On September 4, 2019, @CryptoMichNL offered an analysis in which Bitcoin will not decrease below $8,500. In this scenario, BTC has already made a yearly low and will steadily increase to around $25,000 by May of 2020.

The full tweet is given below:

The tweet consists of two images — a long term and a short-term prediction for the future movement of BTC.

Below, below we will briefly describe both analyses while comparing them with our own.

Long-Term Movement

For the long-term movement of BTC, @CryptoMichNL has used a 4-day interval chart.

As for its indicators, the chart contains the RSI and volume.

There is a fractal between similars movement in 2015 and the current year.

If the price behaves in a similar way, it should not drop below $8,500, rather, it should soon begin to increase towards $20,000.

Below, we have used the same 4-day time-frame and comparing the movements side by side.

Both movements had a similar bearish divergence in the RSI.

In the 2015 case, the price broke out despite of the divergence. @CryptomichNL skillfully noted this divergence and made the fractal analysis.

However, there remain concerns about the dissimilar pattern created by the price during the current move, which could mean that BTC is not yet done falling.

First, we have differing price movements after the creation of the first upper wicks.

In the 2015 movement, BTC reached a high of $504 before decreasing to $300.

Afterward, the price made a lower high of $475, which was combined with bearish divergence.

However, the price closed well within the upper wick during the second upward move. This is a sign that the resistance is dissipating.

The price close for the lower-high was actually quite higher than the first, more specifically $463 compared to $409.

Conversely, during the 2019 movement, BTC failed to close inside the upper wick of the first high at $13,764.

Interestingly, the price close during the first and second highs were nearly identical, both being very close to $12,000.

This is likely a sign that the price has yet to clear the resistance above.

Additionally, the price movement in 2015 resembles an ascending triangle, while the current pattern looks to be tilted and descending.

While the ascending triangle is often considered a bullish pattern, the descending triangle, conversely is considered bearish.

The presence of bearish divergence is much more significant in a descending triangle than it is in an ascending one.

Therefore, we predict that the price will not act in the same manner as it did in 2015. Rather, it is more likely to break down from the triangle and find support around $8,000.

Short-Term Movement

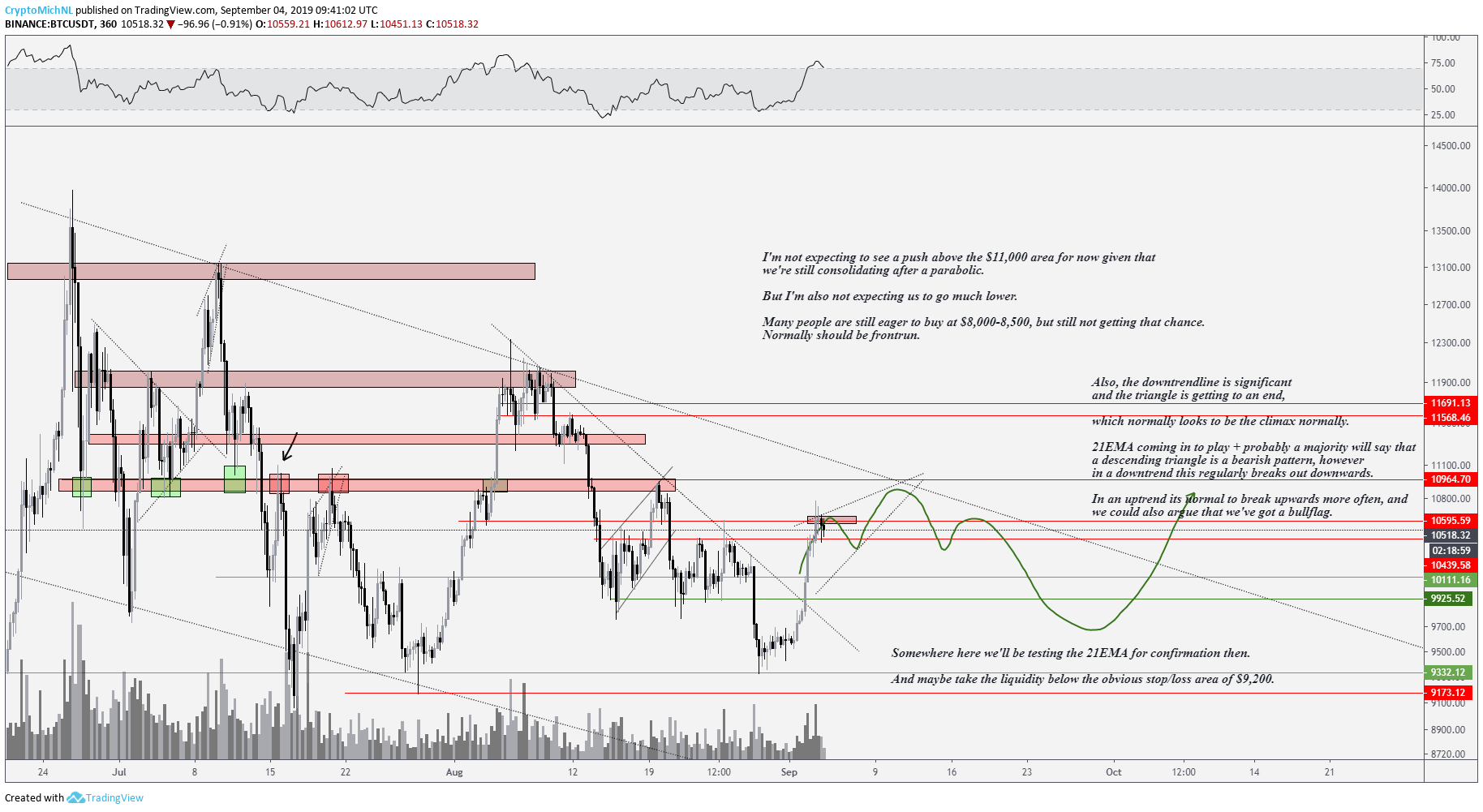

For the short-term movement, @CryptoMichNL predicts that we will soon reach the resistance line of the triangle, before decreasing towards support.

This is a very likely possibility, however after we decrease to the support line, the price is more likely to break down instead of initiating an upward move.

Summary

The BTC price is possibly following a fractal from 2015.

However, the creation of a different trading pattern leads us to believe that BTC will not follow through with a breakout as it did in 2015, but will likely break down and continue to decrease.

Afterward, it is likely to find support near $8000.