock closes above the strike price of $77.50. Should that happen, the option expires worthless.

If the put option is in the money (meaning the market price of Oracle stock is lower than the strike price of $77.50) any time before or at expiration on May. 20, this put option can be assigned. The seller would then be obligated to buy 100 shares of ORCL stock at the put option's strike price of $77.50 (i.e. at a total of $7,750).

The break-even point for our example is the strike price ($77.50) less the option premium received ($2.35), i.e., $75.15. This is the price at which the seller would start to incur a loss.

Cash-secured put selling is a moderately more conservative strategy than buying shares of a company outright at the current market price. This can be a way to capitalize on the choppiness in Oracle stock in the coming weeks.

Investors who end up owning ORCL shares as a result of selling puts could further consider setting up covered calls to increase the potential returns on their shares. Thus, selling cash-secured puts could be regarded as the first step in stock ownership.