Strong ISM non-manufacturing reading and remarks by Chairman Jerome Powell that the Fed may raise interest rates above neutral level given the remarkably positive US economic growth lifted the USD across the board. Noticeably, USD/JPY broke through the 114 handle, while EUR/USD further slipped below the 1.15 baseline.

We are waiting for U.S. non-farm payrolls now. The combination of a higher-than-expected ADP employment report and the strong ISM survey increased market expectations for U.S. jobs report, so the risk of disappointment is also higher. We think that tomorrow’s jobs report may be a breaking event for near-term trend.

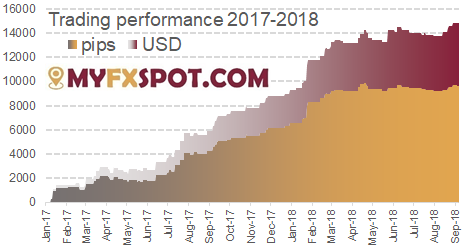

This is how MyFXspot.com trades:

EUR/USD

Trading strategy: Await signal

Open: -

Target: -

Stop-loss: -

Recommended size: -

Short analysis: While the outlook is quite negative due to daily close below 1.1497, 61.8% of the 1.1301-1.1815 rise, trading near the 30-day lower bolli-band, now at 1.1499, hints that the market is oversold. We are waiting for U.S. non-farm payrolls. In our opinion this release may change market picture.

Trading strategy: Await signal

Open: -

Target: -

Stop-loss: -

Recommended size: -

Short analysis: GBP/USD extended gains on Thursday to rise back above 1.30 after an EU source close to the negotiations said Britain's new proposals were positive. Bearish momentum is fading and U.S. non-farm payrolls are likely to be a breaking event for near-term trend.

USD/JPY

Trading strategy: Await signal

Open: -

Target: -

Stop-loss: -

Recommended size: -

Short analysis: The USD/JPY posted its biggest one-day gain since July when in closed up on Wednesday 92 pips. Market has been trading comfortably above the 200-week moving average, now at 113.21, leading us to deduce the bias is on the upside. Scope growing for gains to test 115.33 Fibo, a 76.4% retrace of the 18.66 to 104.56 (Dec 2016 to Mar 2018) fall. Today’s price action suggests that a deeper corrective move is likely here, especially if U.S. non-farm payrolls disappoint tommorow. We have cancelled our bid.

USD/CAD

Trading strategy: Sell

Open: 1.2950

Target: -

Stop-loss: 1.3075

Recommended size: 1.54 mini lots per $10,000 in your account

Short analysis: Canada's jobs data for September and August trade data are due on Friday and could help guide expectations for another Bank of Canada interest rate hike as soon this month. We keep USD/CAD sell order at 1.2950.

Trading strategy: Await signal

Open: -

Target: -

Stop-loss: -

Recommended size: -

Short analysis: The 21-day MA exerts bearish influence, the September 14 low breaks and RSIs are biased down. Bear sentiment is growing. A test of the 2018 low seems likely. We will watch how price action around that low develops. If it breaks we will likely look to get short.

Trading strategy: Await signal

Open: -

Target: -

Stop-loss: -

Recommended size: -

Short analysis: The pair is consolidating losses between the 10- and 100-day MAs. RSIs are biased down. Bear sentiment is present. We will watch how price action around the 200-day MA and September low develop before putting on a position. Stand aside for now.

Trading ideas by MyFXspot.com