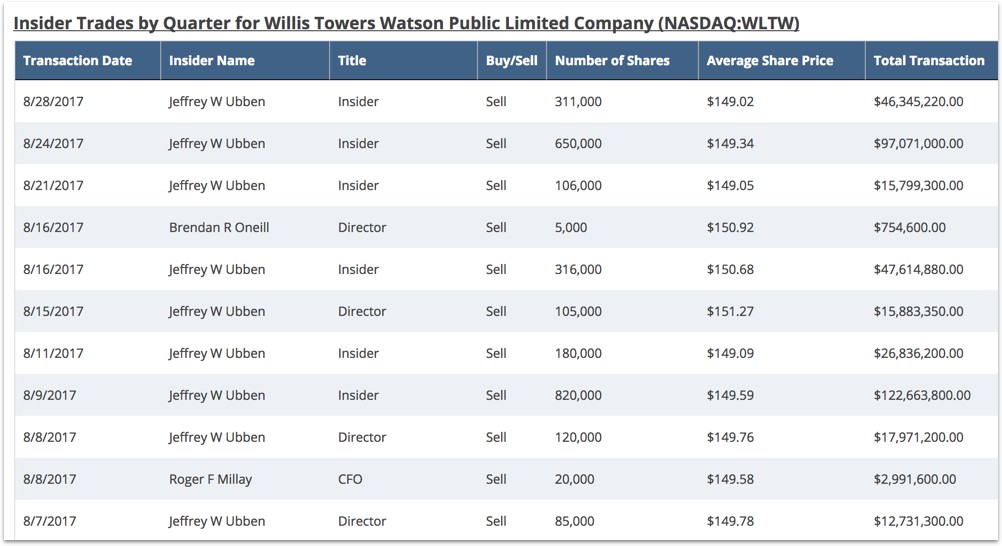

Jeffrey W Ubben, a board member of Willis Towers Watson PLC (NASDAQ:WLTW), sold 311,000 shares of the company worth a total of $46.3 million on Monday, August 28th. Mr. Ubben has served as a Director of Willis Towers Watson since January 4, 2016. He is the Founder, CEO and Chief Investment Officer of ValueAct Capital. Through ValueAct, Ubben continues to hold 4,227,358 shares of Willis Towers Watson which is worth approximately $625 million.

According to Market Beat, Mr. Ubben has sold roughly $400 million worth of Willis Towers Watson stock in the month of August alone (roughly 2% of the company’s market capitalization).

The company’s shares last traded at $147.87 as of Tuesday, August 29, approximately 97.7% of its 52-week high. While the stock is up 22% year-to-date, Mr. Ubben appears to be taking some chips off the table. Could the recent insider transactions signal a troubling road ahead for shareholders?

Willis Towers Watson operates as an advisory, broking, and solutions company worldwide. The company was formerly known as Willis Group Holdings Public Limited Company and changed its name to Willis Towers Watson Public Limited Company in January 2016, right when Mr. Ubben of ValueAct joined the board of directors.

Analysts covering the stock often compare the company to a peer group that includes Aon plc (NYSE: NYSE:AON), Arthur J Gallagher (NYSE:AJG), Marsh & McLennan Companies, (NYSE: NYSE:MMC) and CNA Financial Corporation (NYSE:CNA). Analyzing Willis Towers Watson’s valuation metrics and ratios provides further insight into why insiders may be selling their shares.

Potential Reasons For Insider Selling

We define fundamental metrics and present charts below that may help explain why insiders are selling their shares.

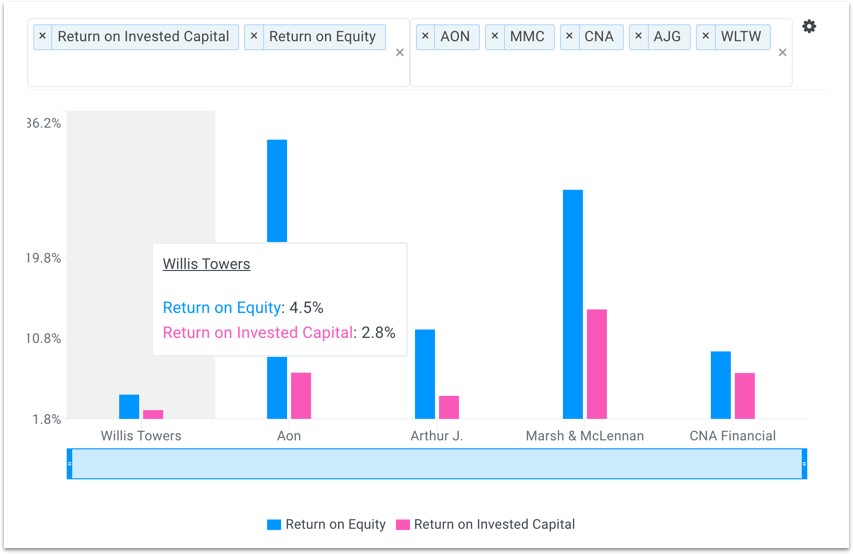

Return on Equity (ROE) measures a company’s profitability in relation to the book value of Shareholders’ Equity. ROE is a measure of how effectively management makes investments to generate earnings for shareholders. It’s calculated as Net Income / Average Total Equity. Willis Towers Watson's ROE of 4.5% is below all of its selected comparable public companies: AON (32.9%), AJG (11.8%), MMC (27.4%) and CNA (9.3%).

Furthermore, Return on Invested Capital (ROIC) is used to evaluate the ability of a company to create value for all its stakeholders, debt and equity. It is calculated as NOPAT / Average Invested Capital where NOPAT is defined as Net Operating Profit After Tax. Notice in the above chart the company's ROIC of 2.8% is also well below all of its peers: AON (7.0%), AJG (4.4%), MMC (14.0%) and CNA (6.9%).

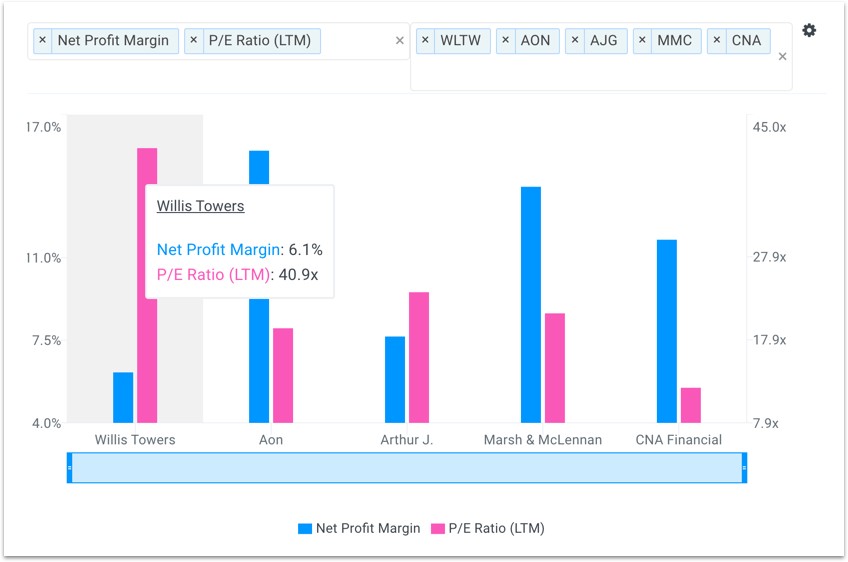

Net Profit Margin is defined as Net Income / Total Revenue. All else equal, companies with higher profit margins command higher valuation multiples. However, Willis Towers Watson's net profit margin of 6.1% is below its entire peer group but its P/E multiple of 40.9x trades above this same peer group as illustrated below.

Although the company’s stock is up 22% year-to-date, shares are up only up 25% since August 2014. Additionally, the stock has hovered around the $145-$150 range over the last three months. Insiders may be trying to take some chips off the table while fundamentals appear stretched and the stock remains in a holding pattern.

The fundamental charts above indicate that the company’s stock may be trading at a premium and helps explain why insiders have been selling shares. Value investors long Willis Towers Watson may want to re-evaluate their positions.