- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Which stocks will surge next?

Will Fed Trigger Inflation Boosting Gold?

During the Great Recession, many people feared that the Fed's quantitative easing would trigger high inflation, or even hyperinflation. As we know, it didn't happen. Why? Well, the main reason is that the Fed created money – that's true – but in the form of bank reserves. And this is a very specific medium of exchange that does not enter the real economy like cash, but stays within the interbank market. You see, bank reserves are a special kind of money used only between commercial banks, the central bank and between commercial banks themselves.

So, larger supply of reserves does not automatically translate into higher prices.

This can happen only if these additional reserves motivate commercial banks to expand their lending. Investors should remember that in the contemporary banking model based on the fractional reserve banking, the bank deposits account for the majority of the money supply. And when the bank deposits are created? They are created whenever banks grant loans.

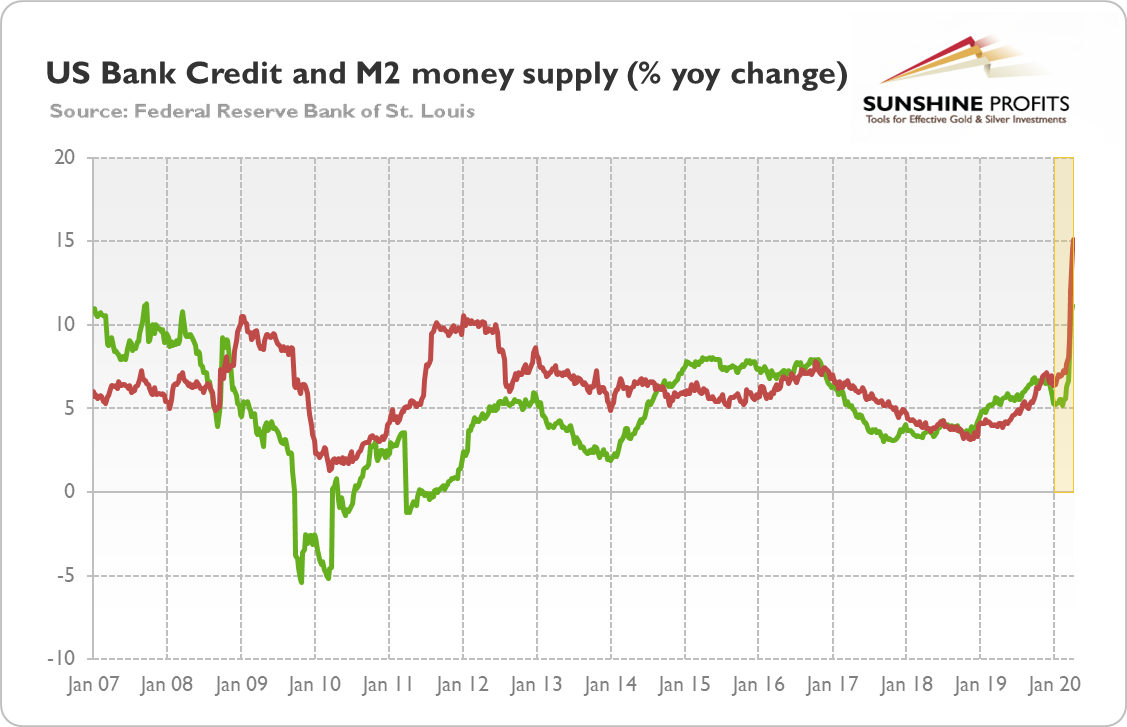

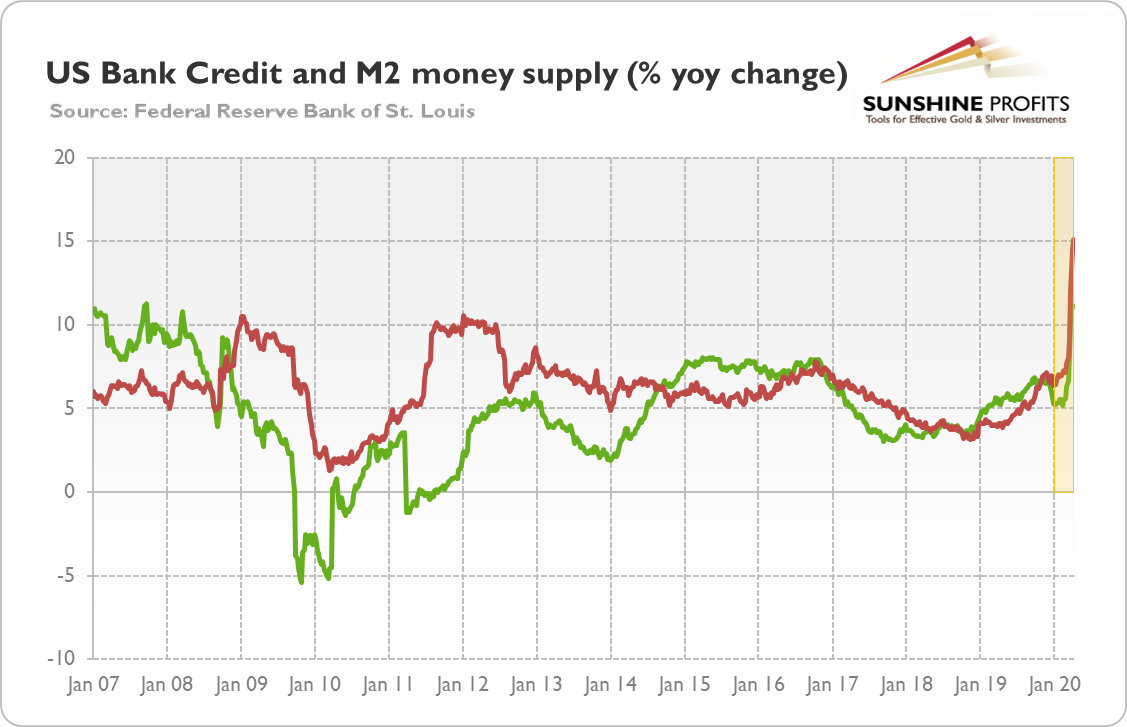

As the chart below shows, the growth rate of credit supply was falling during Great Recession, reaching even negative values for some time. Why? For two reasons.

First, American households have deleveraged, i.e., they decided to pay back the debts they had, so they were not interested in taking new loans.

Second, as the name suggests, the global financial crisis was, well, financial crisis to a large extent. It means that banks were severely hit and they were left with a lot of toxic assets. So, banks themselves were not interested in granting new loans, rather they cleaned their balance sheets. Please also remember that the supervisors tightened the bank capital requirements in the aftermath of the Lehman Brothers' collapse.

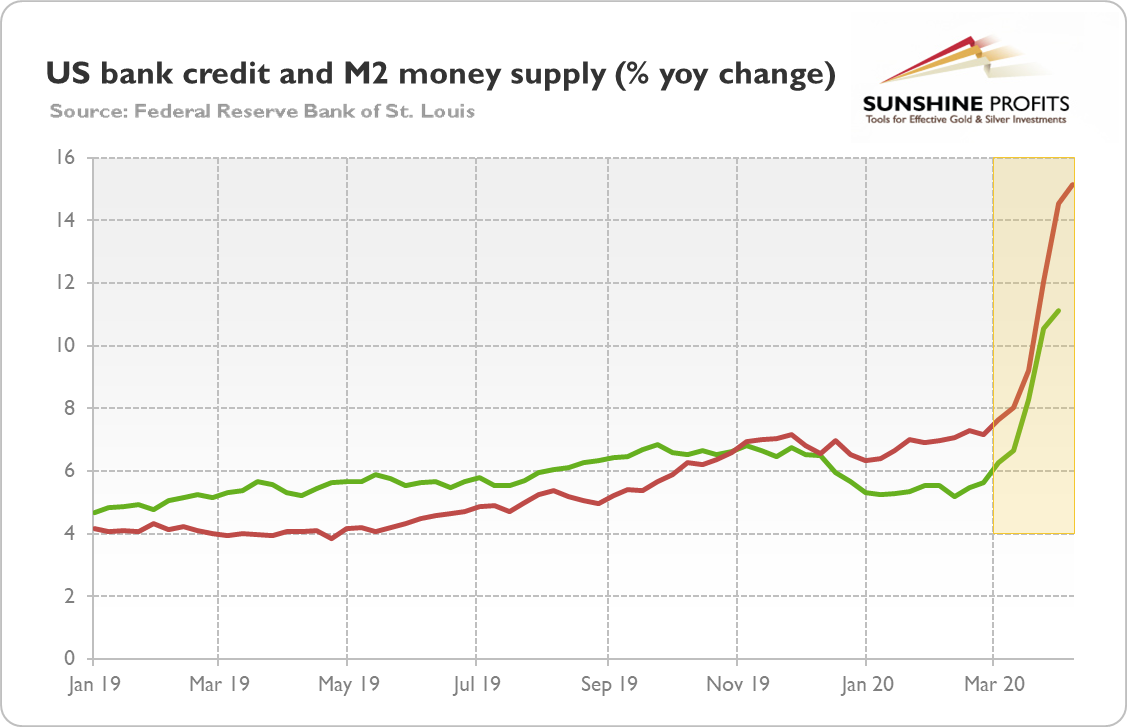

However, this crisis is different. The Fed and other central banks did not only introduce quantitative easing, but they also implemented other programs which can turn out to be more inflationary. For example, the U.S. central bank will lend, under the Term Asset-Backed Securities Loan Facility, to holders of certain AAA-rated securities backed by newly and recently originated consumer and small business loans. Moreover, the new Main Street Lending Program set by the Fed in April works like this: commercial banks grant loans to small and medium companies employing up to 10,000 workers or with revenues of less than $2.5 billion, and then they retain 5% of the loan on their balance sheets but sell the remaining 95% of the loans to the Main Street facility created by the Fed.

All these programs aim to support the flow of credit to employers, consumers and businesses, encouraging commercial banks to grant new loans to companies that have suffered as a result of the economic lockdown. Moreover, the financial sector has not been hit initially by the coronavirus crisis, while the supervisors eased reserve and capital requirements for banks. The demand for loans from entrepreneurs is also vivid. All this means that the pace of growth of credit and money supply may be higher than during the Great Recession. Indeed, as the chart below shows, they accelerated in March and April.

Summing up, the unconventional monetary policy implemented in the aftermath of the Great Recession did not spur inflation. However, this time may be different. To be clear, we are not saying that we will see hyperinflation in the U.S. That's still very unlikely. What we mean is that the commercial banks are – so far – significantly more eager to grant new loans. So, the resulting increase in money supply should create higher inflation after some time, if other factors remain unchanged.

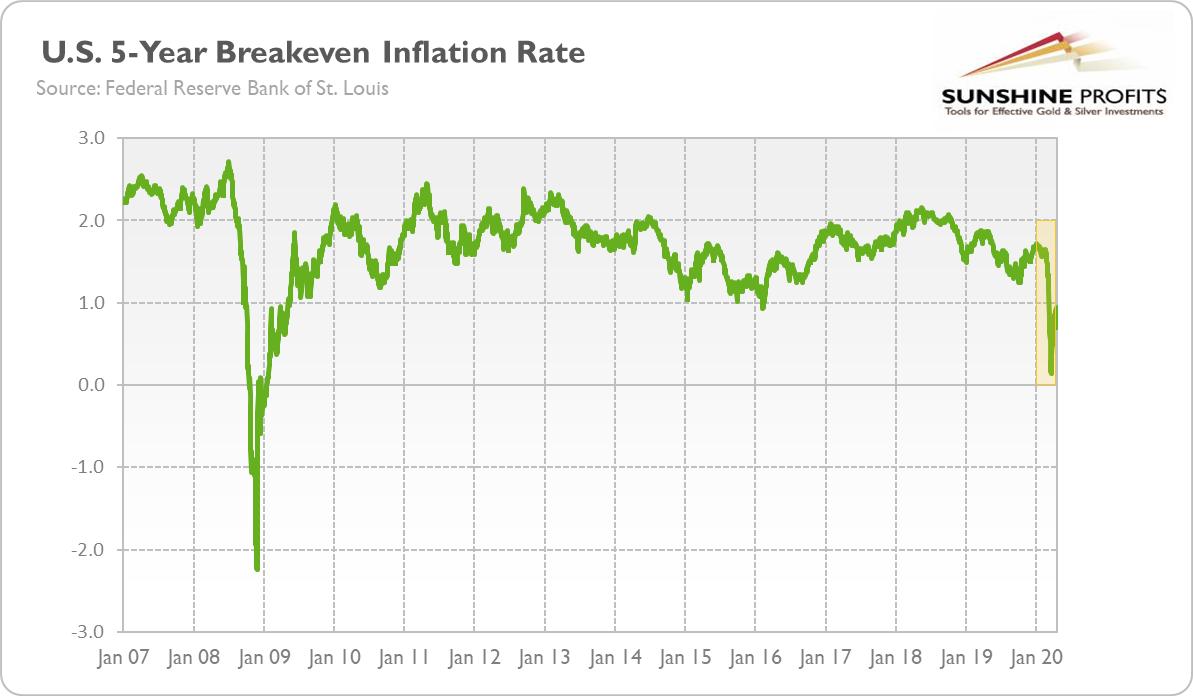

In other words, this crisis is more likely to result in stagflation than the Great Recession, especially as economy faces disruptions in the supply chains. Indeed, please take a look at inflation expectations derived from the 5-year inflation-adjusted Treasuries displayed in the chart below – as you can see, the market does not expect deflation now, as it did in the aftermath of the previous economic crisis.

Given that gold is considered to be an inflation hedge, the higher odds of inflation are fundamentally positive for the gold prices. It does not mean that disinflation or deflation would be negative for the yellow metal, as it could shine nevertheless during the crisis of any kind, but increased chances for stagflation should be an additional factor that could encourage more investors to buy gold.

Related Articles

Here is a trillion (dollar) reasons why the US economy is likely to hold up until elections: between now and then, Yellen is likely to drain the Treasury General Account (TGA) and...

Stocks finished flattish on the day, but we are moving into the busiest part of the week. Now that Meta’s results are out of the way, we will have GDP and PCE to finish the...

The airline industry is gearing up for what could be a record-breaking summer travel season, if forecasts turn out to be correct. Despite challenges such as the Boeing (NYSE:BA)...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.