Last week, several major news outlets reported that detailed data harvested from Facebook (NASDAQ:FB) had been pressed into service by political consultancy firms under questionable circumstances. The data were harvested by researchers who were abiding by FB’s then-current policies when they collected them. But observers and some FB insiders, including former employees, allege that the company did not take the fate of the data seriously once they had been collected, and did not make serious efforts to ensure that they were not misused or sold on to other third parties in violation of FB’s terms of service. The response of FB’s management has thus far been characterized -- fairly, we think -- as tone-deaf and inadequate. While FB’s policies have changed since the data harvesting occurred, the whole event certainly does nothing to reassure investors or regulators that the company is capable of policing itself when it comes to consumer privacy protection.

FB stock is still reeling. The company’s platform remains, with that by Alphabet (NASDAQ:GOOG), one of the indispensable destinations for todays’ marketing dollars. The platform is not going away. But the prospect of government regulation just came into sharp focus, after having been an undercurrent of news coverage for months. This op-ed piece from November by an ex-FB employee is an articulate and heartfelt expression of the case for regulation -- and it’s an argument that is going to be heard a lot more and gather a lot more political momentum in coming weeks and months. (Note that the employee in question left FB in 2012, and the conditions he describes, even if they did obtain at the time, may no longer do so.)

Time For a Change in Stock-Market Leadership?

What does all this mean for investors?

Every stock’s price depends in the last analysis on two things: the company’s earnings, and the multiple of those earnings that investors are willing to pay (that’s the “price-to-earnings ratio” in investment speak). Companies whose earnings are growing fast typically win a higher price-to-earnings ratio from investors. FB’s historical and projected growth has been strong enough to support steady appreciation in the price of its stock since its initial public offering nearly six years ago.

However, when government gets involved with a company or an industry, the price-to-earnings multiple that investors are willing to pay almost inevitably goes down, and the change is usually dramatic. Complying with regulations slows growth. So all of a sudden, investors are reassessing what they are willing to pay for FB stock, because the chance of substantial regulation just got much more significant.

Reassessing Companies’ Values

Of course, although stock analysts do their best to turn all of this into numbers and arrive at a fair and rational valuation of a company, precision is illusory where such big future risks to the previous consensus expectation are concerned. The current free-fall of FB’s stock shows that investors are struggling to decide what the longer-term risks really are.

Other technology stocks were caught in the downdraft. After all, FB is not the only tech giant with an abundance of data about consumers, and with activists and regulators asking probing questions about how those data are used. Amazon (NASDAQ:AMZN) and GOOG have been in the crosshairs of European regulators. Apple (NASDAQ:AAPL) is the last of the components of the “FAANG” group that now comprises a quarter of the tech-heavy NASDAQ index. Although it is not now under regulatory scrutiny, it has been a persistent target of public opinion surrounding its manufacturing practices; President Donald Trump has touted his efforts to get AAPL to move manufacturing back to the United States. And rest assured, AAPL certainly has an enormous trove of data on its users.

In Europe, the US tech giants have been under pressure for some time. European regulators tend to act against anti-competitive practices; they don’t want to see underdog companies (especially European companies) getting squashed by giants (especially US giants). US regulators, though, tend to strike an easy tone as long as consumers are benefitting. FB’s current woes may finally give US regulators the push they needed to start putting pressure on big tech -- motivated by concern for consumers’ well-being.

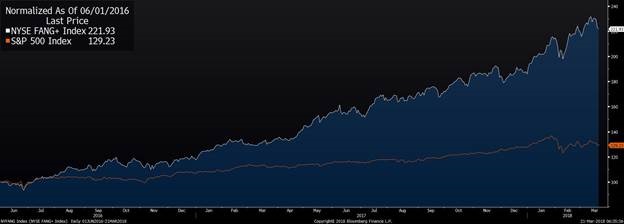

The “FAANG” stocks -- FB, AAPL, AMZN, Netflix (NASDAQ:NFLX), and GOOG -- have been the undisputed large company champions in US stock market since 2016, riding the wave of growth that has come from the mass adoption of disruptive consumer-facing technologies. As a group, these stocks have generated a much higher return than the S&P 500 since mid-2016.

Now, though, the landscape is changing. Regulation is getting clearer on the horizon. It may be that this shift is close enough in investors’ minds that they will begin seriously taking account of it in the prices they’re willing to pay for the stocks of big technology growth companies. After their big runs over the past two years, this reassessment of their future prospects may take the mantle of market leadership away from them. (It’s also possible that, with an administration favoring a lighter regulatory hand, the regulatory changes may be tolerable, and allow continued rapid growth. We’ll have to wait and see.)

So does that mean that tech is over? We don’t think so.

Where Tech Will Continue To Shine

The technology companies that are coming under pressure are all big, companies whose profitability depends on the collection of huge amounts of data about their consumers. In some cases they sell those data to advertisers or other third parties (for example, FB and GOOG). In other cases they use those data to maximize the profitability of their businesses (for example, AMZN and AAPL). Some do both.

However, these consumer-data dependent companies that are going to be in the line of fire are far from the only participants in the long-term transformation being created by the “fourth industrial revolution” that we’ve written about many times.

The key aspects of “fourth industrial revolution” technology are in the process of transforming all aspects of commerce, industry, and communications. That transformation is going to continue for the foreseeable future. Whatever troubles are faced by companies that are in regulators’ direct line of fire, it isn’t going to stop this transformation. Regulatory threats and action may cause a wide range of tech stocks to decline simply because they are all linked together in the same indexes, but these effects will be temporary.

Below, we list some tech sub-sectors that we find attractive:

• Data networking

• Video game hardware and software

• Computer hardware and storage

• Semiconductors, both manufacturers and designers

• Software for creation, collaboration, and data analysis

• Cloud storage, service, and infrastructure

• Cybersecurity

• Financial technology

We believe investors should wait for corrections as a way to avoid buying companies in these tech sub-sectors at excessive valuations, and should do enough research to have a fundamental grasp of their products and growth outlooks.

Two Chinese companies -- Alibaba (NYSE:BABA) and Tencent (OTC:TCEHY) -- are in a unique position. In one sense, their position vis-à-vis China’s regulators is more precarious; the regulatory atmosphere in China can change very rapidly, without the lag of public debate and argument that has to occur in the US and Europe. But on the other hand, these companies are used to working with Chinese authorities hand-in-glove, and have strong, longstanding relationships with those authorities, often including personal relationships between executives and nationally powerful politicians. These relationships, and their willingness to be unquestioning good and useful corporate citizens, may insulate them from regulatory wrath.

Investment implications: The big tech leaders of the past two years have been coming under increasing regulatory scrutiny for some time, and recent events surrounding the misuse of data culled from the FB platform may mark a sea-change in public and regulatory opinion about them. If they begin to price in bigger regulatory burdens and control, their status as stock market leaders may fade (even if volatility does create occasional trading opportunities in their stocks). However, beyond these big, consumer-facing companies, the transformation of commerce and industry by technology is inexorable. We recommend that investors continue to use corrections to buy the stocks of strong tech companies that are beyond the regulatory limelight -- in networking; videogames; hardware and storage; semiconductors; creative, collaborative, and analytical software; cloud services; cybersecurity; and financial technology. We suggest that investors use market corrections if they decide to make purchases.