Kirkland Lake Gold Ltd. (TO:KL) is set to release first-quarter 2019 results on May 7, before the opening bell.

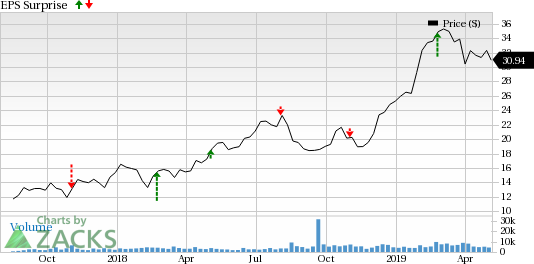

The stock has rallied 71.2% in the past year against the industry’s 6.4% decline.

Some Factors at Play

In April 2019, the company released gold production figures for the first quarter.

Consolidated gold production totaled 231,879 ounces in the quarter, marking an increase of 57% year over year. The company witnessed record quarterly production at Macassa and Fosterville. While gold production at Fosterville surged more than two-fold to 128,445 ounces, production at Macassa climbed 35% to 72,776 ounces.

Production at Holt rose 3.3% year over year to 17,225 ounces. However, gold production declined 5.2% to 12,377 ounces at the Taylor mine.

Notably, the Zacks Consensus Estimate for total revenues for the first quarter is currently pegged at $290 million, indicating an increase of 46.5% from the year-ago reported figure.

What the Zacks Model Says

Our proven model does not show that Kirkland Lake Gold is likely to beat estimates in the to-be-reported quarter. That is because a stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here, as you will see below:

Earnings ESP: Earnings ESP for Kirkland Lake Gold is 0.00%. The Most Accurate Estimate and the Zacks Consensus Estimate are both currently pegged at 52 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Kirkland Lake Gold currently carries a Zacks Rank #3, which when combined with a 0.00% ESP makes surprise prediction difficult.

Note that we caution against stocks with a Zacks Rank #4 (Sell) or #5 (Strong Sell) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks Poised to Beat Estimates

Here are some companies in the same space you may want to consider as our model shows that they have the right combination of elements to beat estimates.

Intrepid Potash, Inc (NYSE:IPI) has an Earnings ESP of +25.00% and carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Bunge Limited (NYSE:BG) has an Earnings ESP of +5.00% and carries a Zacks Rank #3.

Covia Holdings Corporation (NYSE:CVIA) has an Earnings ESP of +9.47% and carries a Zacks Rank #3.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Intrepid Potash, Inc (IPI): Free Stock Analysis Report

Bunge Limited (BG): Free Stock Analysis Report

Kirkland Lake Gold Ltd. (KL): Free Stock Analysis Report

COVIA HOLDINGS (CVIA): Free Stock Analysis Report

Original post

Zacks Investment Research