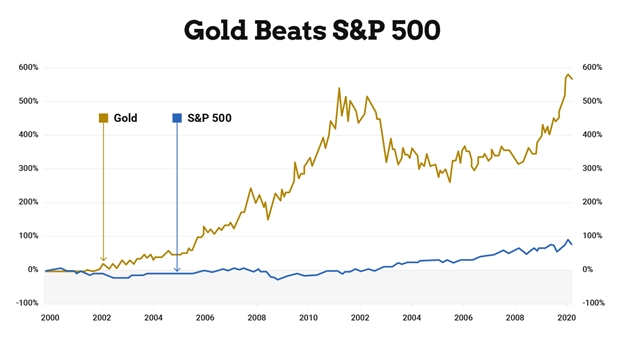

It was February 2000 and I walked into a coin show and bought a one ounce American Gold Eagle coin for only $295. That same gold coin now would set you back $1780. Unfortunately, my returns in the SPDR S&P 500 ETF (NYSE:SPY) have not even come close. Over that same period gold has appreciated over 500% while the total returns of the S&P 500 are a bit north of 190%.

The issue is that the Federal Reserve has increased the money supply from 4.7 trillion back in 2000 to over 20.3 trillion today. Effectively the government deliberately debased the dollar following the 2008 recession and COVID crisis in order to prop up the economy. There is little reason to think this will stop given that they continue to print another 120 billion every month through quantitative easing.

Back in 2000 the Federal Reserve had an interest rate target of 6.5% and there was no government deficit. It was the core belief of central bankers at the time that it was important to keep the dollar strong. This was all well and good until that thought process began to change towards that of Modern Monetary Theory. Essentially, the new thesis is that we can print as much money as we want and spend our way into trillion dollar deficits.

Fortunately there is a solution for those of us who don't want to allow the Federal Reserve to debase our money. The Solactive Gold Backed Bond Index which invests in a portfolio of investment grade corporate bonds hedged to the price of gold has tracked a pre-inception history since Jan. 3, 2006 of 14.57% annualized. Those gold backed bond returns considerably outpaced both the price of gold by itself and the S&P 500. One new ETF that is designed to track the Solactive Gold Backed Bond Index is the Strategy Shares Gold Hedged Bond ETF (NYSE:GLDB).

Ray Dalio has been a long time proponent of gold in a portfolio and has been known to say, “cash is trash.” The reality that is that it is hard to argue with his logic. Every portfolio needs a hard currency component in the form of gold to drive long term returns.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Why Gold Has Outperformed The S&P 500 Over The Past 20 Years

Published 07/01/2021, 08:45 PM

Updated 07/09/2023, 06:31 AM

Why Gold Has Outperformed The S&P 500 Over The Past 20 Years

Latest comments

Looks like the last ten years haven't been so good.

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.