It’s a number that is almost impossible to comprehend... $2.5 trillion.

That’s the estimated amount of cash U.S. companies are hoarding offshore.

It’s difficult to visualize such a gargantuan sum of money. It’s like thinking about the amount of stars in the universe. But this galaxy-sized pile of cash is worth spending some brain power on...

Those willing to put forth the effort could be in store for a windfall of profits in the next 100 days.

Let me explain...

The Key to Offshore Tax Hoarding

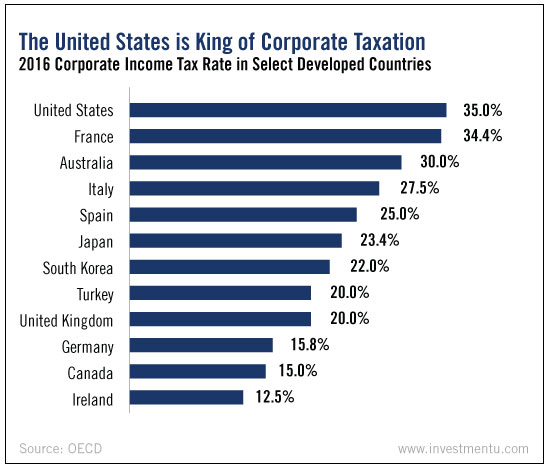

As you can see in our chart above, the United States has the highest effective corporate tax rate in the developed world - 35%.

This higher rate has its consequences. A major one involves U.S. companies sheltering their overseas profits.

It’s not hard to understand why. If you had the choice to leave money offshore untaxed or bring it home to be taxed at 35%, what would you do?

It’s this line of thinking that’s led to that $2.5 trillion stockpile overseas.

But thanks to President-elect Trump, that is about to change.

Trump’s Tax Holiday

Whether you like his politics or not, Trump has a time-tested solution to the offshore profit problem - a tax repatriation holiday.

In short, he wants to enact a short time frame where companies can bring cash back to the U.S. at a 10% rate.

This would be a huge win for companies that have big cash balances overseas. This isn’t just a theory, either. George W. Bush enacted a similar tax holiday in 2005. A sea of cash came flooding back into the United States as a result.

Our research confirmed 58 companies repatriated more than $217.8 billion in 2005. And with this cash, they repurchased shares, paid special dividends to investors and purchased other companies.

Shareholders are the main winners of special dividends and share-repurchasing programs.

But here’s the important thing we discovered: Not every company that repatriated cash handed investors a windfall of profits.

In fact, of the 58 companies that repatriated, only a small group of stocks handed investors meaningful returns.

Knowing which stocks will pay out big time if Trump gets his way is critical...

A 1,438% Outperformance

You might think that large cap stocks - companies worth $10 billion or more - would have offered the greatest rewards for shareholders. But these companies returned only a measly 1% average return following the tax holiday.

The real gains were made from the small cap and midcap stocks that repatriated.

This small group - which made up only 15% of the stocks that repatriated in 2005 - handed investors an average return of 20%.

That’s a 1,438% outperformance by the smaller stocks!

Naturally, this got everyone in our research department quite excited. We made it our mission to hunt down a small handful of stocks that would benefit most from Trump’s repatriation holiday.

If you want details about these companies, then you need to check out a special event that The Oxford Club has put together for this Thursday. I'll be hosting it alongside Chief Income Strategist Marc Lichtenfeld.

Together, we will kick off Trump’s inauguration by covering the sectors set to benefit most from his first 100 days in office. This small group of repatriation winners will be among the first items we discuss.