According to the Investment Company Institute, assets in institutional money market funds increased $17.19 billion to $1.69 trillion for the week ended on September 24, 2014. This was the biggest weekly increase in these money market funds in the last five months. (Source: Investment Company Institute web site, last accessed October 1, 2014.)

This is critical: when institutional investors sense the risk of a stock market sell-off in key stock indices, they tend to move their assets into highly liquid money market funds.

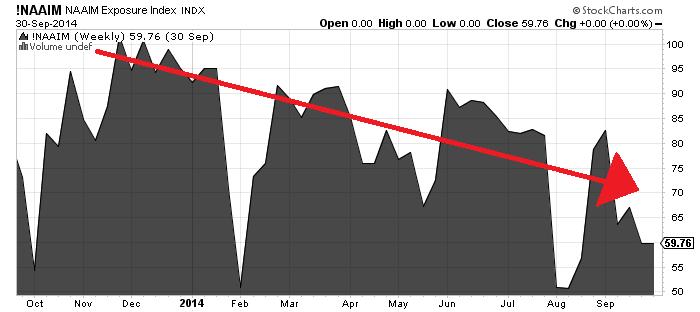

The sudden rush of institutional money into money market funds correlates with the National Association of Active Investment Mangers (NAAIM) Exposure Index below. It shows a clear decline in the amount of stocks active investment managers are holding in their portfolios.

Since late 2014, we’ve seen investment managers reducing their exposure to key stock indices. While they were fully invested in early 2014, we see investment managers are only 59.76% invested in stocks right now. Is it just an anomaly they are selling stocks when money market funds are seeing an influx of cash? I hardly think so.

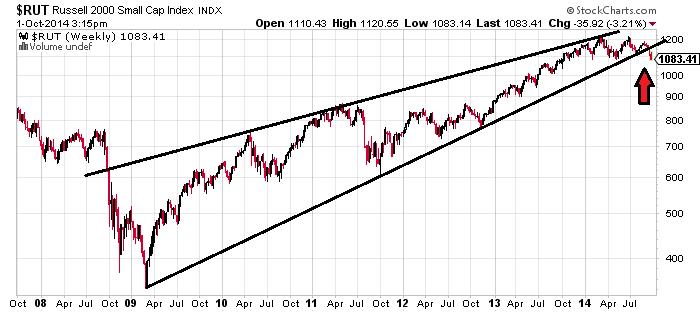

Finally, let’s look at small-cap stocks, as they are facing severe scrutiny. Key stock indices like the Russell 2000 that track the performance of small-caps are plunging. The Russell 2000 is now down more than 10% since it made new highs in March of 2014. This small-cap index has now broken down below its long-term uptrend, as illustrated in the chart below.

(Let’s remember that the trend is your friend—until it’s broken.)

All of this should be nothing new to you. For months, I’ve been warning about the coming decline in stock prices…courtesy of the new bubble in key stock indices created by the Federal Reserve’s easy money policies.

Now that the Federal Reserve has repeatedly told us it is moving away from low interest rates and is putting the brakes on money printing, we’re seeing the market sell off. This is not a new phenomenon. Whenever the Federal Reserve pulls back on its easing, we have seen the broad market sell off. It happened after the first and second rounds of quantitative easing came to an end. It’s happening again now.

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and analysis. The opinions in this e-newsletter are just that, opinions of the authors. Information contained herein, while believed to be correct, is not guaranteed as accurate. Warning: Investing often involves high risks and you can lose a lot of money. Please do not invest with money you cannot afford to lose.

Original post