Our outlook on eBay Inc (NASDAQ:EBAY) has been negative since early 2015. And indeed, eBay stock went exactly nowhere, after moving up and down during the rest of 2015 and the first half of 2016. Things changed in the second half of last year when the bulls decided they have had enough and lifted the price to a new all-time high. The uptrend continued and as of today, eBay shares will cost you more than $34 a piece. Does this mean it is time to give up and start buying? According to the Elliott Wave Principle, the answer is still “no.” The following price chart explains why.

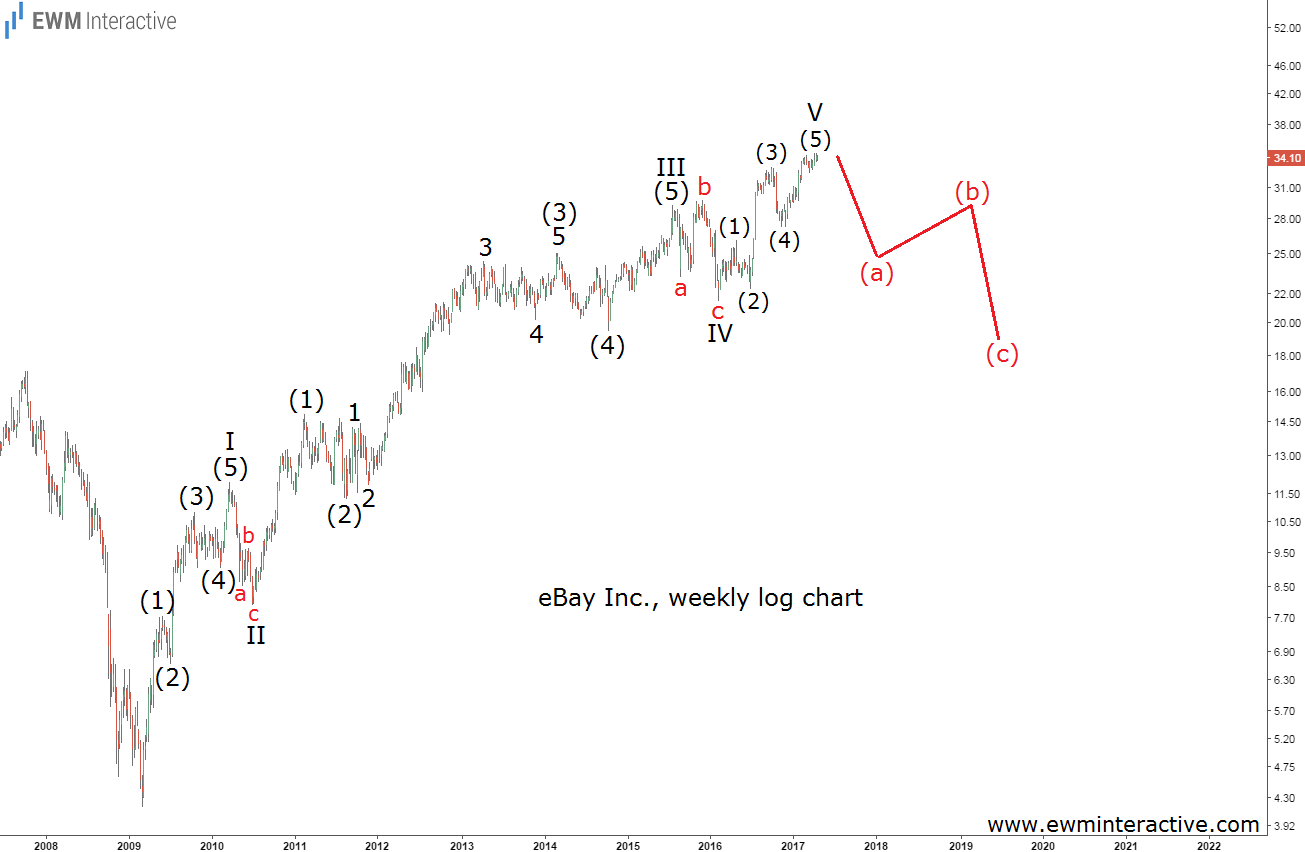

The weekly logarithmic chart of eBay stock allows us to see the wave structure of the entire uptrend since March 2009. It has been more than 8 years. Enough time for the price to draw a complete five-wave impulse between $4.17 and $34.74 so far. Waves I and IV even obey the rule of alternation, since wave I is a sharp zig-zag, while wave IV is an expanding flat correction. Furthermore, the structure of wave V can hardly be any clearer. Unfortunately for investors, the Elliott Wave theory postulates that every impulse is followed by a correction of three waves of similar magnitude in the opposite direction. So, instead of trusting the bulls and joining them near $34 a share, we think we would be better off to continue avoiding eBay stock for now, because a major pullback is likely to occur soon. Calling a top is difficult, of course, which is why shorting is also not recommended. The best decision, it seems, is to simply stay aside.

In conclusion:

- eBay stock has been rising for over 8 years

- the trend seems to be exhausted

- from an Elliott Wave perspective, staying aside is preferable right now