As the GLD (NYSE:GLD) and silver continued in their paths higher this week, there is no suggestion from price action that they have met the top to this current rally. However, the lagging in the miner complex certainly has made many heads turn.

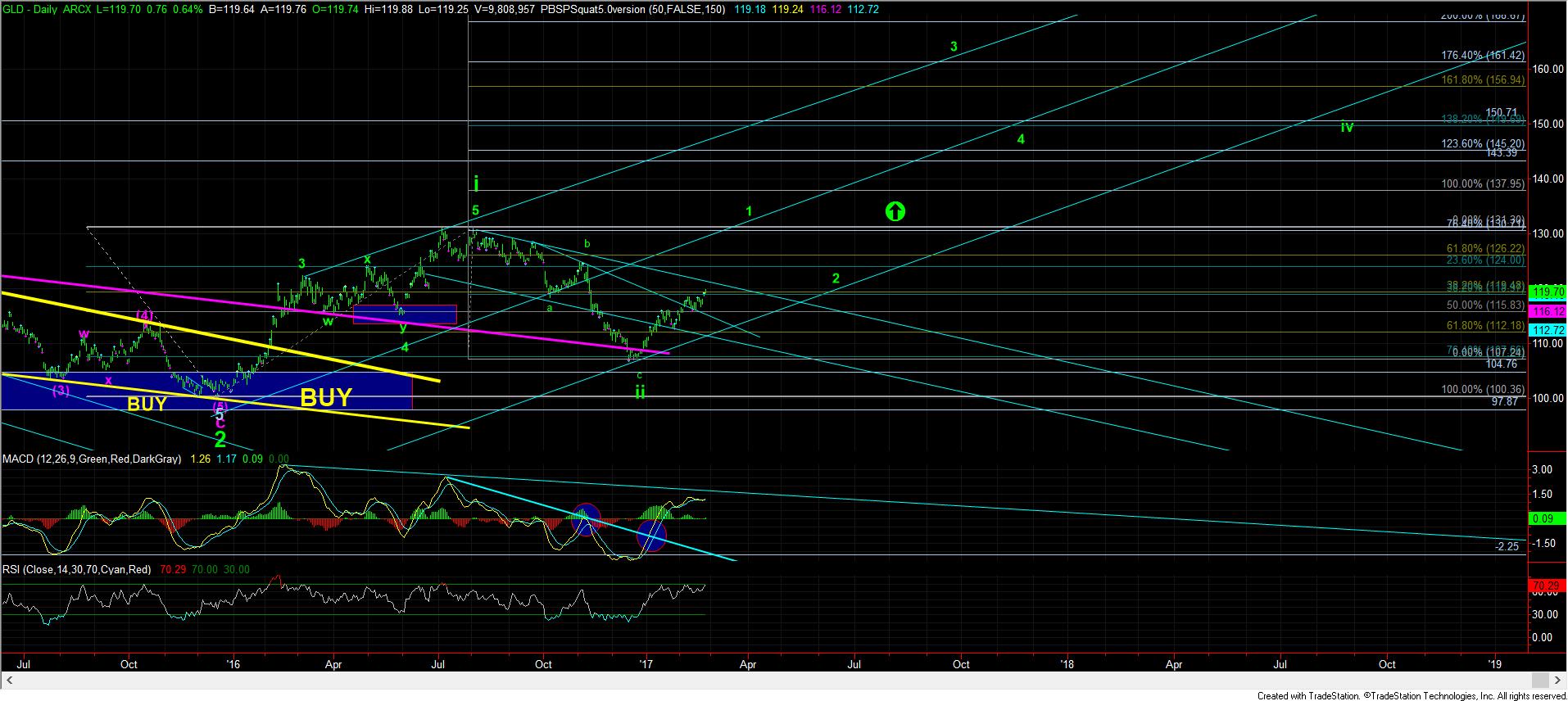

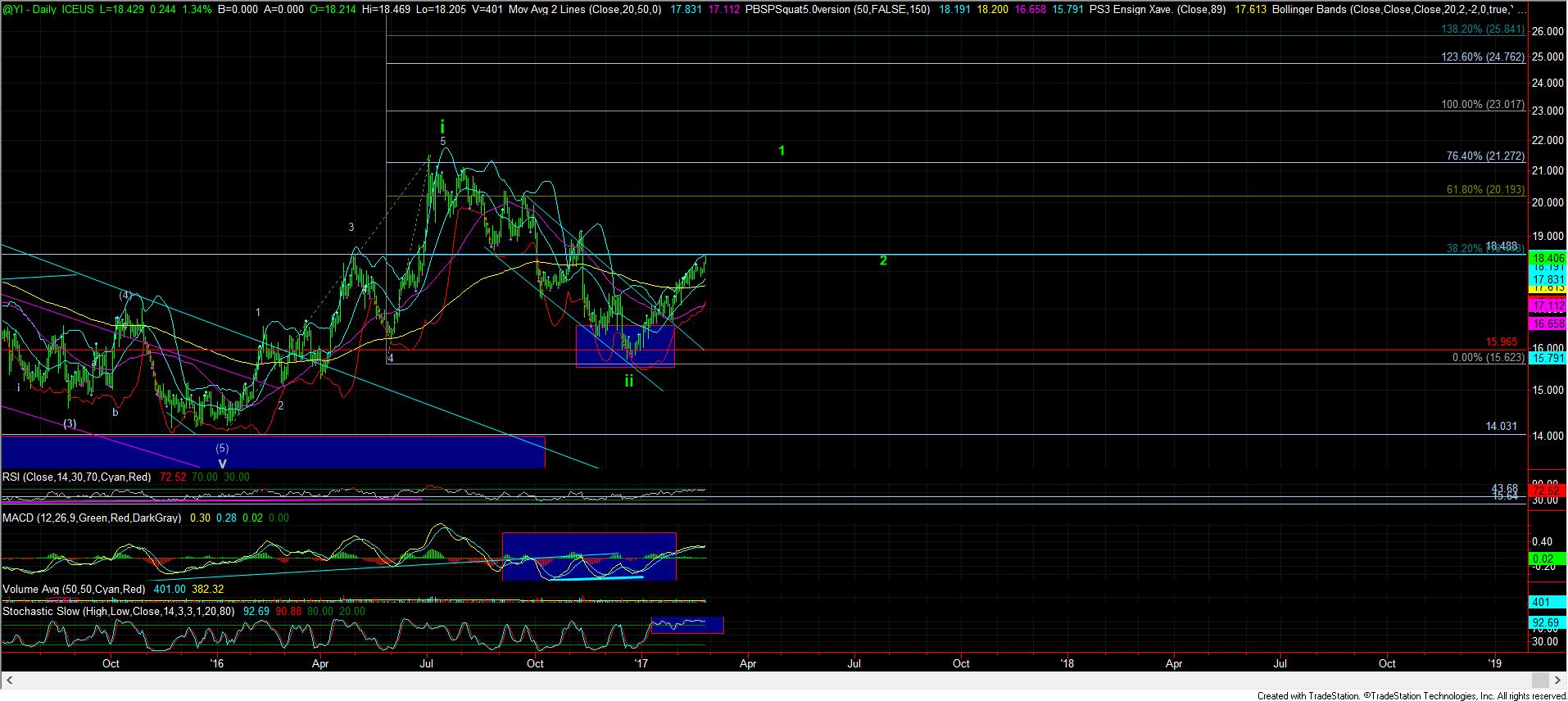

Now, I have always preached “each chart on its own,” and this is a great example of why. You see, until this past week, silver was leading the complex, with the GDX (NYSE:GDX) not far behind it, and GLD bringing up the rear. This “leader-board” is purely based upon the Fibonacci extensions which they have each struck during this last multi-month rally.

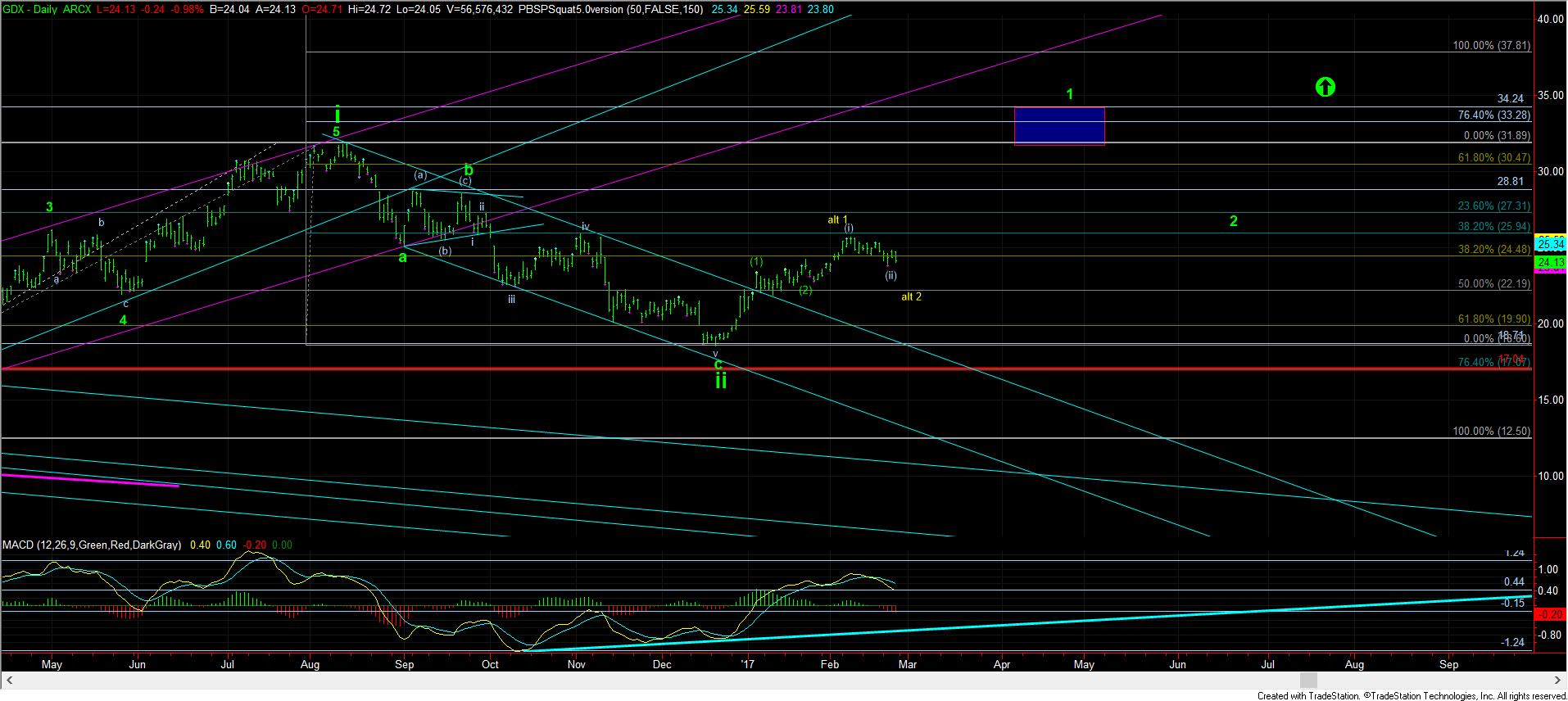

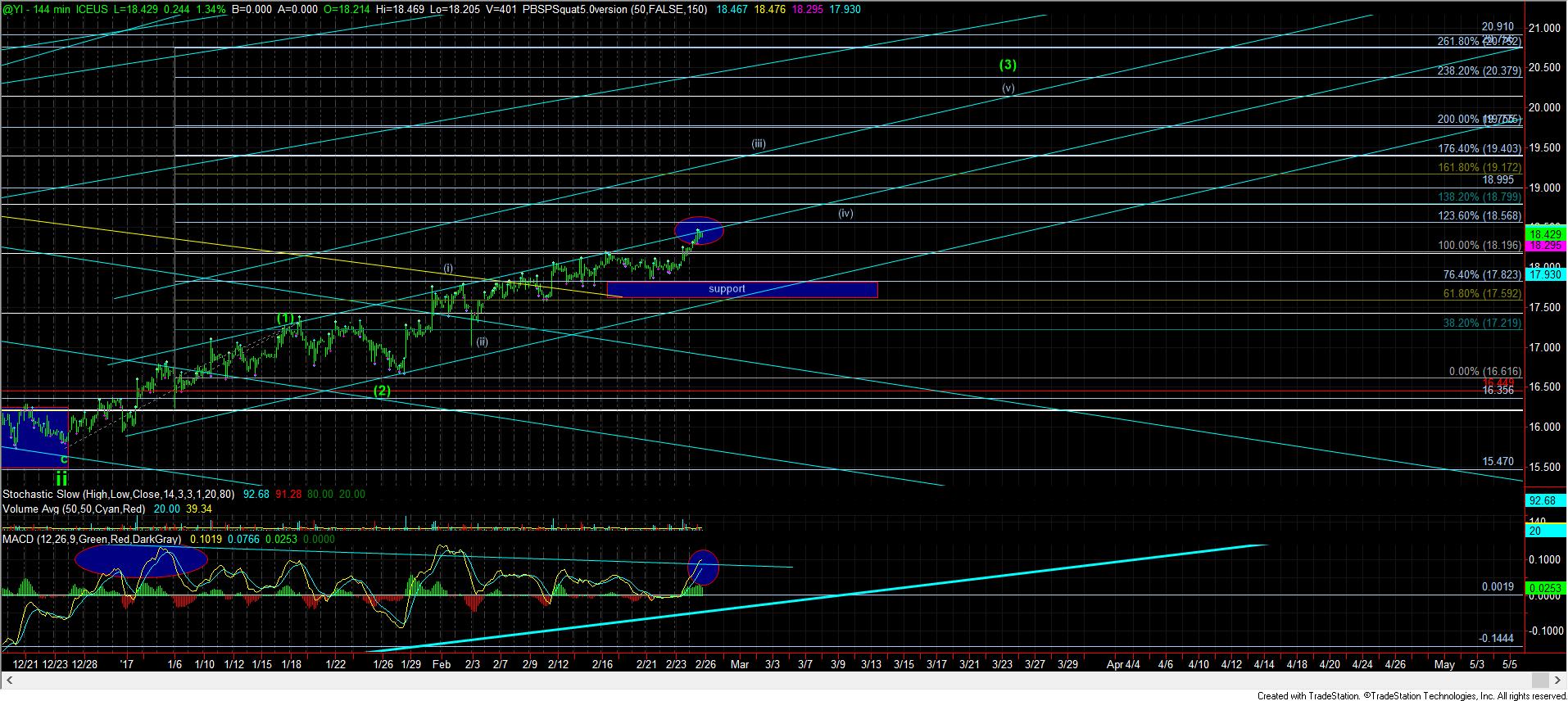

With silver breaking out through 18.20, it has now moved up to its 1.236 extension, whereas the GLD has only slightly moved through its .764 extension. Yet, the GDX still consolidating below its .764 extension. But, the fact that GDX has still not been able to break through its resistance has left it in a position where it can still pullback down towards the 21.50-22 region, but, clearly, that would not be my preference at this time.

As I noted regarding silver taking out its 1.00 extension at 18.20, that means that we really should not see silver breaking down below its .618 extension (17.60) – and preferably not below its .764 extension (17.80) – should we see any weakness in the complex in the coming week. But, the most immediate path for silver has it pointing directly to the 19.15-19.40 region should the market continue along its current immediately bullish path, without breaking any support.

Also, take note of the stochastics on the daily silver chart, which are clearly embedded, and quite supportive of the fact that silver is in a 3rd wave rally.

On the GLD, I have a micro support region noted on the 8 minute chart between 118.65-119.35. As long as all pullbacks do not break below that micro upper support, I can remain immediate bullish, with the 121 region as my next micro target. However, if that support should break, with follow through below 118, that would cause me concern about the immediate bullish potential in the GLD.

As far as the GDX is concerned, it is clearly stuck in the mud. It also has had a very bullish micro-structure to it for almost two weeks now, but it simply has not triggered. And, as I noted many times over the last week, if the market has a set up and fails to follow through in that set up, that alone is telling us something. And, when we did not break out two weeks ago, I noted that I was going to be hedging my personal miner’s portfolio, with stops at just over the .764 extension.

But the pattern to the downside in the GDX is quite overlapping and has developed in 3’s. That tells me that the probabilities suggest it is corrective in nature. But, when we do not have a solid 5-wave c-wave down to conclude the pattern, the market does not provide us the guidance we normally appreciate. Therefore, I am looking towards this past week’s low (23.82) as initial support, with the 23.30 region just below that. Should we break 23.30, only then will I be looking towards the 21.50-22 region for a larger degree 2nd wave, but, again, that really is not my preference at this point in time.

Lastly, I want to remind you that there are no guarantees in life, and there are certainly no guarantees in financial markets. Financial markets are non-linear environments, so, as I have noted so often, we have to approach them from a perspective of probabilities. So, allow me to reiterate how I approach the metals market from an analytical perspective, which I posted on Elliottwavetrader.net this past week:

“. . . based upon the larger degree perspective, with seeing 5 waves up from the 2015 lows, and then another 5 waves up from the December 2016 lows, I am on the hunt for the heart of a 3rd wave in this complex. When we are looking for a heart of a 3rd wave to take hold, they OFTEN do not provide much in the way of pullbacks. For that reason, I have always defaulted to a more immediate break-out scenario potential, since, otherwise, you can be left in the “dust” (pun intended), wondering where your pullback went.

Along those lines, the market has been consolidating near the highs for quite some time now. And, as I noted last week, when the market has made a number of attempts to break out, and is unable, it often falls back into more of a correction, in order to take another running start at the heart of the 3rd wave. So, with the inability to break out when it had a break out set up last week, I noted towards the end of the week that I would be hedging my account in consideration of that potential, and while we were still right at the highs.

While some of you may want me to tell you EXACTLY what the market is going to do at any point in time, I am sorry to disappoint you by telling you that I, or any other human being for that matter, am unable to do so. Rather, I can show you where we have set ups to break out or break down, but I cannot provide you any certainty. For that reason, I will inevitably be wrong at times.”

So, until I am able to find a crystal ball that works 100% of the time, I will provide to you what I am seeing in the markets based upon my most current probabilistic analysis. Those that follow us know that a rather high percentage of set-ups we present follow through, while the minority do not. For now, the GDX has not followed through on its immediate set up, but would still need to break 23.30 to suggest a deeper pullback is in the cards.

But, do note that I will adjust my expectations as the market provides further information. Until then, I believe we may need a little more patience before the heart of the 3rd wave higher in the miner complex takes hold.