The Japanese yen fell to a seven-year low of 125 against the US dollar on Monday as the Bank of Japan continued easing its monetary policy, further widening the gap with the US Federal Reserve’s hawkish tone.

But instead of seeing it as a threat to the Japanese economy, the BOJ reiterated that a weaker yen would have positive effects on pushing Japan’s GDP higher.

BOJ’s Divergence From Fed

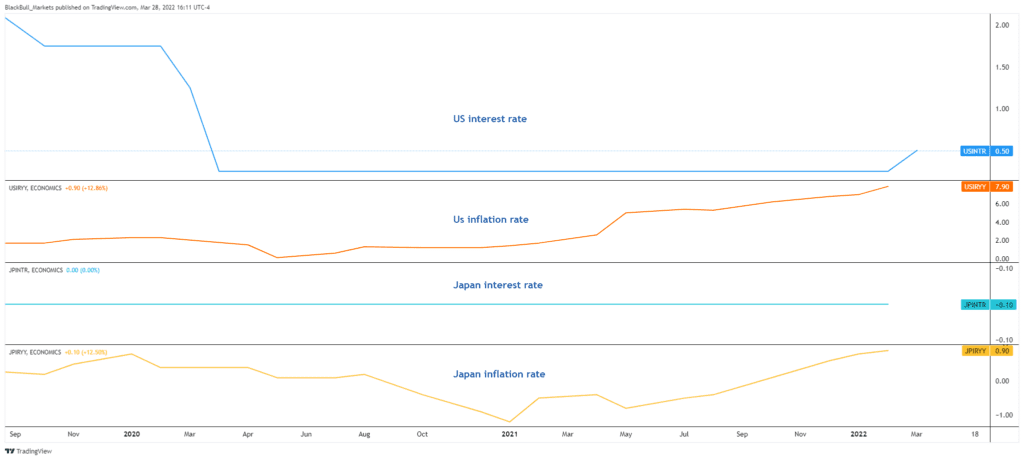

The US central bank recently raised interest rates for the first time since 2018 and signaled more rate hikes in the coming months to tame rising inflation. The US consumer inflation rate skyrocketed to a four-year high of 7.9% in February, prompting the Fed to take a more hawkish stance despite the lingering COVID-19 pandemic and geopolitical uncertainties.

Conversely, the BOJ continued to loosen its monetary policy, reiterating that it would maintain interest rates at ultra-low levels to support Japan’s economic recovery and as inflation stays below its 2% target. The central bank also offered to purchase an unlimited amount of government bonds from Monday through Thursday at 0.25%.

The offer is for debts with maturities of more than five years and up to 10 years. The move is one of the BOJ’s attempts to contain rising bond yields despite US Treasury yields reaching new multi-year highs.

Piling Pressure On The Yen

On Monday, the measure further weighed on the yen, with economists from ING Bank expecting upside risks to prevail beyond 125. They said,

"130 is well within reach in the near term unless the bond environment improves.”

A depreciation in the Japanese yen would drive up the costs of imports, ultimately hurting households as it would increase the costs of imported goods and other goods for consumption. It also pushed Japan’s core inflation to a two-year high of 0.8% in March, quicker than market forecasts.

Preference for a Weaker Currency

While many economies beef up efforts to boost the value of their currencies, Japan has been aiming to devalue its currency to gain a competitive advantage in foreign trade. A weak yen will make Japan-made goods more competitive overseas and increase Japanese companies' profits in foreign markets. It would also lift services exports and increase net income receipts from abroad when converted into yen.

In January, the BOJ estimated that a 10% drop in the yen would boost Japan’s gross domestic product by about 1%. In the final months of 2021, Japan’s GDP rose 4.6% year over year, lower than its previous forecast for a 5.4% rise. Fitch Ratings expects Japan’s inflation at 1.8% this year due to higher energy prices and yen depreciation.

Preventing Another 1998 Yen Volatility

As the yen continues to fall against the greenback, the markets are closely watching for a recurrence of a wild rebound that occurred in the USD/JPY in 1998 at the height of the Asian financial crisis. At the time, the US dollar fell by almost 15% versus the yen from its previous peak. That slump was preceded by a three-year yen depreciation as Japanese authorities believed the yen was overvalued.

Will the Yen Hit 150 Against the Greenback?

Whether the yen will reach 150 versus the US dollar is more of a when as the Fed maintains its hawkish stance and as the BOJ is poised to keep its loose monetary policy setting in the medium term. This would further widen the gap between their policies, sending the yen lower as Japan continues to book current account deficits due to a jump in oil import prices.