Whirlpool Corporation (NYSE:WHR) is a lucrative stock when it comes to dividend payouts and hikes. Apparently, the company announced a 5-cent hike in its quarterly cash dividend to $1.20 per share, payable Jun 15, 2019, to its shareholders of record as of May 17. This new dividend reflects about a 4.3% increase from the prior payout of $1.15.

This home appliances behemoth has been consistently raising dividends, marking the seventh straight year of a hike now. Moreover, the company follows a balanced capital allocation approach focused on making appropriate capital allocations to fund its capital needs and return value to its shareholders via dividends and share repurchases. Dividend hikes are expected to bolster investors’ confidence in the company’s financials, strengthen its market position and drive the stock.

During 2018, Whirlpool generated $1,229 million cash in operating activities and $853 million of free cash flow, with capital expenditures of $376 million. Furthermore, the company bought back shares worth $1,153 million and paid dividends of $306 million in the same year. For 2019, Whirlpool anticipates generating free cash flow of $800-$900 million, while operating cash flow is projected to be $1.4-$1.5 billion. The company expects capital expenditures of $625 million related to free cash flows.

Markedly, Whirlpool is among those few companies that heavily invest in technologies to produce differentiated products to suit the needs of their end consumers. Moreover, its robust product pipeline, solid innovations and cost-productivity initiatives keep it on track to deliver long-term goals. In addition, the company’s bottom line is benefiting from strong execution of higher prices, strict working capital reduction and a lower tax rate. Solid growth at the company’s North America segment despite sluggish industry demand and higher raw material costs has been aiding results. For 2019, Whirlpool envisions adjusted earnings in the range of $14-$15 per share.

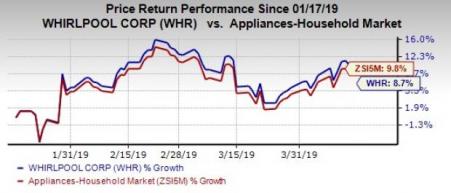

A glance at this Zacks Rank #3 (Hold) stock’s price performance shows that it has gained 8.7% in the past three months compared with the industry’s 9.8% rally. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Apart from Whirlpool, investors may count on these companies that have recently raised their quarterly dividend. The Procter & Gamble Company (NYSE:PG) or P&G announced a 4% hike in the quarterly cash dividend rate to 74.59 cents per share, payable May 15, 2019. Colgate-Palmolive Company (NYSE:CL) announced a 2.4% hike in its quarterly cash dividend to 43 cents per share, payable May 15. The TJX Companies, Inc. (NYSE:TJX) hiked its quarterly cash dividend by 18% to 23 cents per share, payable Jun 6.

Will you retire a millionaire?

One out of every six people retires a multimillionaire. Get smart tips you can do today to become one of them in a new Special Report, “7 Things You Can Do Now to Retire a Multimillionaire.”

Click to get it free >>

Whirlpool Corporation (WHR): Free Stock Analysis Report

The TJX Companies, Inc. (TJX): Free Stock Analysis Report

Procter & Gamble Company (The) (PG): Free Stock Analysis Report

Colgate-Palmolive Company (CL): Free Stock Analysis Report

Original post

Zacks Investment Research