Clinging to delusional fantasies of "free wealth" won't lead to positive outcomes, any more than swallowing handfuls of meds leads to "free health."

Under various guises, labels and rationalizations, "free money" has now been established as the default policy fix for any problem. Stock market falters? The solution: free money! Economy falters? The solution: free money! Bankers face collapse from ruinously risky bets? The solution: free money! Infrastructure crumbling? The solution: free money!

Inflation raging? The solution: free money! Ruh-roh. We have a problem free money won't fix. Instead, free money accelerates the conflagration. Dang, this is inconvenient; the solution to every problem makes this problem worse. Now what do we do?

Despite the apparent surprise of the policy-makers, pundits and apologists, this was common sense. Create trillions of dollars out of thin air and spread the money around indiscriminately (fraudsters and scammers getting more than the honest, of course) after global supply chains were disrupted and shelves were bare, then open the floodgates of speculative gambling in stocks, cryptos, housing, used cars, bat guano, quatloos, etc., and what do you think will happen?

Supply can't catch up with free-money-boosted demand, prices rise, people instinctively over-order and over-buy, and "don't fight the Fed" speculative betting begets more betting: the inflation rocket booster ignites, wages soar as workers try to keep pace with rising expenses, speculative bubbles inflate to unprecedented extremes, and all this "wealth without work or productivity" gooses spending and gross domestic product (GDP).

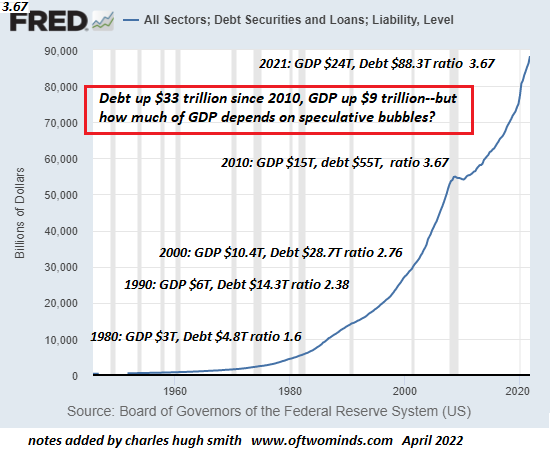

In the chart below, I've noted GDP and total debt (TCMDO). The raio of debt to GDP is informative. Forty years ago, the ratio was 1.6: debt was $4.8 trillion and GDP was $3 trillion.

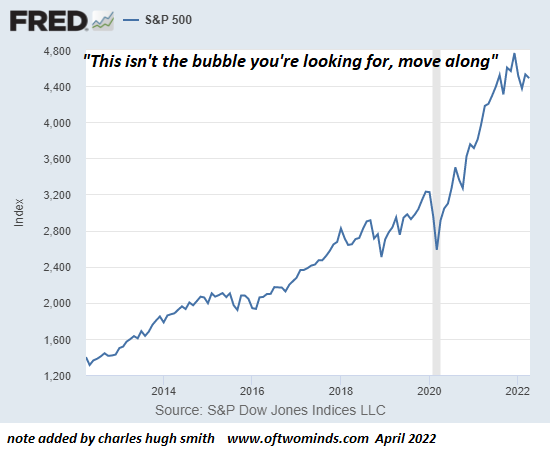

Then the policy solutions of fiscal "borrow and spend" and Federal Reserve "balance sheet expansion." a.k.a. free money, became the policy default. The ratio rose to 2.76 in 2000 and has wobbled around 3.7 for the past decade—a decade that just so happened to see the stock market quadruple and the housing bubble reinflate to new heights as the Federal Reserve kept interest rates near zero as part of the "free money" policy: if we're going to borrow tens of trillions of dollars to squander, we need near-zero interest rates to keep costs of borrowing down.

Though no one in a position of power or influence dares admit it, the ratio of debt to GDP hasn't blown out for one reason: speculative bubbles have pushed GDP higher in a massive, sustained distortion of "wealth effect" and winner take most gains for those who knew how to extract the majority of gains from the bubbles.

Once the bubbles pop, GDP crashes and the ratio blows out. The belief that adding trillions in debt magically adds GDP will be revealed as delusional fantasy.

Completely forgotten in the era of Free money as the solution to all problems is the discipline of frugality, which can best be defined as discipline over spending as a means of building long-term financial stability and general well-being.

Financial discipline (frugality) has been set aside as a needless discomfort: why make difficult tradeoffs and sacrifices when the solution is just to borrow/create more free money? Indeed. Along the same lines, why bother with all the hassles of healthy food and fitness? Just pig out and swallow a couple handfuls of "free" (heh) meds.

Discipline isn't just about limiting waste. It's about investing capital and labor wisely to secure future gains in productivity which is the only real source of income and wealth. Creating "money" out of thin air and spreading it around to satisfy every constituency doesn't increase productivity. It destroys productivity by incentivizing waste—the waste is growth Landfill Economy—and speculative bets on bubbles never popping.

Alas, all bubbles pop, and now that creating free money only makes costs rise faster, there is no solution other than—oh, dear, dear, dear—the unforgiving discipline of frugality and investing for productivity gains rather than for speculative bubble "wealth."

Which path leads to doom? Free money. Which path leads to revival? frugality and discipline. That's not what everyone wants to hear, but clinging to delusional fantasies of "free wealth" won't lead to positive outcomes, any more than swallowing handfuls of meds leads to "free health."

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Which Leads To Doom, Which Leads To Revival: Free Money Or Frugality?

Published 04/11/2022, 01:52 AM

Updated 07/09/2023, 06:31 AM

Which Leads To Doom, Which Leads To Revival: Free Money Or Frugality?

Latest comments

Well written. Due to lowest interest rates in more than 3000 years and going off the gold

standard so the printing presses are humming 24/7, bubble everything is truly historic. As far as I am concerned all central bankers should be on trial for gross negligence and treason.

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.