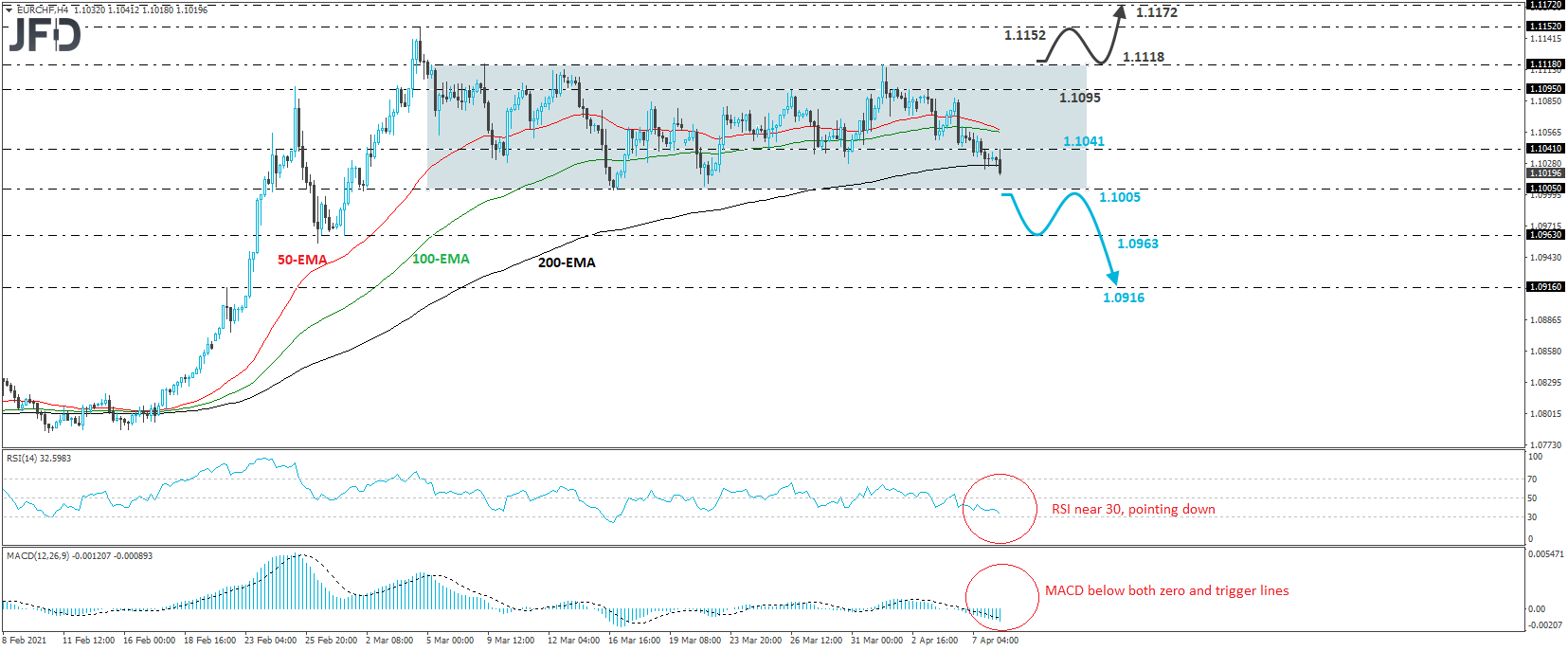

EUR/CHF traded lower on Thursday, after hitting resistance at 1.1041. That said, looking at the bigger picture, we see that the pair is still trading within the sideways range that’s been in play since Mar. 5, between 1.1005 and 1.1118. With that in mind, we will adopt a neutral stance for now.

At the time of writing, the pair looks to be headed towards the lower bound of the range, where a break would confirm a forthcoming lower low and may turn the short-term outlook to negative. The bears may then get encouraged to push the action towards the low of Mar. 1 at 1.0963, the break of which may see scope for extensions towards the inside swing high of Feb. 22, at 1.0916.

Shifting our attention to our short-term oscillators, we see that the RSI is near 30, pointing down. It could fall below that line soon. The MACD lies below both its zero and trigger lines, pointing south as well. Both indicators detect downside speed, which increases the chances for the pair to break the lower end of the aforementioned range soon.

The picture will turn positive only if we see EUR/CHF climbing above the upper end of the range, at 1.1118. This will confirm a forthcoming higher high and may initially pave the way towards the high of Mar. 4, at 1.1152. If the bulls are not willing to stop there, then a break higher may lead the rate towards the 1.1172 zone, defined as a resistance by the high of July 2, 2019.