Gold

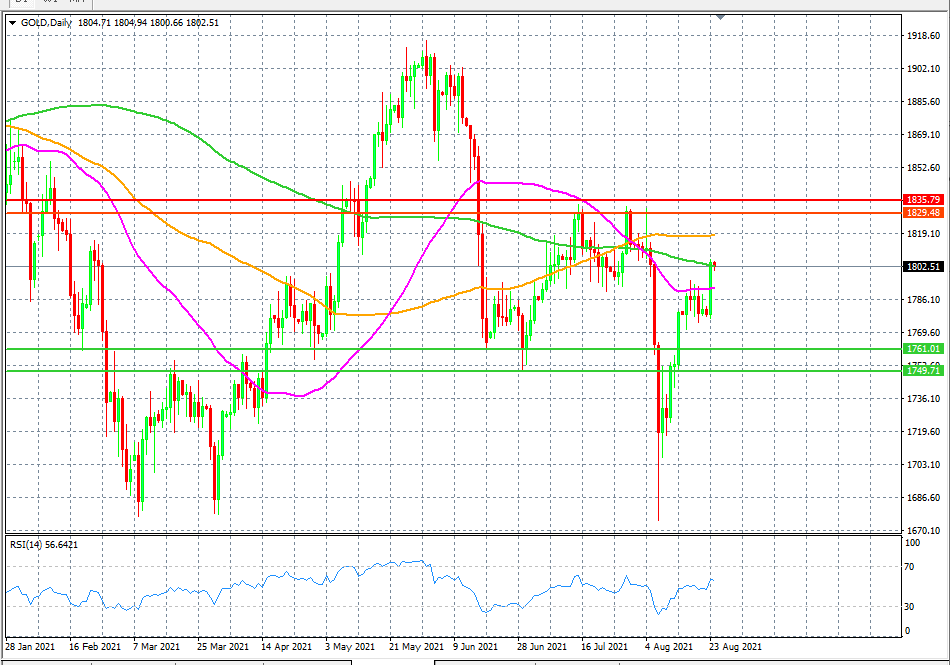

Following a drop in prices over the last few days, gold prices are making a comeback. Gold prices have risen above the crucial $1,800 level after an increase in coronavirus cases convinced investors that the Fed might postpone the unstoppable tapering of stimulus. The dollar has also recently depreciated, prompting investors to increase their exposure to the precious metal.

Moving onwards, traders would need strong reasons to drive prices further above the $1,800 level considering resistance levels near the 100-day and 200-day moving averages. Furthermore, investors should understand that if future economic data shows continued strength, hawks could be cornered to take control, leading to an eventual boost in interest rates, which would increase the opportunity cost of holding the yellow metal and drive its prices down.

Asian Markets

Asian Pacific markets are posting modest gains following the slump in markets witnessed last week because of additional regulatory restrictions imposed by Chinese regulators. However, markets have so far reacted favorably to China's central bank's call for additional credit support for the country's real economy. Equities have been on a rise following the news.

As of 11:28 p.m. EST, the Nikkei jumped 0.98% while the Shanghai Composite Index was up 1.00%. The ASX 200 index surged 0.44% and Seoul's KOSPI rose 1.56%. The Hang Seng index, in Hong Kong, climbed 1.59%.