Several years ago, and before the December 2015 low, I posted about one particular gold cycle.

To be frank about this subject, there is open dissent about whether time cycles exist in financial markets at all, or if there are quasi time cycles. Or if alternatively this market's valuation is a random walk through chaos as real events unfold and become discounted into the gold price event by event.

My own opinion on this is that cycles do exist, but they are transient. They appear. They disappear. they morph into longer or shorter periods when they return.

And that is my view about this. It's not easy, but I think it is worth the time and effort to figure these strange patterns out.

I see it as locating threads of non random semi predictability that are woven through a fairly random cloth, and following those threads to see where they lead me. Sometimes I arrive at a trade, othertimes no significant conclusion.

This is a slippery matter. And we MUST deal with partial information. And the situation, like reality, evolves and nothing is fixed.

But still these cycles or whatever they are seem to come back (when they choose to). So let's work with an example which has been documented realtime right here.

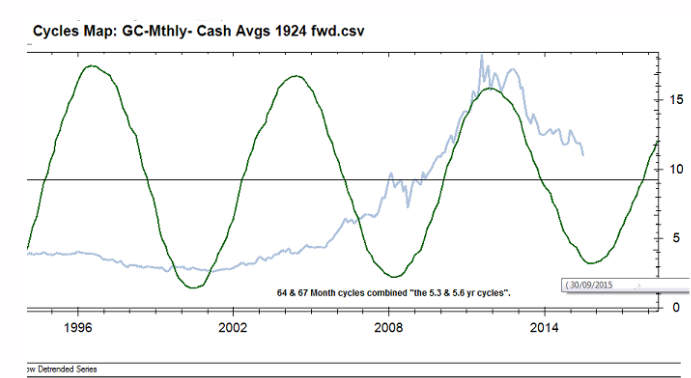

At the time of my 2015 article I also posted these charts of the gold market:

As you can see I included a list of possible cycles on monthly (ie large) scale with the chart. These might be called "likely suspects" if I were to do a fresh search, a starting point in other words.

So how did it work out?

Pretty well! It showed on the chart a date for a low at 30 September 2015, which was two months early. Gold bottomed in December of that year.

That is just two price bars off on that scale. I was happy with the outcome, did most of my buying in November, and a little more the following month.

That was then. Now we are approaching a five year anniversary.

So if these two or this one cycle, with a period of 5.3 to 5.6 years is still lurking around, or if it reappears, when would that be? The answer is a guesstimate of from early 2021 to mid 2021.

This however depends upon a repetition of the main cycle, and in the real world even a hammer does not strike the nail in the exact same way every time.

But I reproduced the list of many other prominent contenders to the throne of "boss cycle" above.

Some people will take a pen and paper, others make up a chart online or wherever, and many will simply move on.

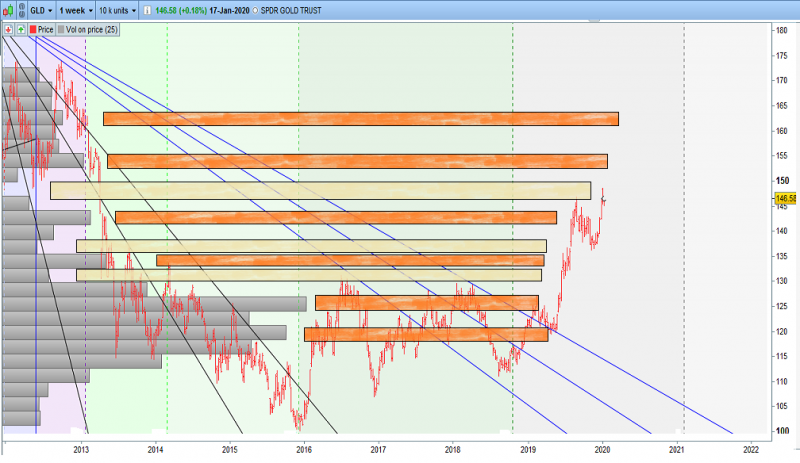

Here is a sample weekly chart of the SPDR® Gold Shares Fund (NYSE:GLD) to work with. I left some random lines on it for convenience.

If they help use them. If not, ignore them. It's the dates and prices this is more about.

I will make a reminder at this point—a cautionary note about cycles—sometimes at the time for an anticipated top, a bottom appears, or occasionally a breakout appears and the journey to an even higher top begins.

The cycles doesn't tell you what you want to know. It merely indicates points in time when significant events tend to occur.

Stops must be employed to do the rest or losses can accumulate instead of the preferred profits.

The cycle "turn" is when to look out for opportunity and-or danger, as controlled by the particular timescale you are working with.

Try it for several timescales. Keep notes. See what works and what doesn't (this time). Keep an open mind.

What alternative periods would I try? Well, I like to use the last price swing, and half and quarter that, and also try the thirds. I look to see if an alternate cycle appears at those periods and watch those times.