When it comes to what happens during the next major market correction-crash, we can count on that “this time will be different” for the gold and silver prices. While many precious metals investors believe that gold and silver will crash along with the broader markets, the charts and data suggest the opposite.

In my newest video, Why Gold & Silver Won’t Crash Along With The Stock Markets, I provide charts and updated information on the break-even analysis of the primary gold and silver mining industry. According to my research, the gold market price has not fallen below the production cost of the top gold miners in the past two decades.

Some analysts, such as Harry Dent, believe the gold price will fall to $700 this year. Dent reconfirmed his forecast in the following article, Why We Are Heading Toward $700 Gold In 2018:

Investors are fleeing to gold in a desperate attempt to weather the recent market volatility… but is this long time “safe-haven” actually poised to collapse wiping out trillions of dollars of wealth in the process?

While many economists will argue that gold is not in a bubble… and insist it will soar to $2,000, $5,000 and even $10,000, my research has said otherwise. I’ve never been more certain of anything in over 30 years of economic forecasting.

Market volatility, worries over the Europe Central Bank, negative interest rates, and China are among a laundry list of events that are driving panicked masses to buy the yellow metal. But this is only inflating the gold bubble that is poised to pop at any moment.

Mr. Dent states the due to the current market volatility, worries over Central banks, negative interest rates, and fears about China’s massive credit bubble are driving investors into gold. BUT, according to Dent, this gold bubble is about to POP.

I find Dent’s analysis that gold is in a bubble quite interesting because if something were in a bubble, then it would have to be at least 50-100% overvalued. If we look at the data on gold and silver, they are no were near BUBBLE TERRITORY.

Shame on you Harry for putting out bogus analysis.

Unfortunately, Harry Dent has no clue about Energy, the Falling EROI or the cost of production when he applies his forecasts. Dent, like most in his industry, produce superficial, incomplete and faulty analysis because they are forecasting in a vacuum. Now, when I state that they are forecasting in a vacuum, that means they are providing analysis by excluding the most crucial variable… ENERGY.

In my video below, I include the cost of production analysis of the primary gold and silver mining industry. If Harry Dent took the time to look at one of the charts in this video, he would see that the gold price never fell below the average cost of production since 2000, and I would suggest for the majority of the 20th century.

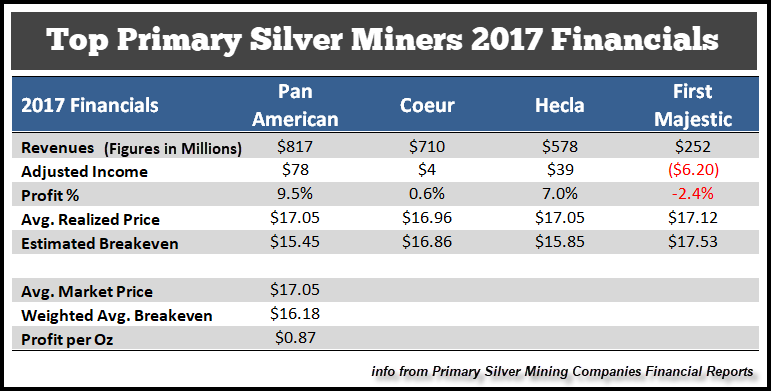

In the video, I include two tables on the top primary gold and silver miners cost of production. Below is the chart for the top primary silver miners 2017 Financials:

This table shows that the average cost of production for 2017 in this group of primary silver miners was $16.18. The current silver price is $16.48. Now, when the price of silver shot up to $50 in 2011, the average cost of production for the primary silver miners was between $25-$27. So, if Dent were to say that silver was in a bubble in 2011, then maybe he may have some credibility if we were to remove all other negative financial factors such as the massive debt, derivatives, and leverage in the markets.

Regardless, if we were to exclude all the highly leveraged Stocks, Bonds, and Real Estate values (from the massive debt & derivatives), then it is correct to suggest that silver was in a bubble in 2011. But, to say that gold and silver are in a bubble today when the current market prices are close to the average cost of production, is pure LUNACY.

To understand my full analysis on why I don’t see the gold and silver prices crashing along with the broader markets, please watch the video above. Also, if you find the video informative, please consider sharing it with those who may also find it interesting.