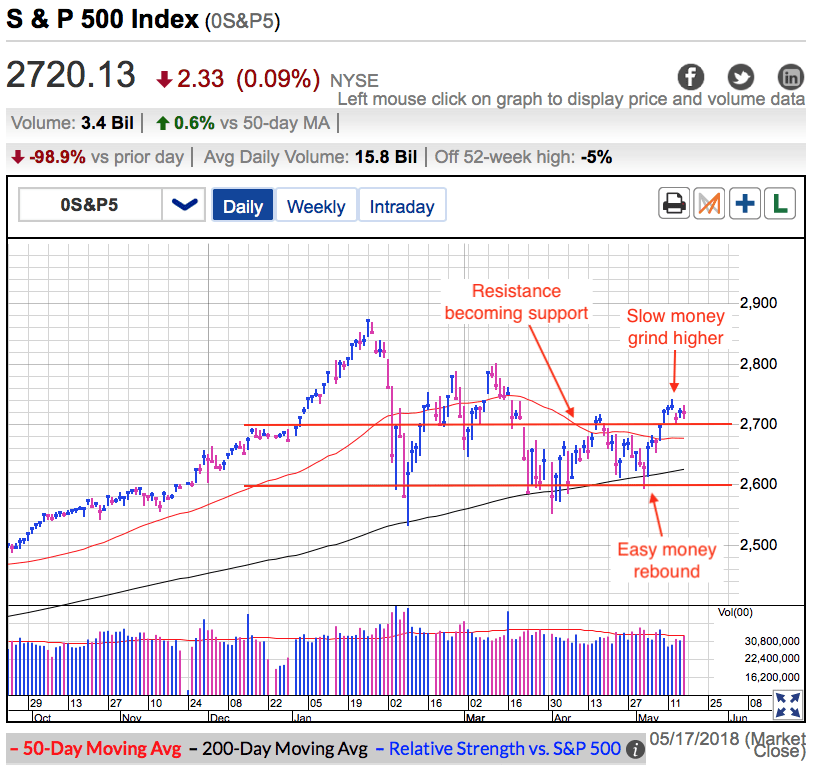

On Thursday the S&P 500 closed mostly unchanged, losing a trivial 0.1%. This was the sixth consecutive close above 2,700 as last month’s resistance turns into this month’s support.

In Tuesday’s free blog post, I told readers May’s rebound could go one of two ways. Either we hit our head on the upper end of trading range and stumble back into the mid-2,600s. Or prices stabilize above 2,700 following Tuesday’s dip and test of support. Two days later and we are still holding 2,700 support and things look good for this market. If we were overbought and vulnerable to tumbling back into the heart of the trading range, it would have happened by now.

The lack of follow-on selling when we tested 2,700 earlier this week tells us most owners are confident and not interested in selling. Plenty of bad news has been making the rounds between oil topping $70, gas approaching $3, interest rates passing 3%, trade negotiations breaking down, and Trump’s North Korea summit on the verge of collapse. There have been more than enough reasons for this market to tumble, yet here we are still holding above support.

The thing to remember about headlines is if no one sells them, they stop mattering. All of the above headlines have been reoccurring themes that keep popping up over the last few weeks and months. The thing about recycled headlines is they get priced in. Anyone who fears these stories bailed out a long time ago when these issues first came up. Those nervous sellers were replaced by confident dip-buyers who demonstrated a willingness to own these headline risks when they bought. And it should be no surprise these confident dip-buyers are not flinching when these headlines come back around. As I said, when no one sells the news, it stops mattering. That is why prices are holding up so well despite the headline headwinds.

A market that refuses to go down will eventually go up. And while the path of least resistance for this market remains higher, the easy gains are behind us. A couple of weeks ago I encouraged readers to buy the dip. Risk is a function of height and falling near the lowest levels of the year made May’s dip one of the safest times to buy stocks this year. But now that the easy money and quick gains are behind us, the ride is going to get slower and harder. The market’s resilience this week tells us it still wants to go higher and 2,800 is very much in play. But it will be a grind getting there that could take a couple of months. If buying the rebound off 2,600 support was the fast money trade. Buying 2,700 support is going to be the slow money trade and it could take most of the summer to reach 2,800. That means lots of up and down between here and there.

Last month I told readers people would be kicking themselves for not buying the Tech Highflier dip and no doubt a lot of people are now kicking themselves for not buying it. People had been begging for a pullback so they could jump aboard this year’s hottest trade. Yet when the market granted their wish, most were too afraid to buy the dip they were asking for. Even though prices are nowhere near as attractive as they were a few weeks ago, the Tech Meltdown is over and these stocks are leading the way higher. Most of the FAANG stocks are back near their highs and will only go higher as the broad market climbs this summer.

The same cannot be said for Bitcoin. I wrote a couple of weeks ago that $9k support risked turning into stalling if we held that level too long. The problem with staying near support too long is it makes a violation inevitable. When BTC couldn’t rally beyond $9k, falling under it was the only option left. And now last week’s $9k support has turned into this week’s $8k support and we are on the verge of falling to $7k support next week. The rebound off $6k earlier this year boosted sentiment, but this dip is threatening to erase all of those good feelings. I don’t think the lows are in yet and that means lower prices are still ahead of us.